AMC Entertainment Holdings Inc. dizzied investors Thursday by losing 40% of its market value, then regaining most of it -- while pocketing more than $500 million in fresh cash by exploiting the frenzy over the stock.

The wild rally initially collapsed on Thursday as the company disclosed plans to raise money by selling more shares so it could cut its heavy debts. AMC went ahead anyway, collecting $587 million by midday, and any doubts among investors that their holdings would be watered down faded after AMC said it completed the program.

After briefly erasing all of its losses, the shares were trading 8% lower at $57.20 at 2:40 p.m. in New York.

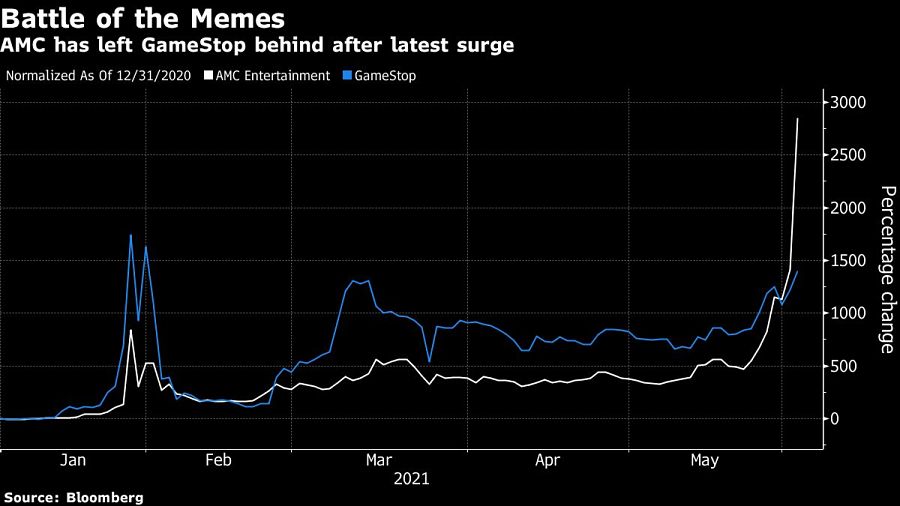

It’s just another remarkable turn of events for AMC, which was staring at potential bankruptcy only a few months ago in the face of the pandemic and brutal competition from streaming services. Amid the mania for meme stocks, shareholders have brushed aside doubts about the wisdom of bidding up shares in a company whose survival was recently in doubt, and they reserved extra contempt for Wall Street professionals.

“As crazy as today’s action might seem, it’s a lot more normal than the action the stock has seen over the previous seven trading days,” said Matt Maley, chief strategist at Miller Tabak + Co. After all, he said, it’s not unusual to see a stock back off after such an outsized rally. “Nothing that has taken place over the past two weeks should be considered normal, until today,” Maley said.

Analysts such as Chad Beynon of Macquarie aren’t backing off from predictions of a bigger plunge to come.

“Based on what we’ve seen with other retail stocks and given the paper profits from these retail investors, we would expect for shares to fade,” Beynon said. “Fundamentally, we still believe that AMC is worth $6.”

Credit investors, by contrast, bid up bond prices because even at the newly depressed price, the share sale could take in about $500 million, enough to make a sizable dent in AMC’s crushing pile of debt.

“It would be irresponsible for the board and management to not do a raise to secure the balance sheet at these levels,” said Greg Taylor, chief investment officer at Purpose Investments. CreditSights analysts Matt Zloto and Hunter Martin wrote that a successful offering “would be a massive first step in deleveraging the AMC capital structure.”

Thursday’s filing for the potential sale comes just days after AMC raised $230.5 million by selling stock to Mudrick Capital Management. Those shares were then flipped and sold for a profit as the New York-based investment firm told clients AMC’s stock was overvalued.

The company had warned investors they could see their stakes diluted and perhaps lose everything after the new offering.

“The market prices and trading volume of our shares of Class A common stock have recently experienced, and may continue to experience, extreme volatility, which could cause purchasers of our Class A common stock to incur substantial losses,” AMC said in its filing.

The filing allowed for shares to be sold at-the-market, which is unlike a traditional stock offering because the buyers are found in the open market where retail traders thrive. Stocks sold in traditional offerings are purchased mostly by institutional investors. B. Riley is handling the transaction.

“I would have told them to cash out the last time this happened,” said Barry Schwartz , chief investment officer at Baskin Financial Services. “In the dot com boom it continued until everyone lost all their money and took whole stock market down with it.”

The frenzy has pushed shares in the money-losing company to improbable levels and left the business with a market capitalization of $31.3 billion, making it more valuable than half of the listings in the S&P 500 Index. “AMC to the Moon” posters have popped up at street corners and pool parties in the U.S. amid the reality-defying surge for AMC and other meme stocks.

But signs of fatigue emerged on Thursday among AMC’s army of retail investors amid temptation to book some of the outsized profits, and the share sale touched a raw nerve that triggered a stockholder rebellion earlier this year. AMC had sought to authorize 500 million new shares, but withdrew the plan in April amid objections from shareholders worried about getting diluted.

Still, the company said at the time it was likely to revisit the idea “at some point in the future.” Back then, the stock was selling for less than $12. At today’s prices, a similar offering could wipe out the company’s entire debt load of about $5 billion several times over, and raise billions more to fund AMC’s turnaround.

AMC’s bonds were among the top gainers in the U.S. high-yield market on Thursday, setting fresh highs. Its second-lien bonds due 2026 rose 1.9 cents on the dollar to a new high of 99.4, according to Trace bonds trading data.

The company “had an unsustainable debt level and is chipping away by issuing equity,” said Michael Pachter of Wedbush Securities in an email. “I think that’s smart to ensure that they remain healthy so they can thrive as things return to normal.”

Most firms place a limit on advisors’ sales of alternative investments to clients in the neighborhood of 10% a customer’s net worth.

Those jumping ship include women advisors and breakaways.

Firms in New York and Arizona are the latest additions to the mega-RIA.

The agent, Todd Bernstein, 67, has been charged with four counts of insurance fraud linked to allegedly switching clients from one set of annuities to another.

“While harm certainly occurred, it was not the cataclysmic harm that can justify a nearly half billion-dollar award to the State,” Justice Peter Moulton wrote, while Trump will face limits in his ability to do business in New York.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.