Forget the saying “rags to riches,” financial advisors! It now turns out that the younger you are, the richer you're becoming.

That’s according to data from the Federal Reserve’s 2022 Survey of Consumer Finances cited in the Cerulli Edge US Retail Investor Edition report for the first quarter. The data show that over the past three years, financial assets of millennials and Gen Z grew the most of any generation. Gen Z, the youngest generational cohort, recorded nearly $6 trillion in financial wealth – up from $2 trillion in 2019.

Several advisors discussed what that means for advisory firms.

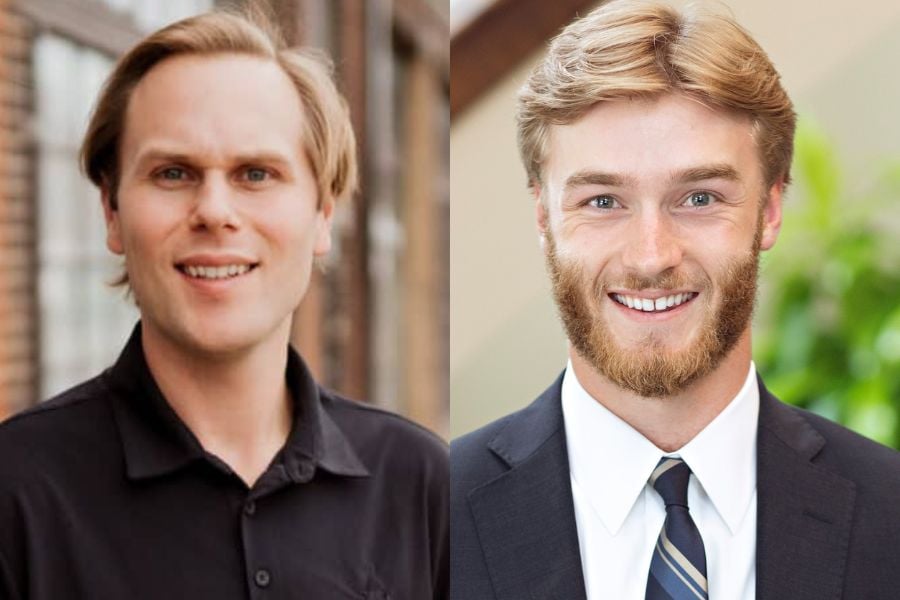

Dinon Hughes, financial consultant at Nvest Financial, says Gen Zers have only recently started entering the workforce, which has caused many of them to enrol in retirement accounts. As a Gen Zer himself, Hughes says his firm is investing in both the technology and people that Gen Zers are looking for.

“We need to meet them where they're at,” he says. “We can't stick with the same paper-and-pen methods that advisors have used for decades. We have to meet them with the tools that they need and that they are used to using. We also have to meet them with the talent there, too.”

Hughes said that Gen Z and millennial clients, when looking for financial advice, have a “hot button” that drives them to seek out financial planning, “whether that's a concentrated stock position, if they just had a company, they were involved in IPO, or they're really worried about life or disability insurance, because they just got a horrifying health condition.”

While Nvest and many other firms are capitalizing on the multitrillion-dollar assets among millennials and Gen Z clients, Hughes notes it’s not always about the dollars and cents.

“We're a relationship-based firm,” he says. “It's something we've always done is manage the entire family relationship. Just by the nature of having that relationship, we're a lot more likely to keep those kids or grandkids as clients when eventually that wealth does get passed on to them.”

Michael Dunham, director of planning and wealth advisor at Fontana Financial, shares the same sentiments as Hughes. Dunham said that one of the values of serving multiple generations and having insight into everybody's situation is understanding that parents aren’t always going to be around.

“Eventually, some or all of those assets will pass to the next generation,” he says.

Dunham said that when his mother died a few years ago, knowing her tax situation and what assets she had helped him make some financial decisions.

“She was on disability, had a very low income and we took advantage of that by doing Roth conversions of her retirement accounts when logging in lower tax rates,” he explained. “I wouldn't end up having to pay that when I inherit the money and have to take it out over a 10-year period.”

Jennifer Storey, principal at Homrich Berg, said that younger generations are more proactive about asking detailed questions like “Am I saving enough? What are my goals? Where should I be? What should I be doing?”

The bulk of Storey's millennial clients are seeking advice on life goals, which involves conversations about buying a house, saving for college, or starting a college fund for their children.

“We've seen more of the younger generation in the last five years, being more engaged in asking those questions,” she added.

Catherine Valega, founder of Green Bee Advisory, says younger clients are more tech savvy and appreciate having the data provided to them, including being educated on the pros and cons of various decisions that may impact their financial lives.

“I get all my clients fully on-boarded to their unique financial portal. This portal aggregates all of their account data, insurance, deeds, basically anything of value. It is from SEEING their data, and the impacts of decisions LIVE, that we can best guide them to take actions that will positively affect them and their families,” she wrote in an email.

As for the kinds of services that are the most effective among the younger generation, Andrew Evans, founder and CEO of Rossby Financial, said it comes down to subscription-based or modular planning.

“They like having an expert that can talk to them, not talk down to them, but really guide them through as to what they're going to be experiencing or what they are experiencing in their professional life,” Evans said.

The Federal Reserve’s data show that millennials and Gen Zers are poised to make great clients on their own, Hughes said, regardless of who their parents are.

“These clients come with different needs and demands than their parents,” he said. “Many of them try the apps available today for DIY investing and planning, but once their net worth grows to a certain point, it becomes much less comfortable to make those decisions yourself.

“That is where holistic advisors come in," Hughes added. "We have the opportunity to create the greatest impact on outcomes with millennial and Gen Z clients, whose wealth and complexity is increasing rapidly.”

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Raymond James also lured another ex-Edward Jones advisor in South Carolina, while LPL welcomed a mother-and-son team from Edward Jones and Thrivent.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.