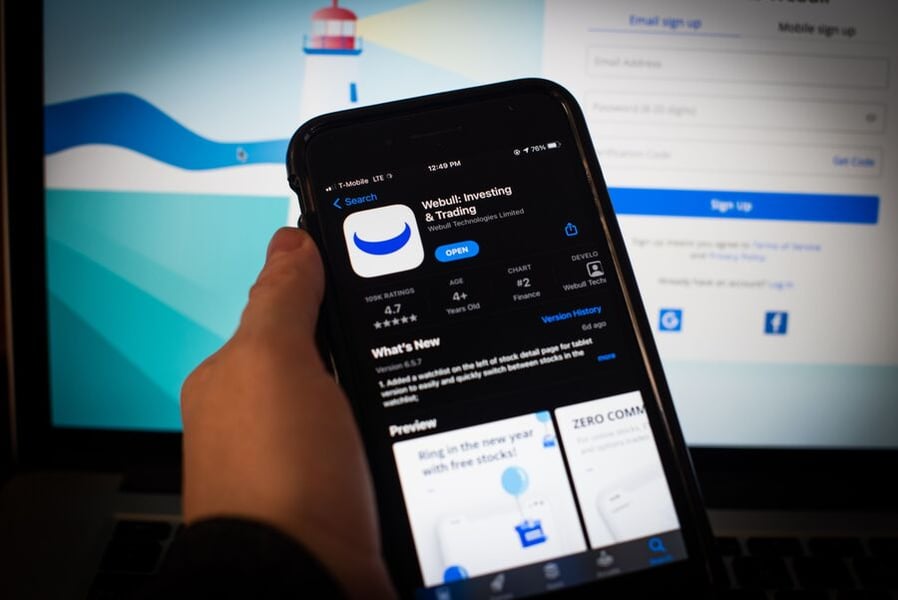

Stock trading app provider Webull Financial has been fined $3 million by Finra for allegedly not properly vetting its customers, including more 2,500 people younger than 21 who were allowed to trade options spreads.

Finra, which announced the fine Thursday, found that the company did not conduct adequate due diligence on customers between December 2019 and July 2021, according to an announcement from the self-regulatory organization.

“During this period, the firm employed an automated system to review customer applications for options trading, but the system failed to compare new applications with information previously provided by the customer,” Finra’s announcement read. “This led to Webull’s approval of customers for options trading who did not satisfy the firm’s eligibility criteria, or whose accounts contained red flags that options trading was potentially inappropriate for them.”

The young app users could not have satisfied the three years of options trading experience the company required to allow them to trade options spreads, according to Finra.

The company also mistakenly approved about 9,000 people to trade options even though those customers indicated they had no investment experience. That was a result of “program errors in the firm’s automated systems,” Finra stated.

Additionally, the fines address faults in Webull’s supervisory system that did not allow it to monitor customer complaints between May 2018 and December 2021. The company didn't report some customer complaints to Finra, including ones that alleged thefts from their accounts or misappropriation, the regulator stated.

As part of the settlement, Webull acknowledged Finra’s findings but did not admit or deny the allegations. The company declined to comment to InvestmentNews.

Webull, which was founded in 2017, is a subsidiary of Fumi Technology, according to data from Crunchbase. Last year, Webull was in negotiations to be acquired by now disgraced cryptocurrency exchange FTX, although an agreement was not reached, reporting by Bloomberg found.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.