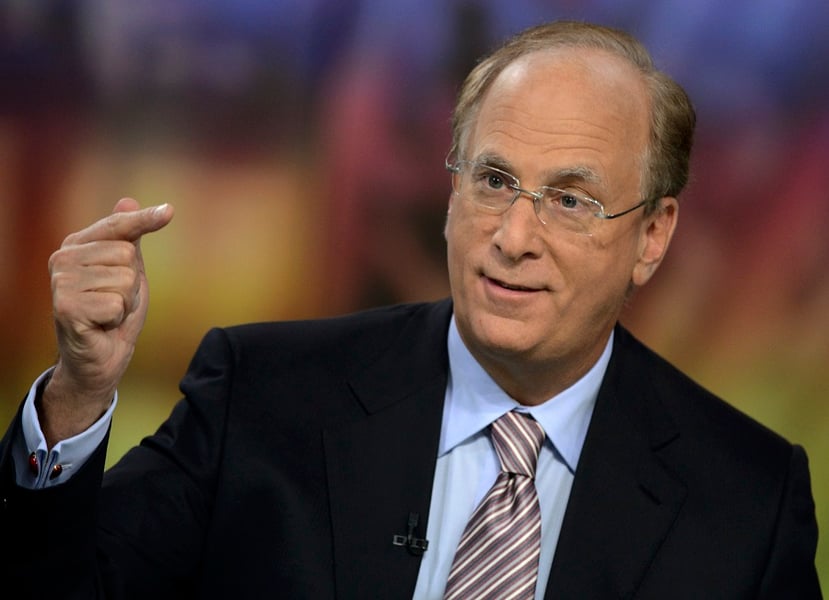

The world’s largest asset manager is bringing proxy-voting choice for retail investors to its largest exchange-traded fund.

BlackRock’s iShares Core S&P 500 ETF, which trades under the ticker IVV, has $305 billion assets under management. More than 3 million shareholder accounts, representing more than half of the index’s AUM, will be able to participate.

Starting in the 2024 voting season, investors will be able to chose among a range of policies that determine how IVV votes their shares. Plans include one the prioritizes climate considerations while a new one, aimed at conservatives, favors company managements, according to Reuters.

BlackRock, Vanguard and State Street Global Advisors have all introduced new proxy voting systems in an effort to combat pressure from right-wing activists and Republican lawmakers to disavow the use of environmental, social and governance criteria in investing decisions.

The so-called “Big Three” asset managers announced voting choice programs in 2022 for a limited set of investment options, with plans to expand to more retail clients. In May, State Street brought proxy-voting choice to institutional shares of its index mutual funds and some of its exchange-traded funds.

BlackRock envisions a future where every investor can participate in proxy voting choice, according to Salim Ramji, the firm’s global head of iShares and index investments. The firm will use IVV to gauge investor interest in proxy voting as well as test the firm’s infrastructure and user experience before expanding further.

"BlackRock has been working for years with public and corporate pension funds and other institutional investors to make voting easier and more accessible than ever before,” Ramji said in a statement. “These efforts have spurred innovation in the proxy voting ecosystem, catalyzing an industry movement to further shareholder democracy.”

While large asset managers, particularly BlackRock, have been the focus of anti-ESG initiatives in Congress and in numerous states, the firms have a mixed track record when it comes to supporting shareholder initiatives. A Morningstar study of 100 shareholder resolutions involving S&P 100 companies found that BlackRock voted in favor of 55% of resolutions related to social issues. State Street was in favor of 60% while Vanguard supported just 27%.

On environmental issues, BlackRock supported 57% of initiatives, compared to State Street’s 61% and Vanguard’s 30%.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.