Investors have pulled money from sustainable funds in the US at a record pace this year, a result partly due to backlash against ESG that asset managers appear unsure of addressing.

Those outflows totaled $8.8 billion during the first quarter, with much of that coming from actively managed funds and two iShares ETFs, according to a recent report by Morningstar.

Amid politicization that has made environmental, social, and governance criteria a risky thing for many asset managers to emphasize as a part of their business, some have reportedly scrubbed mentions of ESG from marketing materials. None of the biggest asset managers that offer sustainable mutual funds and ETFs in the US agreed to interviews covering how they are addressing products and marketing during a time of slumping sales industrywide.

“It’s been a continuation of what we’ve been seeing for the past two years. I think it’s probably getting worse,” said Hortense Bioy, pictured below left, global director of sustainability research at Morningstar, regarding the US fund redemptions in the first quarter. “The picture is bleak in the US, getting worse and worse. ESG backlash is having an impact on investor appetite.”

Amid high interest rates, inflation and supply chain disruptions, renewable energy projects have suffered, dragging down net returns of clean-energy funds, Bioy noted. And the fear of a recession in the US, which has affected conventional, or non-ESG-focused funds, as well, she said.

Widely, sustainable funds have underperformed conventional peer funds, with lower returns in 2022 prompting investors to be more cautious in 2023, she said. Among sustainable funds in the US, actively managed ones have registered outflows as a category since July 2023, she said. Passively managed sustainable funds were slower to see negative sales, with the past two quarters having net redemptions.

It’s impossible to see exactly where the money is moving, but much of it appears to be going to broad-based funds that are comparable in asset class exposure to the sustainability-themed funds from which investors have pulled money, she said. But some types of sustainable funds don’t have comparable, non-ESG peers.

American exceptionalism

While money flowed out of US sustainable funds, that wasn’t the case globally, as $900 million in new sales happened around the world. That was fueled by continued demand in Europe, which saw nearly $11 billion in sales during the first quarter, which doubled figures seen in the fourth quarter of 2023, according to Morningstar. Across regions tracked by the company, Japan was the only one aside from the US to see sustainable fund redemptions in the first quarter, at $1.7 billion.

The biggest company by sustainable assets worldwide is BlackRock, which including its iShares ETFs had $367.6 billion as of the end of the first quarter, more than double the next-biggest sustainable asset manager, Amundi, at $177.2 billion, the Morningstar data show.

Contrasting the outflows the firm saw in the US, BlackRock raked in the most of any European sustainable fund provider in the first quarter, at $6.8 billion.

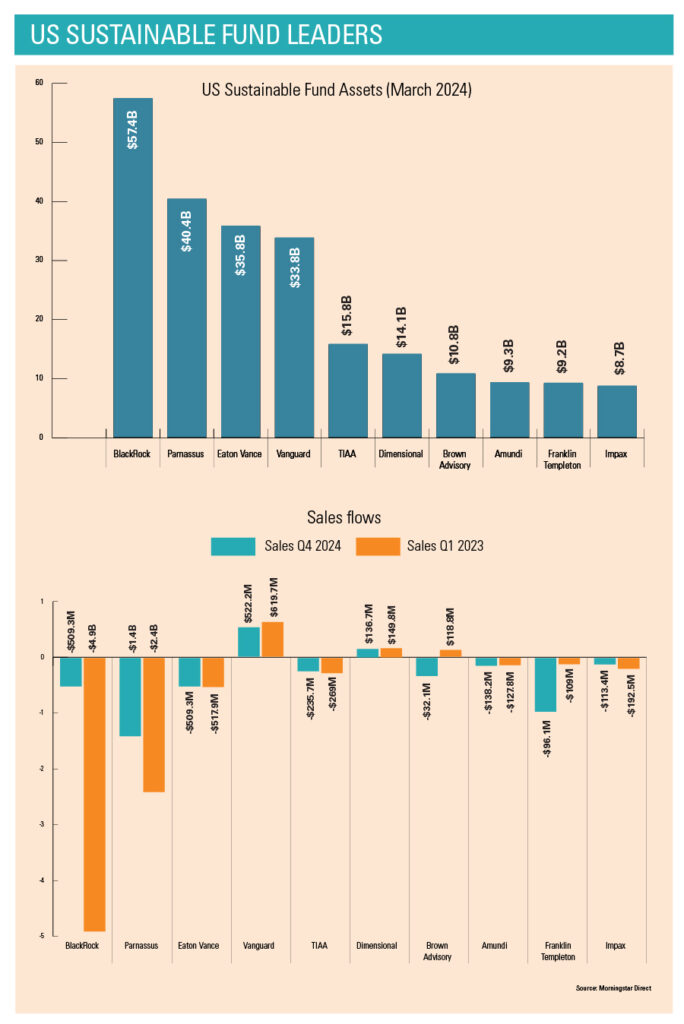

But in the US, BlackRock saw redemptions totaling about $5 billion during the first quarter, nearly 10 times the outflows its sustainable funds saw in the fourth quarter of 2023, at $543 million, data from Morningstar Direct show. Other firms with the most US sustainable fund outflows in the first quarter were Parnassus ($2.5 billion), Eaton Vance ($518 million), State Street ($345 million), TIAA ($269 million), Invesco ($263 million), and Xtrackers ($232 million).

