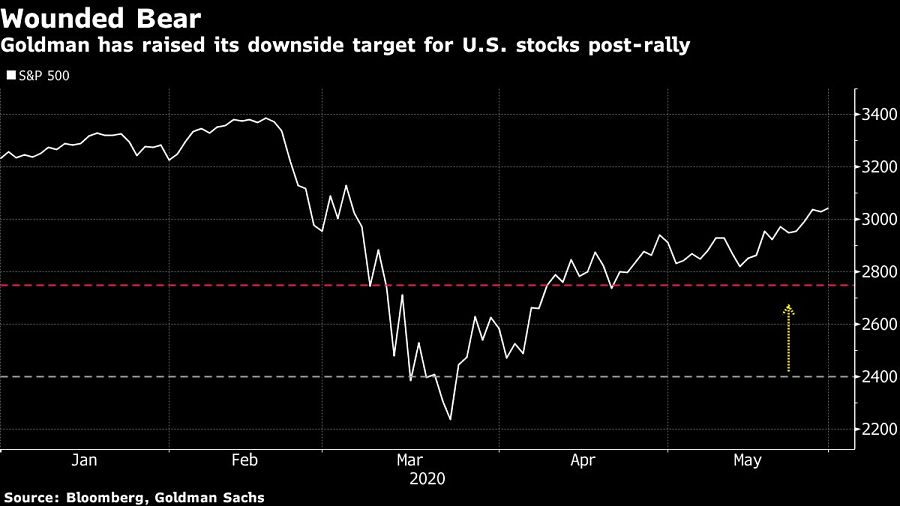

Goldman Sachs Group Inc. has effectively bowed to pressure from the continuing rally in U.S. stocks and abandoned its call for another steep sell-off.

Strategists led by David Kostin have rolled back their prediction that the S&P 500 would slump to the 2,400 level -- over 20% below Friday’s 3,044 close -- and now see downside risks capped at 2,750. The U.S. equity benchmark could even rally further to 3,200, they wrote in a note Friday.

“The powerful rebound means our previous three-month target of 2,400 is unlikely to be realized,” the strategists wrote. “Monetary and fiscal policy support limit likely downside to roughly 10%. Investor positioning has oscillated between neutral and low and is a possible 5% upside catalyst.”

The shift came just after JPMorgan Chase & Co.’s strategists shifted in the other direction -- reining in their bullish outlook. JPMorgan’s Marko Kolanovic warned about rising U.S.-China tensions in a note Thursday.

Goldman’s strategists maintained their year-end target of 3,000 for the benchmark U.S. stock gauge.

Goldman continues to argue that short-term returns are skewed to the downside -- “or neutral at best” -- thanks to the risk of an economic, earnings, trade or political “hiccup” to the normalization trend. A broader participation in the rally would be needed for the S&P 500 to move meaningfully higher.

The S&P 500 has climbed 36% from its March 23 low, helped by massive fiscal and monetary support, mega-cap outperformance and optimism about the economy restarting, according to Goldman. Last month it argued that fear of missing out was a key driver of the rebound in stocks.

Market risk index shows hidden perils in seeking safety, and potential benefits from non-traditional investment vehicles.

Friends and family members are "the easiest type of victim to profile and steal from,” said one attorney.

The commissioner also known as "Crypto Mom" says the agency is willing to work on different models with stakeholders, though disclosures will remain key.

Cetera's policy advocacy leader explains how gig worker protection proposal might hurt independent financial advisors, and why it's "a complete outlier" in the current legal landscape.

Meanwhile, Osaic secures a new credit union partnership, and Compound Planning crosses another billion-dollar milestone.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning