Roughly two months since it secured a fresh round of funding from a consortium of VC investors including Singapore's GIC, Salesforce Ventures, and Iconiq Growth, Altruist is making a statement.

On Monday, the firm unveiled a major update, overhauling its platform with a totally new look that leans into one of its fundamental founding principles.

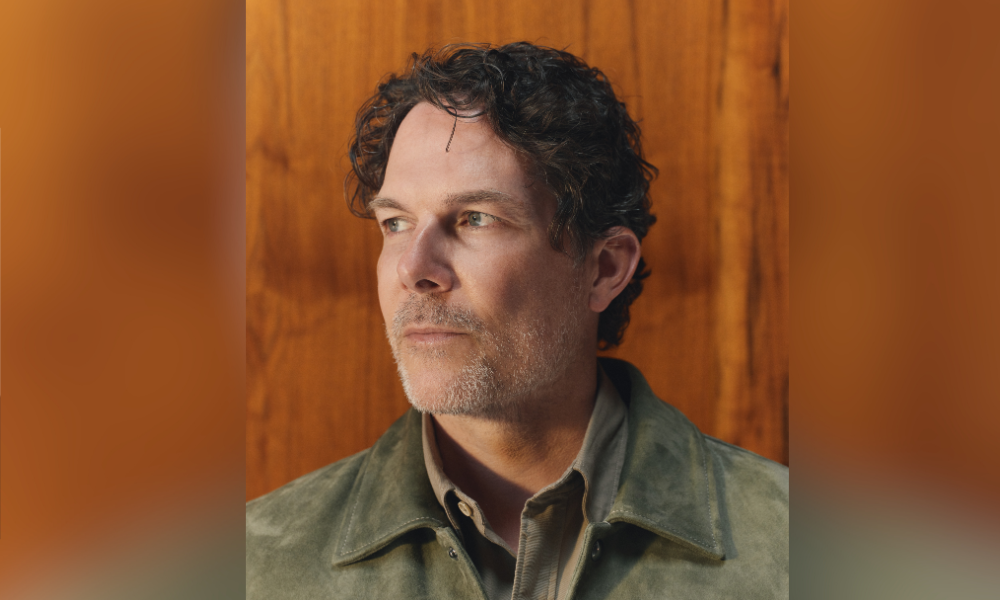

"We've had a ton of success with the current brand," Jason Wenk, the firm's founder and CEO, told InvestmentNews in an interview Monday. "From the very beginning, we've always been a very design-led company."

Since entering the scene six years ago, Wenk says his company has strived to make elegance and simplicity its calling card among advisors. But as it rolled out more features and its platform grew, he says the Altruist experience started to feel inconsistent. At the same time, he says the firm's expansion as a challenger custodian for independent advisors – with 4,900 advisors and hundreds of thousands of end clients now reportedly on the platform – has given it a clearer sense of identity and purpose.

"Our original mission when Altruist started was to make financial advice better, more affordable and accessible to everyone," Wenk says. "Now, what we learned was that's enabled not just with a technology platform, but that's enabled with relationships. So you'll also see us leaning into that through the relationships we have with advisors, their operations teams, and the clients and families they serve."

In the Monday announcement, Wenk called out legacy custodian portals that might make advisors "think [they've] been transported back in time," and how consumer finance apps have led the way in creating a more intuitive user experience.

On that note, he has some good words to say about Robinhood – which is making inroads into the independent RIA space through its acquisition of TradePMR – and its "ability to make complex things simple" as well as its design-forward thinking around the user experience.

"So far, there's been zero evolution to [the TradePMR] brand and product," Wenk says. "But you have to imagine that sometime in the next couple of years ... they'll try to create a much more unified brand experience, and I think that'll be good for the industry."

While Altruist is still very much a David among Goliaths in the custodial platform space – it garnered a 6.25% market share among respondents in the most recent 2025 T3 /Inside Information Software report, a far cry from 45.54% for Schwab and 18.47% for Fidelity – the startup has expanded its profile by leaps and bounds.

Apart from earning honorable mentions on multiple wealth tech categories including portfolio management, cash management, and customized client billing, the company has distinguished itself as the fastest-growing RIA custodian. It has reportedly tripled its AUM for two years running, helped along by its 2023 acquisition of SSG.

When it comes to portfolio management, Altruist earned top marks among the youngest respondents to the T3 survey, garnering the highest ratings among all providers within the 1-5 year user category. It was also rated best or second-best consistently among fee-only and dually registered advisors, the smallest firms reporting less than $500,000 in assets, and those operating in the neighborhood of $1 million and $1.5 million. In terms of market share, Altruist sees the largest uptake from firms with less than $500,000 in assets, where it took second place just behind Advyzon.

Wenk says the platform's clientele can generally be described as "modern growth-focused advisors," who tend to be very client-centric and focused on "delivering great client outcomes." He says Altruist's customers also include multibillion-dollar firms that are still in growth mode, and are therefore intrigued by the firm's capabilities for onboarding and moving clients' money.

"We think people should be able to do better. More people should get access to an advisor. We think business ownership should be simple, and not every RIA needs to sell to a big aggregator," Wenk says. "So many firms want to serve people who are already rich ... I think you solve [the advice gap] much better by having entrepreneurs going out there and building their own business in their local communities, or serving a niche of clients that they deeply resonate with."

Altruist certainly hasn't stood still since its $152 million funding round in April. Aside from announcing new trading integrations with Orion and Advyzon, it has also teased a new premium subscription plan, Altruist One, as well as its flagship AI product Hazel. That came on the back of its acquiring an AI-powered advisor productivity platform called Thyme earlier this month, whose development team has now been rolled into Altruist as it pushes more developments in artificial intelligence.

"Effectively, over 50% of our company are builders," Wenk says. "We're a tech company first, [we want] to build our company first, and we don't intend to change that."

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Elsewhere, an advisor formerly with a Commonwealth affiliate firm is launching her own independent practice with an Osaic OSJ.

A survey reveals seven in 10 expect it to be a source of income, while most non-retired respondents worry about its continued sustainability.

AI suite and patent for AI-driven financial matchmaking arrive amid growing importance of marketing and tech among advisory firms.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning