Pimco guru steering clear of soverign bonds from the Continent; can this family get along?

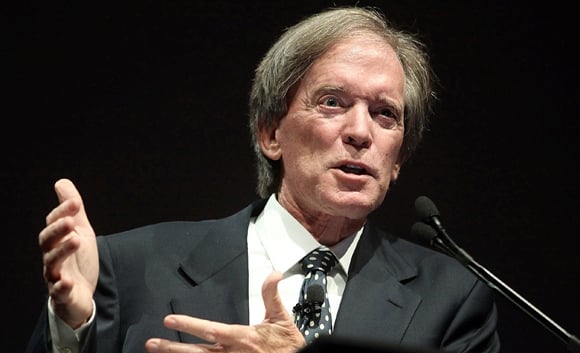

Pacific Investment Management Co.'s Bill Gross said a “debt trap” remains in place even after European leaders reached an agreement that alleviated concern the region's banks will fail.

Pimco continues to avoid the debt of nations including Spain and Portugal in favor of U.S. Treasuries and mortgage securities, Gross, who runs the world's biggest bond fund, said in a radio interview on “Bloomberg Surveillance” with Tom Keene and Ken Prewitt.

“The peripherals and even the core union nations have too much debt,” Gross said. “The marginal cost of that debt is far above nominal GDP growth in respective nations. That continues a debt trap unless the cost of debt can come down.”

Five-year notes of Spain, with $935 billion of debt and an 8.5 percent deficit, yield 5.5 percent. The nation's gross domestic product is forecast to shrink 1.7 percent this year and 0.5 percent in 2013, according to the median estimate of economists surveyed by Bloomberg.

European policy makers eased repayment rules for Spanish banks, relaxed conditions for possible aid to Italy and unveiled a $149 billion growth plan for the region's economy at a summit in Brussels. They dropped a requirement that their governments get preferred-creditor status on crisis loans to Spain's lenders.

Fiscal Union

“We need some sense that the family can get along going forward,” Gross said. “That is a union of some sort. Not just a monetary union but a fiscal union that can have an actual impact going forward.”

Gross raised the proportion of U.S. government and Treasury debt in the $261 billion Total Return Fund (PTTRX) to 35 percent in May, the first increase since January and up from 31 percent of its holdings in April. Mortgages remained the largest holding in the fund at 52 percent last month, according to data on the website.

“Mexico and Brazil, they're all attractive markets with clean balance sheets,” Gross said. “They're much more safe, so to speak, than some of those peripherals,”

Brazil has a deficit of 2.4 percent while Mexico's is 0.92 percent. Bonds of Brazil have returned 2.1 percent this month, and Mexico's have gained 3 percent, according to Bank of America Merrill Lynch index data.

Pimco's Total Return Fund gained 7.2 percent over the past year, beating 74 percent of its peers, according to data compiled by Bloomberg.

--Bloomberg News--