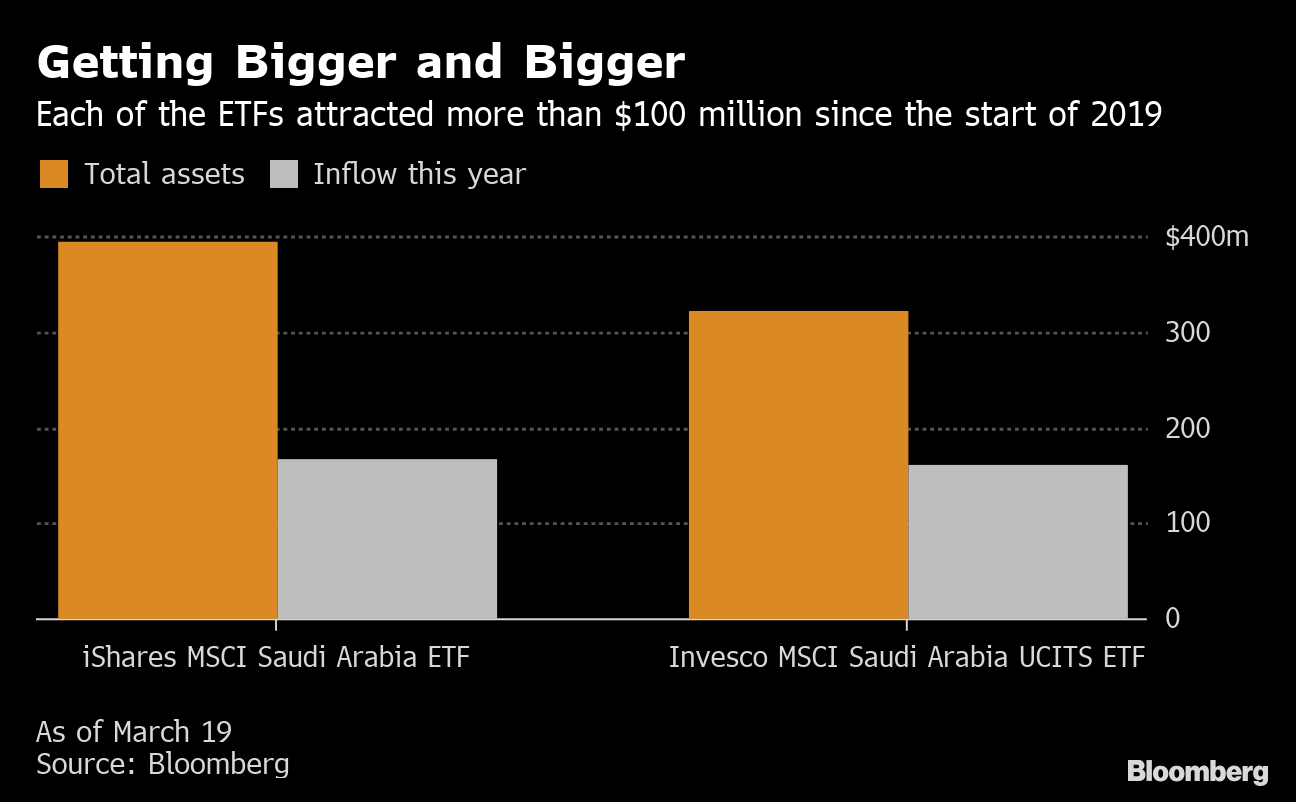

Bets on the Saudi market through funds based abroad have been profitable. They've delivered a return of about 12% each since the start of the year, compared with a gain of 11% for the Tadawul All Share Index. Total assets under management for both ETFs are at the highest since their inception.

Bets on the Saudi market through funds based abroad have been profitable. They've delivered a return of about 12% each since the start of the year, compared with a gain of 11% for the Tadawul All Share Index. Total assets under management for both ETFs are at the highest since their inception.

With trillions of dollars in transit, HNW expert sees a bigger picture.

Summit Financial unveiled a suite of eight new tools, including AI lead gen and digital marketing software, while MassMutual forges a new partnership with Orion.

A new analysis shows the number of actions plummeting over a six-month period, potentially due to changing priorities and staffing reductions at the agency.

The strategic merger of equals with the $27 billion RIA firm in Los Angeles marks what could be the largest unification of the summer 2025 M&A season.

Report highlights lack of options for those faced with emergency expenses.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.