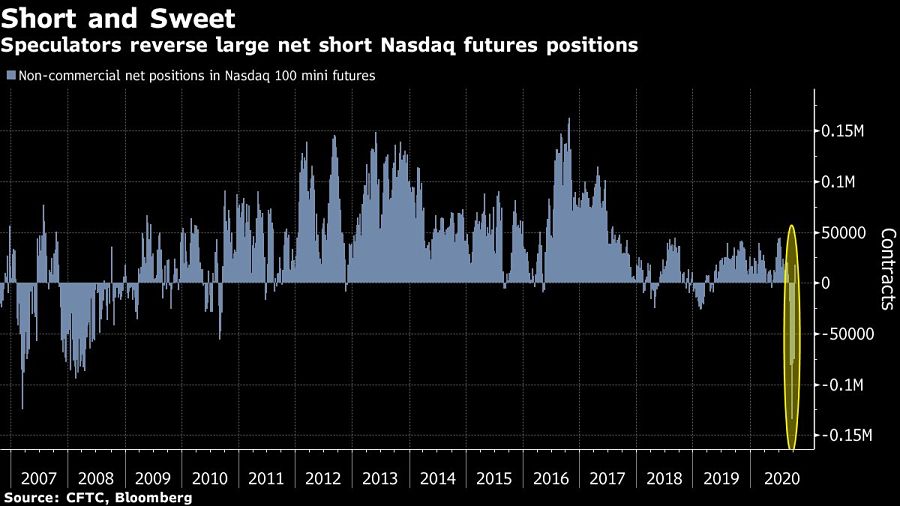

Hedge funds have pulled back from one of the biggest short positions in U.S. tech stocks in over a decade, in a near-record buying spree of Nasdaq futures last week.

Net speculative positions in Nasdaq 100 mini contracts surged by the most in more than 13 years in the week through Oct. 13, according to the latest Commodity Futures Trading Commission data. The increase was the second biggest on record in data going back to 1999 and left speculators net long the futures for the first time since the beginning of last month.

The buying frenzy comes after fast-money accounts had driven net short bets to the highest level since before the financial crisis during September.

The U.S. tech gauge has risen more 9% from its Sept. 23 low amid signs of a return of bullish options activity that helped push it to an all-time high earlier that month. It remains about 5% below that record.

The dialing back of bearish expectations for tech stocks coincided with an increase in wagers that equity volatility will decline. Net short non-commercial positions on futures linked to the Cboe Volatility Index hit the largest since February, the CFTC data showed.

President says he has a ‘couple of people in mind’ for central bank role.

Wall Street firm partners with Dutch online broker to fuel push into EU market.

Agreement with the US Department of Justice comes eight years after settlement.

Series C funding will accelerate unification of TAMP’s model portfolios.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.