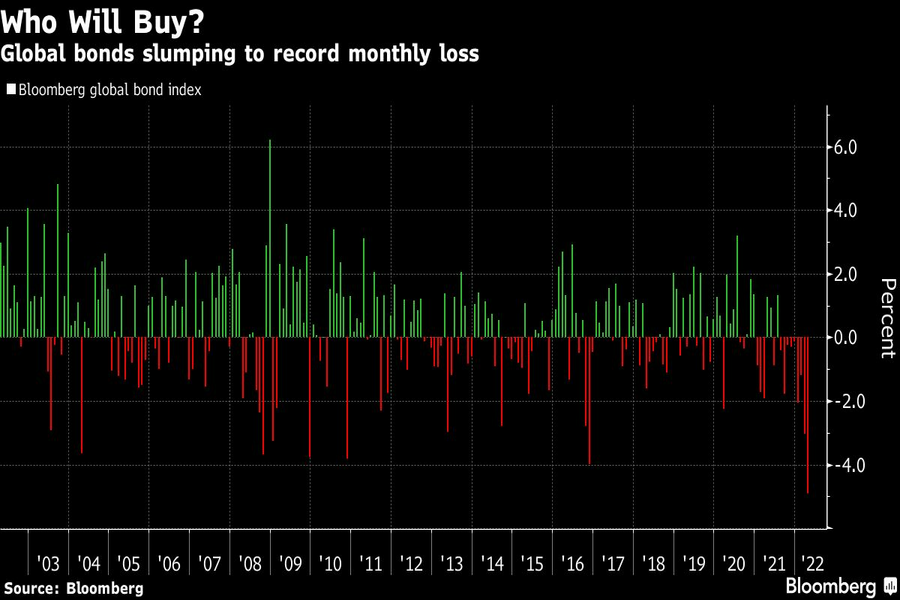

Global bonds are closing in on their worst month on record as investors brace for a flurry of rate hikes in the coming week, including the most aggressive U.S. tightening since May 2000.

The Bloomberg Global-Aggregate Total Return Index has lost 4.9% in April, putting it on track for the biggest monthly drop since its inception in 1990. Australia’s three-year yields climbed as much as seven basis points to 2.74%.

Fears of quickening inflation have torpedoed bonds worldwide, with a cut in Russian gas supply to Poland and Bulgaria and a red-hot Australian inflation print fueling expectations that the rout may continue. Swap traders are pricing in a half-point rate increase by the Federal Reserve on May 4 and also see the Reserve Bank of Australia and Bank of England raising borrowing costs next week.

“Until Fed pricing has run its course and stabilizes, global yields can rise further,” said Imre Speizer, a strategist at Westpac Banking Corp. in Auckland. “Investors will be reluctant buyers of bonds as long as Fed rate pricing keeps moving higher, or until they are more confident about pricing an eventual economic slowdown.”

Volatility in fixed-income markets is likely to remain elevated, as investors weigh the possibility that aggressive tightening by major central banks may derail global growth.

In the corporate debt universe, high-grade notes have lost 5.3% so far this month, according to a Bloomberg multi-currency global benchmark, putting it on track for their biggest monthly slump since March 2020 when the pandemic rocked financial markets.

Credit is especially vulnerable to the increasing stagflation risks generated by war in Ukraine and China’s Covid-driven woes. That’s because not only can inflation decimate investor returns, but a slumping economy also increases default risks for weaker borrowers.

“Stagflation remains our base case for the rest of the year as recession risk is increasing in Europe and central banks remaining committed to their course of policy normalization against the backdrop of very high inflation,” said Salman Ahmed, global head of macro and strategic asset allocation at Fidelity International.

Plus, a $400 million Commonwealth team departs to launch an independent family-run RIA in the East Bay area.

The collaboration will focus initially on strategies within collective investment trusts in DC plans, with plans to expand to other retirement-focused private investment solutions.

“I respectfully request that all recruiters for other BDs discontinue their efforts to contact me," writes Thomas Bartholomew.

Wealth tech veteran Aaron Klein speaks out against the "misery" of client meetings, why advisors' communication skills don't always help, and AI's potential to make bad meetings "100 times better."

The proposed $120 million settlement would close the book on a legal challenge alleging the Wall Street banks failed to disclose crucial conflicts of interest to investors.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.