Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning

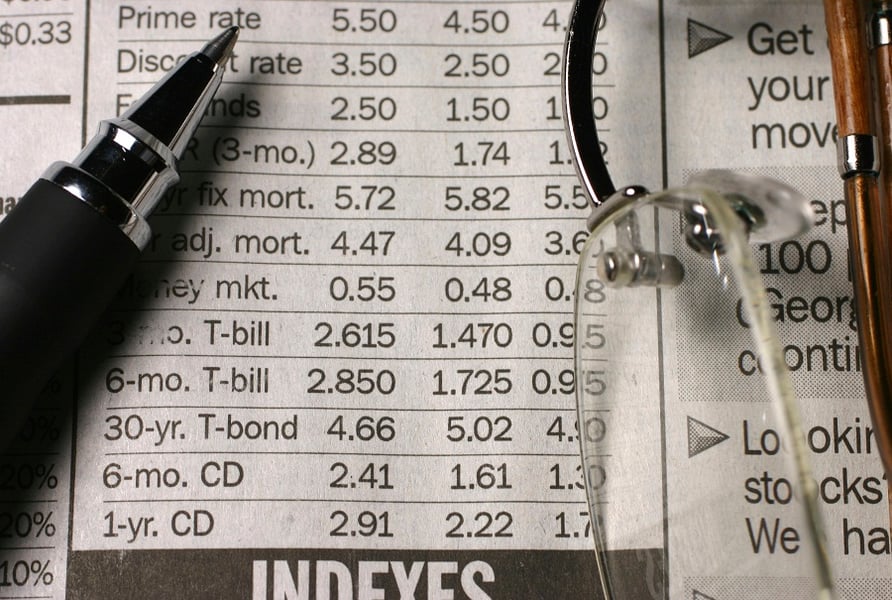

Experts flag potential risks for seniors as headline readings for July obscure higher jumps in key price categories.

Emerson Equity and its advisor, Tony Barouti, were likely the largest sellers of defunct GWG L bonds.

The President's comments on social media came after analysts sounded notes of caution on the impact on consumer prices.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning