UBS Group’s $3.3 billion acquisition of rival Credit Suisse Group will transform it into a banking juggernaut at a bargain price, JPMorgan analysts said Tuesday.

The deal is set to turn UBS into a wealth management “powerhouse” with “one of the most attractive business models in global banking,” analysts led by Kian Abouhossein said in a research note. Meanwhile, the price paid is “attractive” for UBS even after factoring in potential losses on Credit Suisse assets, litigation costs and restructuring expenses, they said.

UBS bought Credit Suisse last month in a deal orchestrated by the Swiss government, following a collapse in confidence at the lender that threatened to trigger a broader financial crisis. UBS, already one of the world’s largest wealth managers, is now taking over a key rival for a fraction of the value of its assets and as much as 9 billion Swiss francs ($9.9 billion) in government loss guarantees.

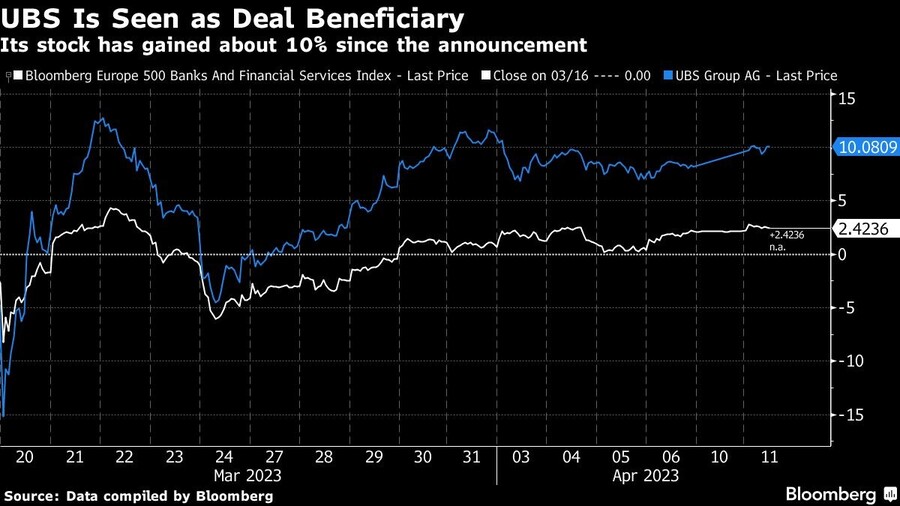

UBS shares plunged after the deal announcement but they have since gained more than 10% as investors increasingly seem to see the terms as positive. By comparison, the Bloomberg Europe 500 Banks And Financial Services Index — a benchmark for the industry as a whole — has only increased by about 5% over the same period.

“The transaction has potential to be very attractive on an economic return-on-investment basis,” the analysts wrote. They forecast that the combined group could generate $7 billion in wealth management pretax profit by 2027.

However, the government-orchestrated rescue of Credit Suisse has met with some discontent among the Swiss population and politicians, with some lawmakers voicing their frustration over the government’s use of emergency measures at a parliamentary session on Tuesday.

Job cuts at Credit Suisse’s Swiss operations following the takeover could be delayed if they become “a political issue,” the JPMorgan analysts said in their note. Risks to the smooth execution of the deal could end up forcing UBS to sell or float the Credit Suisse’s domestic universal bank, which would fetch at least $10 billion in such a scenario.

That would “more than offset” the amount spent on the acquisition of the group by UBS, they wrote.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.