Something happened late last year that had long been predicted in the asset management world, but nonetheless was a major event: money in index funds overtook the assets in active ones.

Behind that milestone is a demand for passive investing across mutual funds and ETFs. As investors and advisors have recognized the ability of active management to outperform benchmarks as an abnormality, money has gushed into index funds, largely at the expense of active managers.

Cost has also been a major factor, which is part of the reason that flows have favored ETFs.

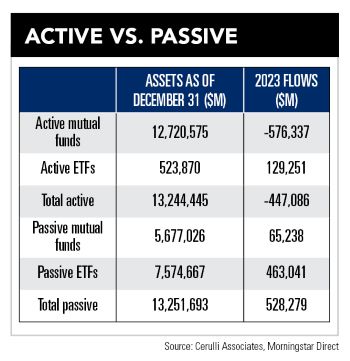

But there’s more to the story, as both active and passive ETFs have seen skyrocketing sales. Active ETFs brought in more than $129 billion last year, nearly double the $65 billion raked in by passive mutual funds, according to a recent Cerulli Associates report that analyzed Morningstar Direct data. Meanwhile, passive ETFs had net sales of $463 billion, and active mutual funds bled $576 billion.

While most financial advisors attribute portfolio returns to a combination of security selection and asset allocation, an increasing proportion – 40 percent – see it almost entirely as the latter, said Matt Apkarian, associate director of product development at Cerulli. That trend has been fueled by the flow of advisors moving from big broker-dealers to independent channels, he said.

“Those advisors, according to our data, believe less in the merits of active investing,” he said. “They believe more that asset allocation is the true driver of portfolio returns, rather than security selection.”

There is, of course, still demand for active strategies, and the early success of many active ETFs shows some proof of that. Those products have been absorbing some of the outflows from actively managed mutual funds, as advisors and clients see benefits in the tax efficiency of ETFs and, to some extent, the cost. That trend will likely accelerate, Apkarian said, as some investors in taxable accounts have been slower to move money out of active mutual funds because of the significant capital gains taxes they stand to incur.

By 2025, ETFs are expected to overtake mutual funds in total assets, he noted.

When asked whether they’ve been favoring passive investing over active management, advisors responded with a range of perspectives, via email.

“For my clients the past three to four years, I have been shifting from actively managed funds to passive, index funds as data continues to suggest the majority of actively managed funds are underperforming passively managed index funds, particularly over longer time periods,” said Justin Rush, founder of JGR Financial Solutions, citing lower expense ratios on passive funds as an additional motivator. “With costs seemingly top of mind for many investors and my expectation that passively managed index funds will continue to outperform the majority of actively managed funds, I would anticipate this trend to continue the balance of 2024 and in the years to come.”

Another advisor, Jay Zigmont, founder of Childfree Wealth, said his firm has always focused on a passive, long-term ETF strategy.

“Most of our clients are invested in three funds: US stocks, international stocks, and bonds, usually at Vanguard,” Zigmont said. “Passive, long-term investing keeps fees low and has stood the test of time. We have seen more clients asking for ESG alternatives, which results in the same three funds, just the ESG versions, again at Vanguard. Investing in long-term, passive funds may not be sexy, but it works.”

Alex Lozano, founder of Lozano Group Wealth Management, noted that financial planning has become increasingly personal, putting clients’ goals and aspirations ahead of traditional market benchmarks. And since clients don’t have to rely on brokers to access investments, with low-cost options plentiful, relationships have become front and center, he said.

“Passive investing will continue to surpass active investing, due to a shift in focus to the overall client/advisor relationship and comprehensive planning,” he said. But “even with the shift of investment philosophy, active investing is not finished. Active investing still provides opportunity to capitalize on short-term opportunistic opportunities, with the ability to focus on specific sectors and companies.”

Another advisor, Chris Diodato, founder of Wellth Financial Planning, said that he’s uneasy about the concentrations large-cap index funds currently have in individual companies.

“When I work with a client, I typically recommend holding no more than 5 percent of an equity portfolio in an individual stock. As of February 8, the S&P 500 has a 7.30 percent allocation to Microsoft, 6.60 percent to Apple, and 4.55 percent toward Alphabet (Google). The NASDAQ Composite [Index] is similarly concentrated,” he said, citing its allocations of nearly 9 percent to Microsoft, 8.6 percent to Apple, and more than 5 percent to NVIDIA. “With this in mind, I’m looking at pairing traditional big cap index funds with active funds, or at least smart-beta funds, which can generate extra return or lower risk, but in a more diversified way versus typical large-cap index funds.”

This year could be different, according to a survey of fund selectors published early this month by Natixis. Sixty-nine percent of those working at the largest US wealth managers said they expect active management to be “essential to investment performance in 2024.”

Among those surveyed, nearly 60 percent said the active funds available through their firms beat their benchmarks last year. And nearly half said they attribute the outperformance of passive funds in recent years to Federal Reserve policy that led to a decade of artificially low interest rates and virtually no inflation.

Even though most active managers don’t beat their benchmarks over three-year time frames, active funds are a major part of model portfolios, though increasingly paired with index-based strategies, Apkarian said.

But while flows have increasingly gone into passive strategies – including in collective investment trusts in the retirement plan market – most of the invested money is still in active, considering vehicles ranging from money-market funds, separately managed accounts, and alternatives, in addition to mutual funds and ETFs, he said, based on his calculations.

“I came to a figure that was more like 70 percent of assets still [being] active and only 30 percent are passive,” Apkarian said.

"QuantumRisk, by design, recognizes that these so-called “impossible” events actually happen, and it accounts for them in a way that advisors can see and plan for," Dr. Ron Piccinini told InvestmentNews.

Advisors who invest time and energy on vital projects for their practice could still be missing growth opportunities – unless they get serious about client-facing activities.

The policy research institution calculates thousands in tax cuts for Washington, Wyoming, and Massachusetts residents on average, with milder reductions for those dwelling in wealth hotspots.

Yieldstreet real estate funds turned out to be far riskier than some clients believed them to be, according to CNBC.

The race to 100 transactions ended a month early this year, with April standing out as the most active month on record for RIA dealmaking.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.