The recent pullback in U.S. stocks could be close to an end if history is a guide, according to strategists at Goldman Sachs Group Inc. and Deutsche Bank.

Its magnitude has matched a “typical” sell-off in the S&P 500 since the financial crisis, albeit at a faster pace, a team led by Goldman’s David Kostin wrote in a note Friday. And options positioning -- at the core of the weakness -- has normalized, their counterparts at Deutsche, including Srineel Jalagani, noted the same day.

“Despite the sharp sell-off in the past week, we remain optimistic about the path of the U.S. equity market in coming months,” the Goldman strategists wrote. “Since the financial crisis, the typical S&P 500 pullback of 5% or more has lasted for 20 trading days and extended by 7% from peak to trough, matching the magnitude of the most recent pullback if not the speed.”

A reassessment of historically high equity valuations and volatility in options markets has sent the S&P 500 down about 7% from its record close on Sept. 2, though it remains almost 50% above its March low. The Nasdaq 100 is off 11%, after investors questioned whether a rally in the tech-heavy gauge might be too frothy.

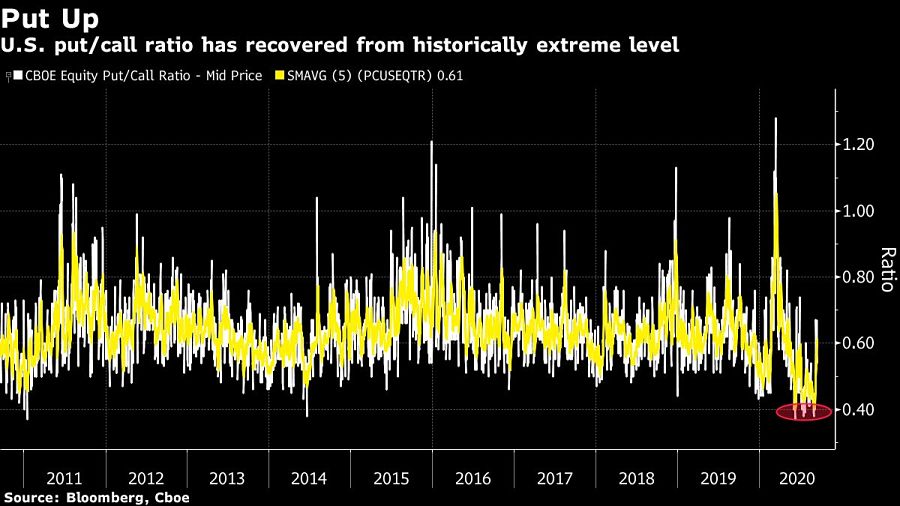

Meanwhile, the Deutsche team focused on the impact of the options market, using a metric that looks at the number of bearish contracts relative to bullish ones. That measure had fallen to the bottom of its 10-year range -- indicating an extreme level of positive sentiment -- but after the correction has already recovered to “about average” levels, the team said.

“Historically, corrections in the put-call ratio have tended to have sharp but short-lived market impacts,” the strategists wrote.

Still, both teams pointed to the U.S. elections as the key source of uncertainty for markets ahead.

“Investors still have to contend with the upcoming macro event of the U.S. presidential elections,” the Deutsche strategists warned. “With a likely unprecedented volume of mail-in ballots, prospects for volatility enduring post-election day are high.”

Federal data show reports of at least $100,000 in losses skyrocketed to hit $445 million in 2024.

The fintech firms' latest additions, including veterans from Bloomberg and JPMorgan, come amid rising demand for alternative assets in the retirement space.

Steward Partners adds a $481 million Ohio-based team, while $35.7 billion &Partners expands its reach in Minnesota.

Emerson Equity and its advisor, Tony Barouti, were likely the largest sellers of defunct GWG L bonds.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning