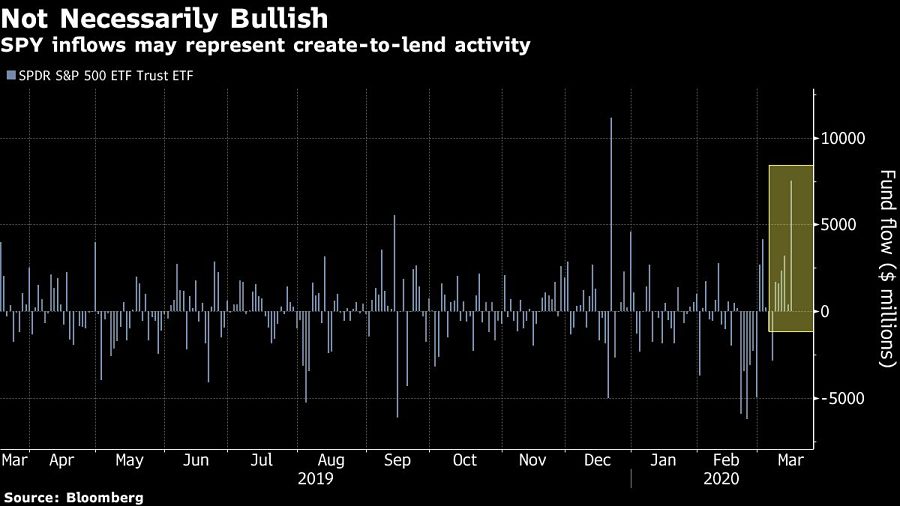

Investors have poured cash into the biggest ETF that tracks the S&P 500 over the past week -- but that’s not necessarily a vote of confidence.

It’s a quirk of the ETF industry. Known as “create-to-lend,” new shares are generated in order for investors to borrow and sell short against the fund. That process could explain why the $226 billion SPDR S&P 500 ETF Trust ETF (SPY) took in over $9 billion of new inflows last week, according to JPMorgan Chase & Co. It saw an additional $7.5 billion on Monday alone, Bloomberg data showed.

“Last week, SPY recorded a $9Bn increase in shares outstanding, as new ETF shares were created for the purpose of lending it out to investors looking to short,” wrote JPMorgan strategists including Marko Kolanovic. “Thus, what looks like an inflow to the fund actually represents new shorts, rather than buying by fundamental investors.”

The S&P 500 Index has plunged more than 30% from its record high set just four weeks ago amid deepening fears about the coronavirus outbreak’s economic fallout. The Cboe Volatility Index remained near all-time highs even after the S&P 500 surged on Tuesday.

Short interest as a percentage of shares outstanding on SPY -- a rough indicator of bearish bets on U.S. stocks -- is currently 5.7%, according to data from IHS Markit Ltd. Short interest peaked at a near-record of 7.4% on March 3.

As short bets build, it’s become increasingly expensive to bet against the fund. The financing rate has increased from 0.3% on Feb. 26 to 1.57% today, according to data compiled by S3.

SPY is often used as a source of liquidity for hedging in periods of “massive volatility,” according to Matthew Bartolini, State Street Global Advisors head of ETF research. For example, an investor might short the fund to offset equity exposure elsewhere in their portfolio, he said.

“It just goes to show, particularly for SPY, the diverse user base that will come to it to express a multitude of directional views, whether it be long, short or derivative-based,” Mr. Bartolini said.

“I’m worried that this tells us that we have not reached bottom yet,” Mr. Maley said. “People need to completely throw in the towel after declines like these before we reach a bottom.”

Plus, a $400 million Commonwealth team departs to launch an independent family-run RIA in the East Bay area.

The collaboration will focus initially on strategies within collective investment trusts in DC plans, with plans to expand to other retirement-focused private investment solutions.

“I respectfully request that all recruiters for other BDs discontinue their efforts to contact me," writes Thomas Bartholomew.

Wealth tech veteran Aaron Klein speaks out against the "misery" of client meetings, why advisors' communication skills don't always help, and AI's potential to make bad meetings "100 times better."

The proposed $120 million settlement would close the book on a legal challenge alleging the Wall Street banks failed to disclose crucial conflicts of interest to investors.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.