What happens when you ask the hottest AI tool in the world, ChatGPT, to design an ETF that can beat the U.S. equity market? It tells you the same thing every frustrated stock manager does.

In a bid to see how close technology really is to replacing Wall Street’s army of analysts, experts and money runners, we challenged ChatGPT, the artificial intelligence tool that’s taking the internet by storm, to create us a winning portfolio for the U.S. stock market.

The result: A classic exercise in fence-sitting, with the tool explaining that the market is too unpredictable to design such a fund, while warning about the need to pick investments aligning with our goals and appetite for risk-taking.

Here was the full response when we instructed ChatGPT to “design an ETF to beat the U.S. stock market and tell us what stocks are in it.”

Score one for the humans. It seems for all the hype, AI still isn’t quite ready to conquer the stock-picking world.

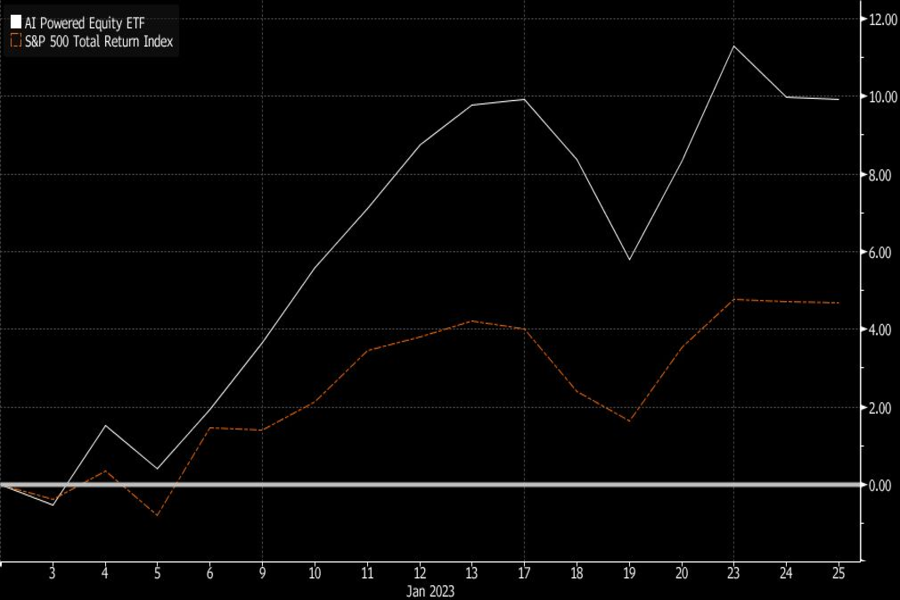

On the other hand, perhaps ChatGPT does know the secret to beating the market, but is intelligent enough not to give it away? There are already artificial intelligence-guided investments all across Wall Street — including in the ETF arena — and some are beating the market right now.

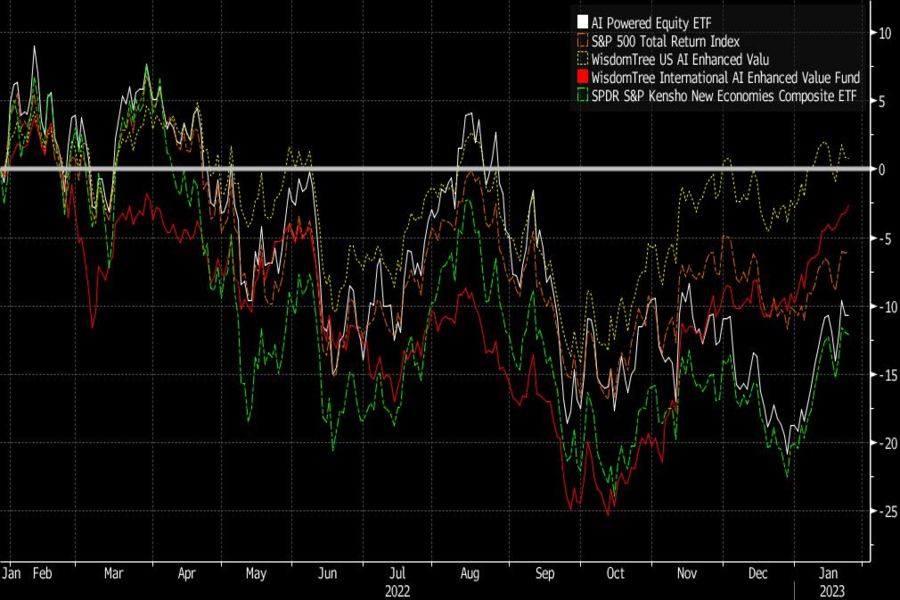

A current standout is the AI Powered Equity ETF (AIEQ), a $102 million vehicle that has returned about 9.9% in 2023 through Wednesday, compared with 4.7% for the S&P 500 Total Return Index.

AIEQ uses a quantitative model running 24/7 on IBM Corp.’s Watson platform to assess more than 6,000 US publicly traded companies each day. It scrapes regulatory filings, news stories, management profiles, sentiment gauges, financial models, valuations and more.

The product, developed by EquBot LLC and overseen by ETF Managers Group LLC, can be quick to shift holdings and exposure levels, making it a barometer of sentiment for observers.

It entered 2023 with a mixed allocation. Major holdings currently include home furnishing firm RH, Las Vegas Sands Corp., sustainable power company Constellation Energy Corp. and JPMorgan Chase & Co.

Returns analysis shows that the ETF’s consumer discretionary holdings — including shares in the likes of Caesars Entertainment Inc., Kohl’s Corp. and the meme-stock favorite GameStop Corp. — have been the biggest driver of performance this year.