About half of the firms that sponsor sustainable funds in the US saw positive sales, however. Leading the pack were Vanguard ($618 million), Fidelity ($585 million), Dimensional ($150 million), Community Capital ($138 million), and Brown Advisory ($119 million).

Most of the outflows over the past year appear to have come from retail investors, as institutional investors – which largely have accepted ESG investment criteria – tend to have more conviction and a longer timeframe for investment decisions.

Advisors on hold

“I actually don’t know if it’s slowing interest from individual investors we’ve been seeing. It’s more of a hesitation with advisors to engage with their clients on this,” said Kiley Miller, pictured above right, principal director of sustainable investing at Envestnet.

There has been immense pushback by Republicans in Congress and some state leaders on the use of ESG factors in investing. BlackRock in particular has been a target of politicized attacks on ESG, although numerous asset managers have been blacklisted by states like Texas.

As a result, some companies have toned down their stances on ESG publicly. Firms including Vanguard, J.P. Morgan, State Street, Pimco, and Invesco have left organizations such as the Net Zero Asset Managers Initiative or Climate Action 100+.

BlackRock, which is losing more than $10 billion in assets under management in Texas and Florida as a result of anti-ESG measures in those states, remains a member of the Net Zero Asset Managers Initiative but has switched its membership in Climate Action 100+ to BlackRock International.

But the anti-ESG laws and efforts almost exclusively affect public funds, Miller noted.

On Wednesday Wyoming published guidance around a rule requiring investment professionals to disclose whether they consider social criteria with regard to any client assets. A similar rule in Missouri is in litigation, and that state failed to get the lawsuit dismissed.

Nonetheless, the regulatory uncertainty – including a forthcoming final rule from the SEC that would institute new disclosure requirements for investment advisors and companies around ESG practices – has led the industry to pause, Miller said. In March, the SEC finalized a climate-disclosure rule for publicly listed companies, following passage last year of an fund-naming rule aimed to curb greenwashing.

But it hasn’t helped that sustainable funds as a category underperformed conventional peers in 2023, Miller said. Data from Morningstar show that 53 percent of US sustainable funds were in the bottom half for returns last year.

That resulted in part from lower exposure among sustainable funds to Magnificent Seven stocks and macroeconomic pressures that have hurt clean energy projects, Miller said.

“Investing through an ESG lens won’t always be in favor every quarter of every year,” she said. “It will always come down to evaluating the skills of managers.”

Amid the pressures against ESG, asset managers appear to have backed off of their stances publicly, but their approaches to it – investment processes, engagement with portfolio companies, and firm-level commitments – haven’t really changed, she said.

Further, Envestnet’s data show that demand for sustainable investments didn’t significantly change last year, despite the outflows from mutual funds and ETFs industrywide.

The sustainable investments available through the company saw net inflows last year, though sales were lower than those in prior years, Miller said. The use of those funds by advisors and investors in Envestnet’s system was flat – a total of 138,000 investors and 14,000 advisors used sustainable investment funds in 2023, she said.

Hush hush

A survey of financial advisors last year by Fuse Research Network found that the biggest factor steering them away from sustainable funds has been performance, said Loren Fox, director of research at the firm. The next-biggest factors were an apparent lack of demand from clients and the recent anti-ESG politicization, Fox said. But for others, greenwashing is also a concern, he said.

Meanwhile, asset managers have obviously toned down marketing efforts around sustainable investing on the retail side of business, he said. In recent conversations with chief marketing officers, ESG does not come up anymore, though was common in the past few years, he said.

“Clearly there’s a shift in emphasis because it’s just not a growth opportunity like it was a few years ago,” he said. “Naturally it’s not as much of a marketing priority for asset managers.”

Asset managers tend to focus marketing efforts around where the money is going, and that varies by where they specialize in investing, he noted.

But it doesn’t appear that firms have changed their overall stances on ESG factors or have cut positions, he said.

“We’re not looking at some wholesale refashioning of the industry. It’s more of a nuanced shift in emphasis,” he said. “Even if they’re not shouting ESG from the rooftops anymore, they’re still maintaining the same processes they had before that were ESG friendly. A lot of firms will be ready to pivot back if ESG comes into favor again.”

However, distancing themselves from sustainable investing shows the commitments that traditional asset managers have to the space, said Leslie Samuelrich, president of Green Century Funds.

“Most of these so-called sustainable funds were issued by major Wall Street firms that saw it as way to capitalize and take advantage of people’s good intentions. They marketed their basic use of ESG material risk factors in a pretty package that was likely never going to impact on our pressing environmental and social problems,” Samuelrich said in an email. “Now that there is pressure to defend their offerings, they won’t risk alienating their other clients. If it’s too hot, let them get out of the kitchen and leave us authentic firms to stand up to the fossil fuel industry.”

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Raymond James also lured another ex-Edward Jones advisor in South Carolina, while LPL welcomed a mother-and-son team from Edward Jones and Thrivent.

MyVest and Vestmark have also unveiled strategic partnerships aimed at helping advisors and RIAs bring personalization to more clients.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.