Just as it looks outward and ahead at the possibilities unlocked by artificial intelligence, CFP Board is preparing its organization for the future by bringing on a seasoned tech leader.

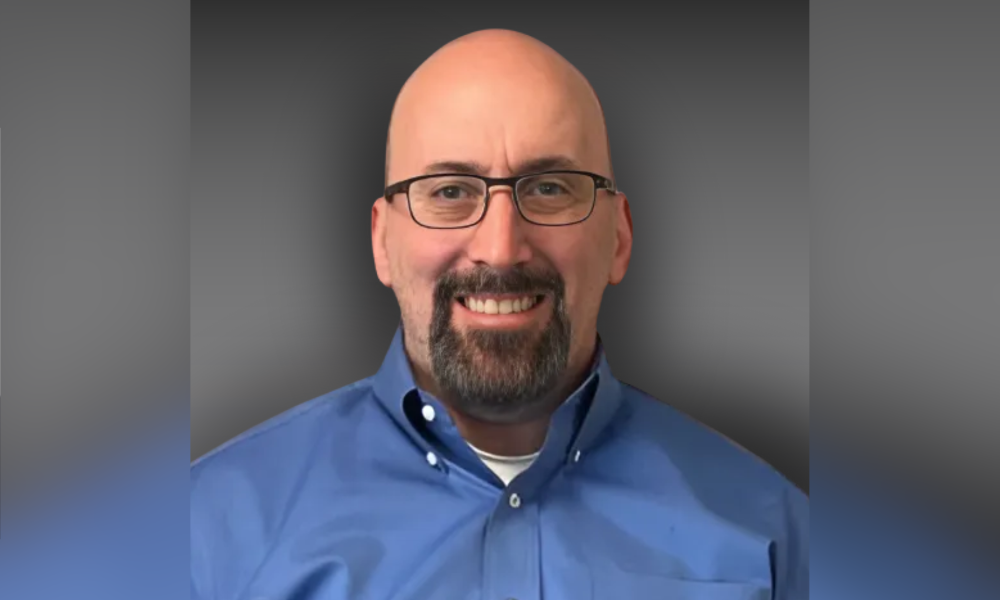

The professional body for personal financial planners announced Thursday that it has appointed Barry Gersten as head technology officer, reflecting its increasing emphasis on digital transformation and emerging technologies.

In this leadership role, Gersten will oversee all aspects of information technology strategy and execution. His responsibilities include aligning tech infrastructure with CFP Board’s mission and operational needs, as well as evaluating how new technologies can serve financial advisors, certification candidates, educators and the public more effectively.

“In this era of rapid technological change, Barry’s leadership will elevate our digital readiness and help us remain at the forefront,” CFP Board chief executive Kevin Keller said on Thursday.

Keller pointed to Gersten's "decades of strategic IT leadership expertise" as a way "to drive innovation, enhance collaboration and build resilient, adaptive systems" to support CFP certificants, candidates, and the broader public.

Before his appointment, Gersten led an independent consulting practice focused on IT assessments and modernization projects for various organizations – including CFP Board. According to his LinkedIn profile, he oversaw a $3 million IT budget and ensured cybersecurity policies and disaster recovery plans across digital platforms, among other achievements and initiatives.

Previously, he served as chief technology officer at the American Nurses Association, where he led digital transformation initiatives that increased operational efficiency by 30 percent and reduced infrastructure costs by 20 percent. His earlier positions include vice president of information technology at The Aspen Institute and chief information officer for the Washington DC Metropolitan Police Department.

“It’s exciting to be in a role where I can apply my experience to make a real impact – using technology to help move both the organization and the financial planning profession forward,” Gersten said.

His appointment coincides with a new initiative from CFP Board to address the impact of AI across the financial planning sector, a topic it's touched on previously with an AI ethics guide published in February.

On June 10 and 11, the organization hosted an AI Working Group at its headquarters in Washington, DC, to examine the implications of artificial intelligence on advisor-client dynamics, business operations and the future of planning services.

“AI is not a distant wave. It’s already reshaping client expectations and how advisors deliver value,” Keller said.

The two-day session is part of CFP Board’s broader strategy to guide the profession through technological change. Led by CFP Board chief operating officer K. Dane Snowden and supported by consulting firm Heidrick & Struggles, the group is tasked with producing actionable guidance for advisors and firms navigating AI integration.

Among other members, the working group includes FP Alpha founder and CEO Andrew Altfest; Joel Bruckenstein, president of T3 Technology; Tim Foley, head of AI at LPL Financial; David Goldberg, chief data and analytics officer at Edelman Financial Engines; Trent Mumma, chief product officer at Orion Advisor Solutions; and Zar Toolan, general partner and head of data & AI at Edward Jones.

The group explored real-world use cases, ethical considerations and strategic trends shaping AI’s adoption in wealth management.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.