J.P. Morgan Asset Management is throwing its hat into the rapidly expanding universe of green funds.

The JPMorgan Carbon Transition U.S. Equity exchange-traded fund (JCTR) will begin trading on the New York Stock Exchange Thursday. The firm’s first U.S. ETF focused on environmental, social and governance standards will be passively managed and track a gauge that screens the Russell 1000 Index for companies seeking to reduce their carbon footprint.

“The carbon space is something that’s particularly interesting. It’s quantifiable, it’s something that everybody can kind of put their fingers on and understand,” said Bryon Lake, head of Americas ETF at J.P. Morgan Asset. “ESG, sustainable, is coming up more and more in the client conversations that we’re having, particularly sophisticated asset allocators, and so we’re really looking to meet that need with what we think is a super compelling investment proposition.”

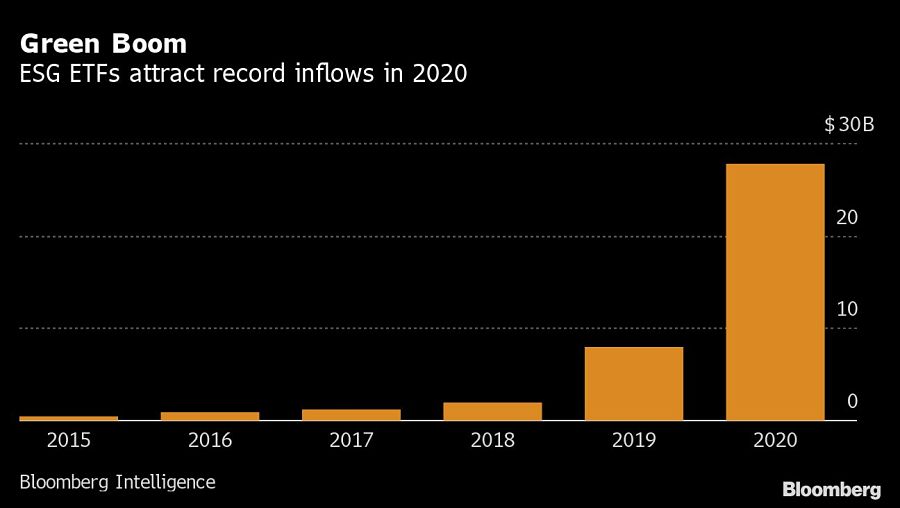

As the world grapples with the coronavirus pandemic, devastating weather and racial unrest, U.S. ESG funds have lured a record $27.9 billion worth of inflows in 2020, according to Bloomberg Intelligence data. Those ETFs currently have about $61 billion in assets.

The new fund will evaluate Russell 1000 companies based on three main criteria: emissions, resource management and risk management. All told, JCTR whittles the Russell 1000 down to roughly 200 holdings, Lake said. Its constituents are selected from companies actively seeking to reduce their carbon footprint, according to Lake.

“Instead of just going through and deleting out the worst offenders, that gets you to only part of the answer. How companies are actually managing that transition is a much more interesting and compelling answer,” Lake said. “If it’s a heavily carbon-producing company, but they’re dramatically changing their behavior -- the emissions piece and the risk management piece -- that’s what we believe is more compelling.”

Eliseo Prisno, a former Merrill advisor, allegedly collected unapproved fees from Filipino clients by secretly accessing their accounts at two separate brokerages.

The Harford, Connecticut-based RIA is expanding into a new market in the mid-Atlantic region while crossing another billion-dollar milestone.

The Wall Street giant's global wealth head says affluent clients are shifting away from America amid growing fallout from President Donald Trump's hardline politics.

Chief economists, advisors, and chief investment officers share their reactions to the June US employment report.

"This shouldn’t be hard to ban, but neither party will do it. So offensive to the people they serve," RIA titan Peter Mallouk said in a post that referenced Nancy Pelosi's reported stock gains.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.