However, expand the time horizon and AIEQ’s market-beating prowess comes undone. Since its 2017 inception, the ETF has handed investors about 41%, according to data compiled by Bloomberg. The S&P 500 Total Return Index has delivered more than 72% in the same period.

“It works best when it can catch on to momentum names in the growth space,” said Jessica Rabe, co-founder of DataTrek Research. “It struggled to find momentum names in a highly volatile stock market last year, and when it’s had the best track record, it’s been during bull markets when it favors tech names.”

So perhaps ChatGPT was wise in refusing to attempt to beat the market. To give it another chance, we asked the tool — like others testing ChatGPT’s capabilities with hypotheticals — to help with a different, never-ending quest of money management: an investment offering clear diversification from the broader market.

Here’s what we got when we told ChatGPT to “design an ETF to deliver a return uncorrelated to the U.S. stock market.”

A multi-asset approach, mixing in some alternatives. Not a bad result, according to Eric Balchunas, senior ETF analyst at Bloomberg Intelligence — even if history shows that human investors tend to like their asset classes separate.

“This is straight out of the institutional playbook,” Balchunas said “These are solid recommendations for asset classes that provide non-correlated returns. This is what the majority of institutional investors invest in. It’s clearly read the books.”

In this answer, ChatGPT notes that it’s hard to create an uncorrelated ETF since there is usually some level of co-movement. It urges that any portfolio should be chosen through analysis of the market, and — in good news for the finance community — once again encourages us to speak to an advisor.

Recognizing the limitations of ChatGPT is an important caveat to our informal experiment. The tool is language based, and optimized for dialog — it wasn’t designed to predict the markets. OpenAI, the company behind ChatGPT, is transparent about its limitations, such as its “limited knowledge” of anything after 2021.

Since the tool won’t provide us a new machine-made portfolio in detail, we tried the next best thing and asked it to name “the best AI-powered ETF.” But for some reason, ChatGPT struggles to identify any at all — despite the likes of AIEQ having the words “AI Powered” in its name. And while it does say “there are some ETFs that use artificial intelligence (AI) as part of their investment process,” the tool doesn’t go on to name any.

If it were naming names, it would likely mention the $419 million WisdomTree U.S. AI Enhanced Value Fund (AIVL), one of the largest. Alongside its sister fund, the $82 million WisdomTree International AI Enhanced Value Fund (AIVI), it underwent changes a year ago to incorporate AI and machine learning into its strategy and name.

AIVL has returned about 0.8% in the past year while AIVI has lost 2.6%, versus a 6.1% loss for the S&P 500 Total Return Index. The two funds are posting mixed performance against the benchmark in 2023, with gains of 3.7% and 7.9%, respectively.

Also nearing an anniversary is the $26 million AdvisorShares Let Bob AI Powered Momentum ETF (LETB), which turns one-year-old next month and analyzes a blend of data to gauge both fundamental sentiment and technical price momentum. It has lost about 9.2% since launch, but is roughly flat in 2023.

One specialist issuer, Qraft AI, runs several small funds powered by machine. Its $12 million Qraft AI-Enhanced US Large Cap Momentum ETF (AMOM) has returned 4.5% this year.

Meanwhile, the $1.7 billion SPDR S&P Kensho New Economies Composite ETF (KOMP) is the largest and most eye-catching of the cohort. One of a number of State Street Global Advisors funds incorporating machines, it tracks an index that uses AI and quant methodologies to pick stocks benefitting from, among other things, AI. It’s up 10% this year.

Matt Bartolini, head of SPDR Americas Research at State Street, says the use of AI means the fund can analyze a much larger set of potential investments than humans alone can manage.

“AI looks at thousands of pages in mere seconds,” Bartolini said. “You can increase productivity in the coverage scope than with a more human-based approach.”

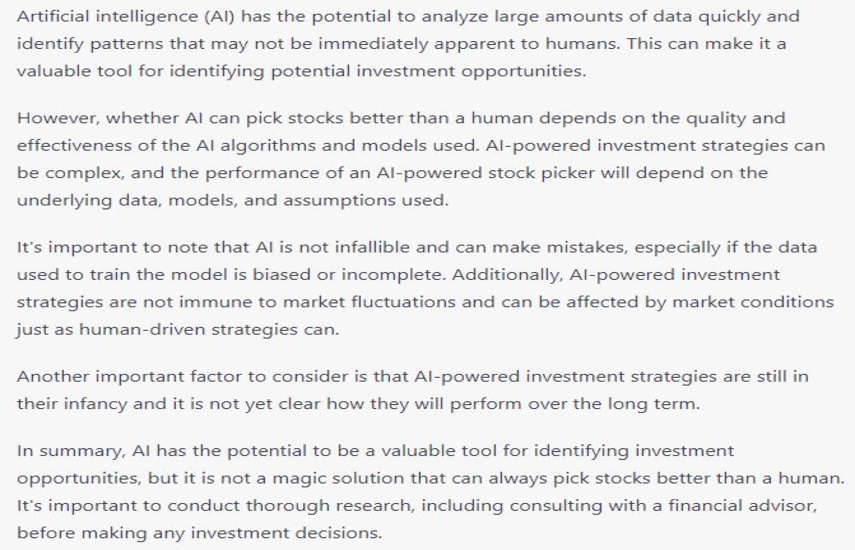

To end our experiment, we decided to be direct. We told ChatGPT bluntly to “explain whether artificial intelligence can pick stocks better than a human.” Here’s what we got back, in full:

So, it seems there’s hope for the humans of Wall Street yet.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.