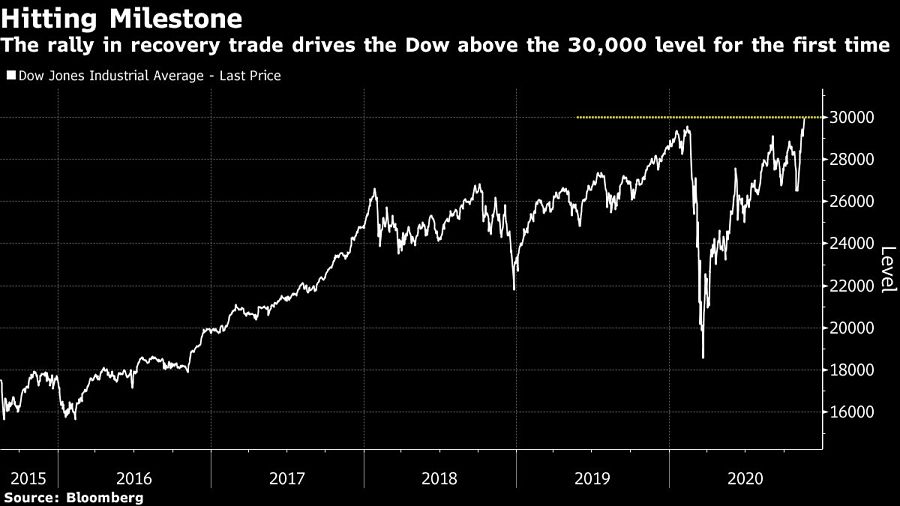

Speculation that vaccines and a possibly peaceful presidential transition are steps toward normalization in the economy ignited another rally in shares ravaged by the pandemic, pushing the Dow Jones Industrial Average past 30,000 for the first time.

Boeing Co., a chronic drag on the 124-year-old index for most of the year, surged almost 5%, while JPMorgan Chase & Co., American Express Co. and Chevron Corp. climbed more than 3%.

Gains outside the blue-chip benchmark were even bigger: American Airlines Group Inc. and Carnival Corp. surged more than 8%, while movie theater operator AMC Entertainment Holdings Inc. jumped 24%.

Once a laggard, the Dow and its cyclical components have shot up 13% since Halloween, putting it on track for its best month since 1987. Gains in the world’s most famous equity index mirror a profound market reordering in November, as growing optimism about an economic reopening pushed up industries like energy and banking that had suffered under stay-at-home restrictions and the policies enacted to cope with them.

“Investors will continue to look through near-term noise and position for normalization next year,” said Dennis Debusschere, head of portfolio strategy at Evercore ISI. “Cyclical will continue to lead into year-end, basically on the idea that people realize they are still awesome companies and everything else has moved significantly.”

The 30-member gauge climbed as much as 1.4% as of 11:22 a.m. in New York, briefly crossing the 30,000 threshold. It’s been almost four years since the Dow first crossed the 20,000 landmark. To analysts who follow charts to forecast prices, breaking above a big round number is seen as a potential boost to sentiment as bulls chase momentum.

Searches for “Dow 30K” have picked up on Google trends in recent weeks as the market rally broadened. On Monday, AstraZeneca became the latest firm to deliver positive vaccine data, bolstering confidence in the economic recovery.

The bounce in economically sensitive shares is helping the Dow make up ground in a market that for most of the year has been dominated by the safe, stay-at-home trade of technology companies. Extending its 2020 gain to 5%, the Dow has narrowed its performance gap to the S&P 500 to 7 percentage points.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.