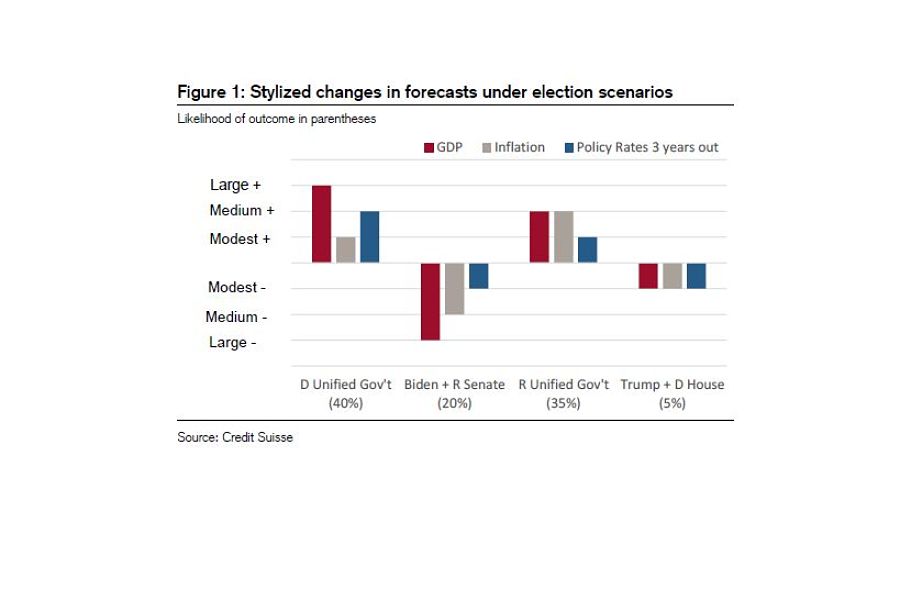

A potential Democratic sweep in the U.S. elections may be the rosiest scenario for risk markets like value and cyclical stocks.

Some strategists have cited the combination of Joe Biden in the White House and his party controlling the Senate and House as a potential downer for markets because it could lead to higher corporate tax rates. But to Credit Suisse Group, the chance for greater deficit spending under that scenario is “massively pro-growth” and outweighs other concerns for equities.

“The most positive outcome for risk markets is a Democratic sweep given the potential for significantly higher fiscal stimulus, and consequently, higher economic growth,” said Mandy Xu, Credit Suisse equity derivatives strategist. “Conversely, the most negative outcome is a Biden White House with a split Congress, in which case we see little prospect of further fiscal aid and increased probability of a stalled recovery/prolonged downturn.”

A Democratic sweep could lead to yields rising, cyclical stocks outperforming and a more pronounced rotation away from growth into value if there’s a bigger fiscal package, Credit Suisse said.

That outlook on yields matches the view of Goldman Sachs Group Inc. strategists led by Praveen Korapaty, who said on Sept. 25 that yields could jump in such a scenario.

The outlook led Xu to recommend a bearish put-option spread on the iShares 20+ Year Treasury Bond ETF expiring in January, as well as wagers on small stocks beating larger ones, plus a rotation away from technology shares.

In the scenario where Biden wins but there’s a split Congress, she sees a broad macro sell-off with a bid for havens and recommends buying a put spread on the S&P 500 while selling a call option.

Federal data show reports of at least $100,000 in losses skyrocketed to hit $445 million in 2024.

The fintech firms' latest additions, including veterans from Bloomberg and JPMorgan, come amid rising demand for alternative assets in the retirement space.

Steward Partners adds a $481 million Ohio-based team, while $35.7 billion &Partners expands its reach in Minnesota.

Emerson Equity and its advisor, Tony Barouti, were likely the largest sellers of defunct GWG L bonds.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning