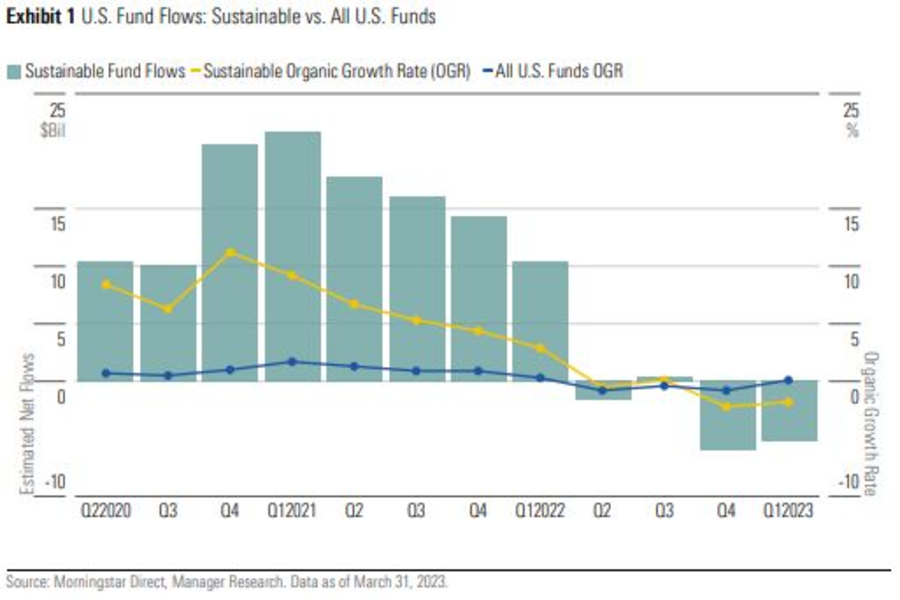

U.S. funds that choose stocks based on environmental, social and governance criteria posted outflows for the second consecutive quarter as investors fled to safer assets amid Federal Reserve rate hikes.

Investors yanked $5.2 billion from U.S.-domiciled sustainable funds in the first quarter of this year, according to a report by Morningstar Inc. The exodus was driven by the $13.6 billion iShares ESG Aware MSCI USA ETF (ESGU), which shed $6.5 billion over that period.

A steady drop in fund flows came as Russia’s invasion of Ukraine boosted oil prices and consequently shares of companies involved in the production of fossil fuels, which tend to be excluded from ESG portfolios.

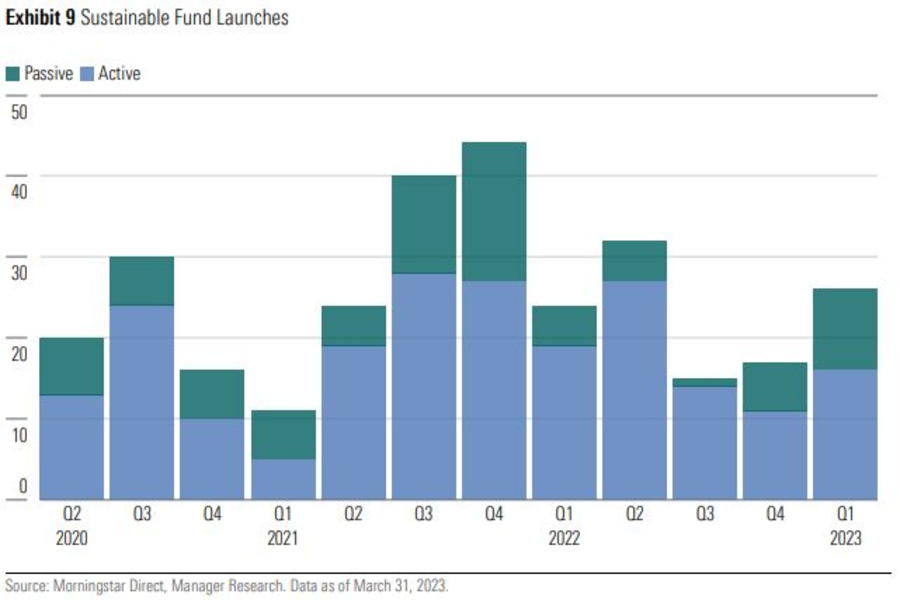

But the outflows didn’t seem to deter asset managers, as 27 sustainable funds debuted in the first quarter, up from the number of launches in the fourth quarter of 2022. And sustainable-fund assets climbed to almost $296 billion — the highest they’ve been since the first quarter of 2022 — thanks, in part, to higher equity and bond valuations, Morningstar’s report said.

It has still paid to be a stock-picker in the ESG arena during this tough market. Actively managed sustainable funds broke a three-quarter outflow streak to post inflows for the first time in a year. Passive sustainable funds, meanwhile, saw an outflow of $6.1 billion in the first quarter, with ESGU’s losses weighing on the group.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Raymond James also lured another ex-Edward Jones advisor in South Carolina, while LPL welcomed a mother-and-son team from Edward Jones and Thrivent.

MyVest and Vestmark have also unveiled strategic partnerships aimed at helping advisors and RIAs bring personalization to more clients.

Wealth management unit sees inflows of $23 billion.

Deal will give US investment bank a foothold in lucrative European market.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.