Few things divide opinion on Wall Street like the outlook for small-cap stocks or the fate of the value strategy. Yet most market players would probably agree that it’s a tough time to launch a product combining the two.

That’s exactly what BlackRock Inc. is doing with a new exchange-traded fund.

The iShares Factors US Small Cap Value ETF began trading on the New York Stock Exchange under the ticker SVAL Thursday. The fund screens for value-oriented stocks in the Russell 2000 Index based on liquidity, volatility, leverage and analyst sentiment and then weights securities equally.

It’s an eye-catching arrival given the backdrop. Small-cap shares and value strategies have been battered anew this year as the coronavirus sparked an economic crisis. U.S. equities endured yet another bout of volatility this week, a broad sell-off that has spared few sectors.

Even after those declines, the S&P 500 Index still gained 1.2% in the year through Wednesday. The Russell 2000 Index, by contrast, was roughly 7.5% lower, and value stocks -- those that look cheap relative to fundamentals -- were down more than 15%.

BlackRock’s existing value-focused ETFs tend to be weighted toward large and mid-cap companies, whereas SVAL will be its first small-cap value single-factor fund, according to the company’s U.S. head of factor ETFs.

“On a forward-looking basis, the future is much brighter than it has been the past few years and we wanted to make sure our lineup has all the exposure our clients are looking for,” Bob Hum said in an interview.

The renaissance of value has eluded investors for years, though there have been plenty of head-fakes in the past few months.

The Russell 1000 Value Index beat its growth counterpart by over 2 percentage points in September for its biggest month of outperformance in a year. On a five-year basis, however, value has trailed growth by nearly 93 percentage points.

Meanwhile, large-cap companies -- led by a handful of technology names -- have trounced small-cap shares over that time period. The S&P 500 has climbed nearly 57% since late 2015, while the Russell 2000 gained about 32%.

Still, Hum expects SVAL to attract interest once economies start to reopen broadly. He points to recent demand for value and small-cap funds.

“Many investors are looking for opportunities that are contrarian to the recent euphoria surrounding mega cap growth stocks,” he said in an email.

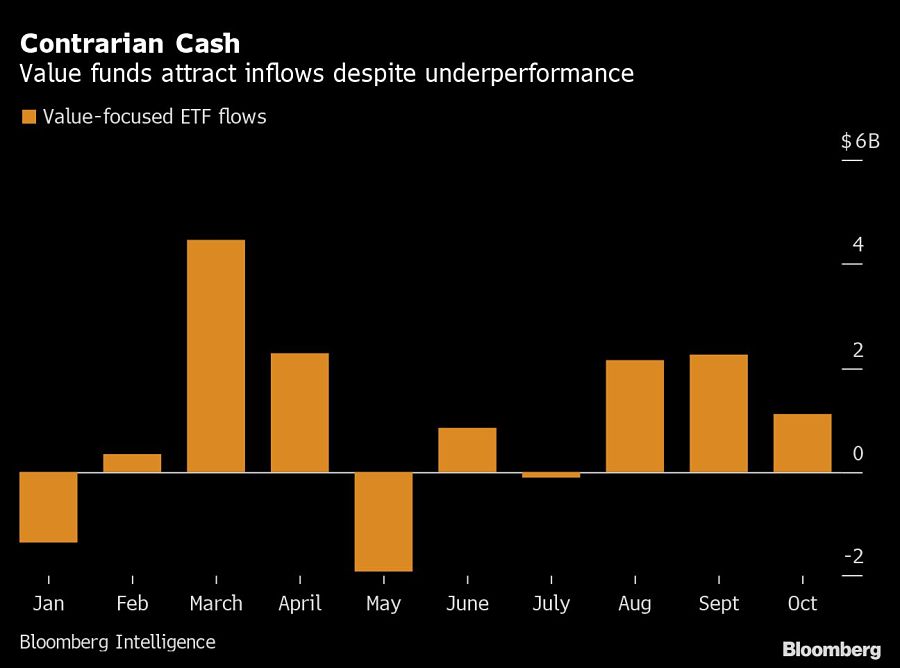

In defiance of the lackluster performance, value-focused ETFs have attracted about $10 billion of inflows so far in 2020, according to data compiled by Bloomberg. Small-cap equity ETFs have absorbed $530 million.

[More: First blank-check ETF debuts]

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.