It’s been two years since Covid-19 shut down the world economy and permanently changed the way all of us live and work. In a special section in the March 21 issue, the InvestmentNews team explores the new challenges, and benefits, that resulted from the pandemic and how the new normal has affected the financial services industry for the long term.

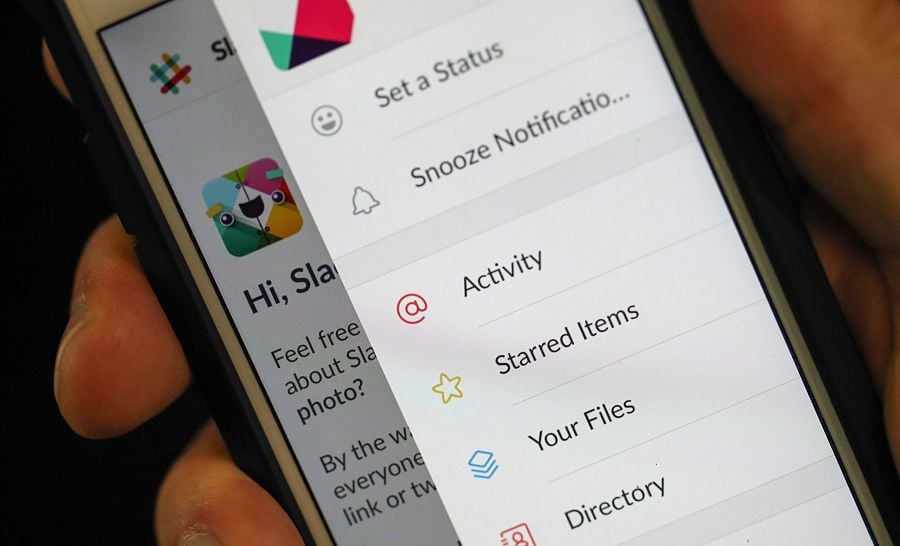

Unmonitored messaging apps are cropping up quickly at wealth management firms as advisers return to office life and reshape how they interact with colleagues and clients.

The latest apps like WhatsApp and email platforms like Gmail are beginning to play an oversized role in adviser communications, a trend that could increase as more clients choose to communicate via their smartphones. The vast majority of Americans (97%) now own a cellular phone of some kind, while the share of smartphone owners with internet connectivity is now 85%, up from just 35% when the Pew Research Center first conducted its annual survey in 2011.

While Wall Street firms have been required for decades to closely monitor and save business communications, the new mobile apps that proliferated during the lockdowns of the pandemic have complicated their oversight efforts in recent years — and are now coming under fire from regulators.

As banks and wealth managers were forced to send workers home amid Covid-19, companies ran into difficulties keeping tabs on advisers who might be using an unmonitored device.

Advisers at JPMorgan Chase & Co., for example, routinely communicated using their personal devices, according to a Securities and Exchange Commission order released in December. The SEC and the Commodity Futures Trading Commission fined the company a total of $200 million, saying that even managing directors and other senior supervisors at the bank had used services such as WhatsApp or personal email addresses for work-related communication.

The Wall Street money manager isn't alone. Firms including Goldman Sachs Group Inc. and HSBC Holdings are also being probed by U.S. regulators over staffers’ communication concerns. Just last week, Citigroup Inc. joined the list of banks being investigated over employee communications using unauthorized messaging services.

The industry’s shift to remote work also blurred the lines between work life and personal communication as advisers brought their jobs home during the pandemic. Financial Industry Regulatory Authority Inc. examinations are still being handled remotely, after the agency extended the deadline to return to in-person exams through June of this year.

Clients are increasingly connected, and wealth management tech providers are betting advisers will want to reach clients using texts or messaging apps. Fintech firms like Redtail Inc. and Snappy Kraken have recently launched compliant texting for advisers.

Faster and more direct forms of communication are likely here to stay. Ninety-eight percent of text messages are opened compared to just 20% of emails, according to data provided by Redtail. And on average, people respond to texts in under 90 seconds, while it takes someone 90 minutes to respond to an email.

As these apps continue to proliferate in wealth management, brokerages will need to keep tabs on employees who choose to communicate with others through unmonitored messaging apps, or risk paying a price with regulators, which will continue to keep an increasingly watchful eye.

More articles from the special section:

Since Vis Raghavan took over the reins last year, several have jumped ship.

Chasing productivity is one thing, but when you're cutting corners, missing details, and making mistakes, it's time to take a step back.

It is not clear how many employees will be affected, but none of the private partnership's 20,000 financial advisors will see their jobs at risk.

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning