The global sum of socially conscious debt is barreling toward $5 trillion as Wall Street’s pursuit of sustainable investments fuels demand for the bonds and loans.

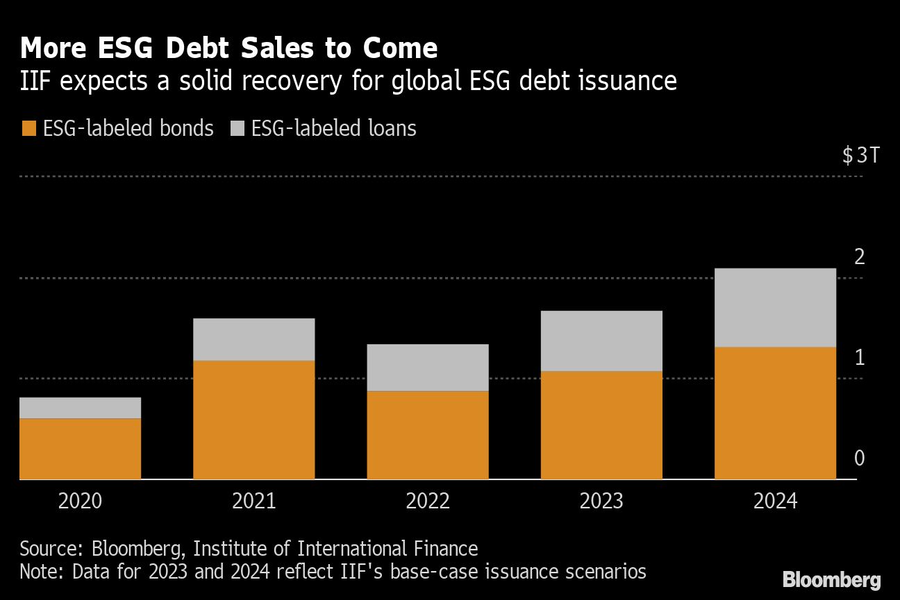

The Institute of International Finance expects $1.7 trillion this year in debt sales geared toward environmental, social and governance causes, a deluge that will vastly expand the $4.8 trillion universe of ESG debt. Another $2 trillion of the debt is forecast in 2024 as governments adopt a global biodiversity framework and commercial banks face pressure to decarbonize portfolios, according to the industry group.

“We anticipate a strong rebound in 2023 as demand for ESG debt continues to surge,” IIF economist Khadija Mahmood and Director of Sustainability Research Emre Tiftik wrote in a Thursday report. “With a softening U.S. dollar — and easier global financial conditions anticipated — international funding pressures should ease further.”

The IIF’s call comes even as conservative politicians in the U.S. push back against the industry, with Florida state officials going so far as to pledge a purge of such thinking from its pension funds.

While overall bond sale activity was tempered in 2022 as major central banks increased interest rates to combat inflation, ESG sales reached a record in emerging markets due governments including China, Turkey and Mexico, the IIF said.

"This shouldn’t be hard to ban, but neither party will do it. So offensive to the people they serve," RIA titan Peter Mallouk said in a post that referenced Nancy Pelosi's reported stock gains.

Elsewhere, Sanctuary Wealth recently attracted a $225 million team from Edward Jones in Colorado.

The giant hybrid RIA is elevating its appeal to advisors with a curated suite of alternative investment models, offering exposure to private equity, private credit, and real estate.

The $40 billion RIA firm's latest West Coast deal brings a veteran with over 25 years of experience to its legacy division for succession-focused advisors.

Invictus fund managers allegedly kept $10 million in plan assets after removal, setting off a legal fight that raises red flags for wealth firms.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.