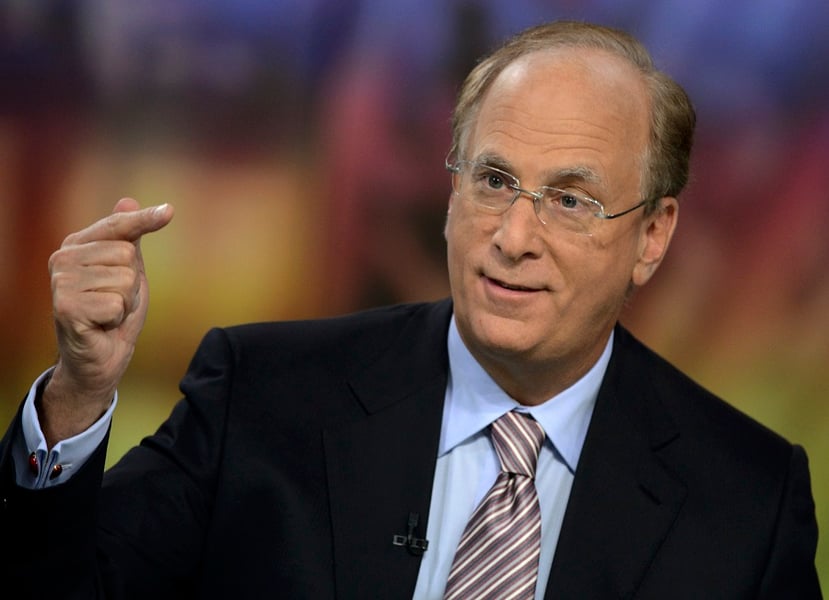

BlackRock Inc. Chief Executive Larry Fink said most crypto companies will probably fold in the wake of FTX’s collapse.

“I actually believe most of the companies are not going to be around,” Fink said Wednesday during a wide-ranging interview at the New York Times DealBook Summit.

BlackRock, the world’s biggest asset manager, is among financial firms stung by the bankruptcy of the Bahamas-based crypto exchange founded by Sam Bankman-Fried, who’s scheduled to speak at the same event later in the day. BlackRock, which oversees about $8 trillion, invested roughly $24 million in FTX through a vehicle called a fund of funds, said Fink, a long-time skeptic of cryptocurrencies.

Money managers from Wall Street to Silicon Valley and beyond poured billions of dollars into FTX, pushing its valuation as high as $32 billion before it imploded earlier this month. Firms including Sequoia Capital and Tiger Global Management have since marked down their stakes to zero, as FTX and more than 130 affiliated entities went bust.

Fink, 70, said he still sees potential in the technology underlying crypto, including instant settlement of securities and simplified shareholder voting.

Separately, Fink said he’s been working to counter criticism from across the political spectrum of BlackRock’s support of sustainable investing. Republicans have retaliated against his firm’s embrace of what they’ve described as “woke” capitalism, while Democrats and environmental activists have targeted BlackRock for investing in fossil-fuel producers.

Against that backdrop, BlackRock poured record amounts of money into U.S. political campaigns this year. Fink said Wednesday that he has been spending a lot of time in Washington to “correct the narrative.”

A Texas-based bank selects Raymond James for a $605 million program, while an OSJ with Osaic lures a storied institution in Ohio from LPL.

The Treasury Secretary's suggestion that Trump Savings Accounts could be used as a "backdoor" drew sharp criticisms from AARP and Democratic lawmakers.

Changes in legislation or additional laws historically have created opportunities for the alternative investment marketplace to expand.

Wealth managers highlight strategies for clients trying to retire before 65 without running out of money.

Shares of the online brokerage jumped as it reported a surge in trading, counting crypto transactions, though analysts remained largely unmoved.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.