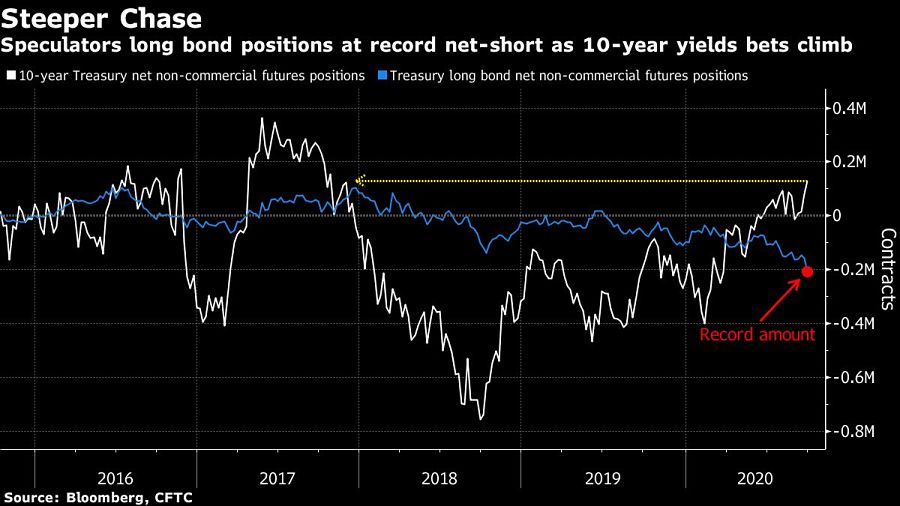

Fast-money wagers against longer-dated Treasuries have hit a record in a sign that hedge funds are positioning themselves ever more aggressively for a steeper yield curve.

Net short speculative positions in long bond futures saw the biggest weekly climb since 2007 to reach around 209,000 contracts, according to the latest Commodity Futures Trading Commission data. Meanwhile, net long positions on 10-year Treasuries have risen to their highest since October 2017.

So-called steepener trades are often seen as bets on reflation, while investors are also positioning for the possibility of greater deficits should the Democratic party prevail in November’s election.

A new Wall Street Journal/NBC News poll taken after Tuesday’s debate showed Joe Biden leading Donald Trump by 14 percentage points. It was taken before the president was diagnosed with coronavirus.

The surge in shorts appears to be related to new wagers on the direction of the curve, rather than so-called basis trades which bet on the spread between bonds and futures, according to JPMorgan Chase & Co. strategists including Jay Barry.

“We think curve positioning could be behind those moves,” they wrote in a note to clients Friday. “While outright exposure to duration positions are not large, curve steepening positions remain large relative to historic ranges, and the risk is these trades could be unwound.”

The spread between the 10-year and 30-year yields has widened by more than 30 basis points so far this year and was at around 79 basis points on Monday. It reached near 81 basis points in June, the high so far this year.

Similar bets are also being made in the swaption market. Options on swap rates show the cost to hedge against a 25 basis point rise in 30-year rates is at the highest in six months relative to protection against a decline of the same size.

[More: Bond market refresh]

Chasing productivity is one thing, but when you're cutting corners, missing details, and making mistakes, it's time to take a step back.

It is not clear how many employees will be affected, but none of the private partnership’s 20,000 financial advisors will see their jobs at risk.

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Elsewhere, an advisor formerly with a Commonwealth affiliate firm is launching her own independent practice with an Osaic OSJ.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning