Market risk index shows hidden perils in seeking safety, and potential benefits from non-traditional investment vehicles.

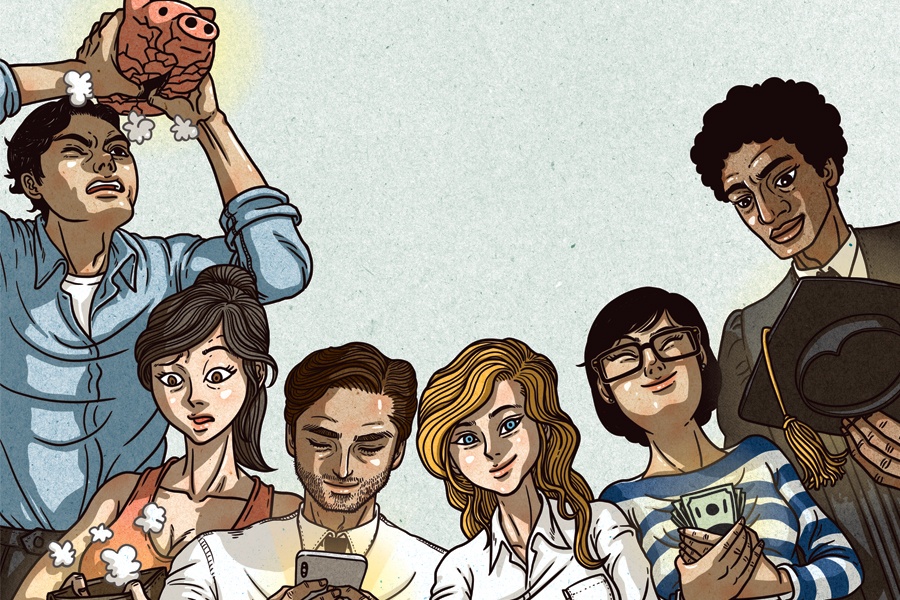

Friends and family members are "the easiest type of victim to profile and steal from,” said one attorney.

The commissioner also known as "Crypto Mom" says the agency is willing to work on different models with stakeholders, though disclosures will remain key.

Cetera's policy advocacy leader explains how gig worker protection proposal might hurt independent financial advisors, and why it's "a complete outlier" in the current legal landscape.

Meanwhile, Osaic secures a new credit union partnership, and Compound Planning crosses another billion-dollar milestone.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning