Wall Street fund managers are cranking up the production line for sustainability-linked exchange-traded funds as investor demand defies this year’s rates and Russia-driven market turmoil.

At least 20 ESG-focused ETFs have launched in the U.S. this year through Wednesday, according to data compiled by Bloomberg. While comparisons are difficult to make because of evolving classifications, that’s roughly double a tally of nine from the same period in 2021, and compares with two in 2020 and just one in 2019.

The acceleration is a bid by issuers to grab a slice of a sector that punches above its weight in terms of winning new cash. Products targeting investments with higher environmental, social and governance standards represent about 4% of the $10 trillion global ETF market by assets, yet have gathered almost $25 billion of inflows in 2022 — around 8% of the total.

“Despite a shifting economic environment, investors are gaining comfort in investing with an ESG lens in 2022,” said Todd Rosenbluth, head of research at ETF Trends. “Asset managers are rounding out their ESG suite of products to provide investors with more tools to build broadly diversified ETF portfolios.”

It all underscores a bounce-back in demand for ESG investment vehicles, even as rising borrowing costs and Russia’s invasion of Ukraine roil assets globally. Earlier this year, it appeared investor appetite was waning as a broad U.S. stock sell-off sent traders in search of safety.

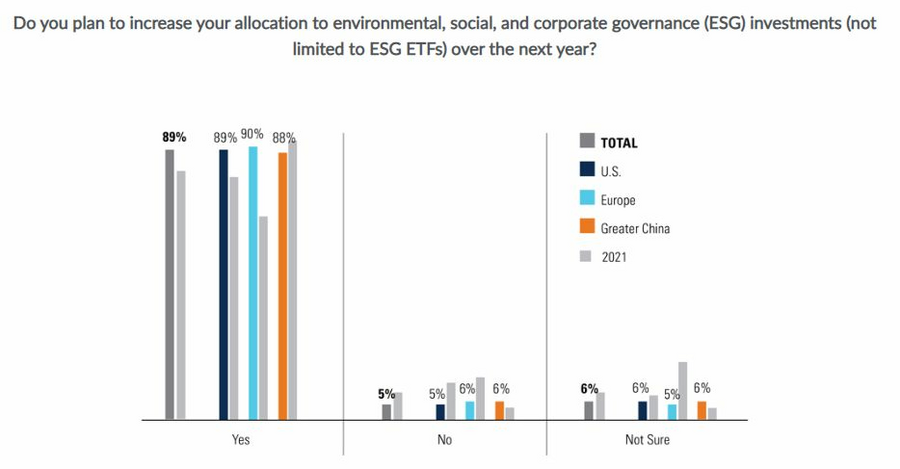

But the long-term outlook remains positive. Almost 90% of ETF investors globally plan to add ESG exposure to their portfolios, according to the results of a survey by Brown Brothers Harriman released last month.

The war may even have brought new focus to various social and sustainability issues, according to Laura Kane, head of ESG research at Voya Investment Management. For instance, clean-energy funds stand to benefit from the push to reduce fuel dependence on Russia, she said.

In the U.S., ESG ETFs launched this year have already amassed more than $1 billion in assets, the data show. The biggest new arrivals include the iShares Paris-Aligned Climate MSCI USA ETF (PABU), which has gathered $620 million, and the AXS Change Finance ESG ETF (CHGX), which has $116 million.

Fund managers launching ESG funds are increasingly broadening their investment opportunities by taking a longer-term view on carbon commitments, according to James Maund, head of capital markets at KraneShares. The KraneShares Global Carbon Transformation ETF (KGHG) is among funds that launched this year.

Traditional green-fund investing has tended to exclude so-called “bad actors,” or firms with climate goals that don’t mesh with the broader sustainability theme, Maund said.

“The next evolution is not necessarily to filter out companies based on where they stand now, but think about what companies are committed to doing in the future,” he said.

A Texas-based bank selects Raymond James for a $605 million program, while an OSJ with Osaic lures a storied institution in Ohio from LPL.

The Treasury Secretary's suggestion that Trump Savings Accounts could be used as a "backdoor" drew sharp criticisms from AARP and Democratic lawmakers.

Changes in legislation or additional laws historically have created opportunities for the alternative investment marketplace to expand.

Wealth managers highlight strategies for clients trying to retire before 65 without running out of money.

Shares of the online brokerage jumped as it reported a surge in trading, counting crypto transactions, though analysts remained largely unmoved.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.