The head of the world's biggest bond fund said he sees a more than 1 in 3 chance that the euro zone will break apart and trigger a financial crisis.

The head of the world's biggest bond fund said he sees a more than 1 in 3 chance that the euro zone will break apart and trigger a financial crisis akin to the one that devastated the global economy in 2008.

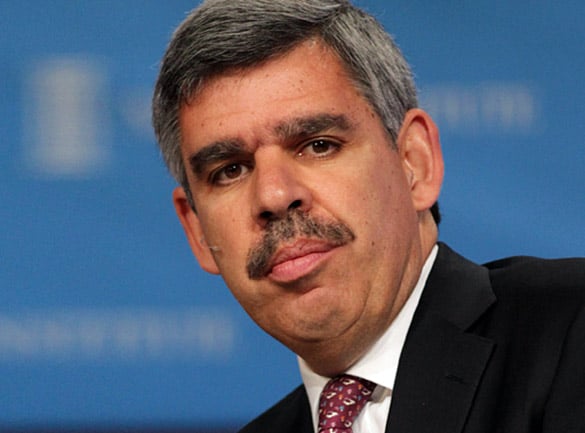

“It would be the equivalent of a sudden stop” in which financial markets seized up, Mohamed El-Erian, chief executive officer of Pacific Investment Management Co. in Newport Beach, California, said. “It would be really, really messy.”

The global economy suffered its worst recession since World War II after the collapse of Lehman Brothers Holdings Inc. in September 2008 triggered steep falls in global stock markets. Gross domestic product in the U.S., the world's largest economy, shrank by 5.1 percent.

El-Erian said in a Bloomberg interview that the crisis in Europe is no longer just about what will happen to periphery nations like Greece. “It is now a crisis for the euro zone as a whole,” he said.

He said the most likely outcome -- with a 1 in 2 chance -- is that European policy makers “get their act together” and manage the transition to a smaller currency union. The least likely is that the 17-nation euro zone stays intact: the possibility of that occurring is just 15 percent, he said.

Europe bolstered its anti-crisis arsenal this week, channeling 150 billion euros ($196 billion) to the International Monetary Fund as the European Central Bank widened its support for sagging bond markets.

Italian Bonds

Bonds of Italy and Spain rallied on expectations that the ECB's unprecedented backing for banks will lead lenders to buy more government debt. Italian two-year note yields dropped 20 basis points, or 0.2 percentage point, to 4.94 percent at 3:47 p.m. London time, after reaching 4.91 percent, the least since Oct. 31. Spain's two-year note yields slid three basis points to 3.34 percent.

El-Erian said that policy makers in Europe are still behind the curve in their efforts to contain the turmoil in the financial markets.

“The contamination has been allowed to travel from the outer core all the way in and threaten the inner core,” he said.

The premium that France must pay over Germany to borrow for 10 years has “gotten to levels that were once deemed unthinkable,” he said. That spread today stood at 113 basis points, up from 40 basis points at the end of last year though down from a high of more than 200 points earlier this quarter.

Credit Ratings

Credit ratings of many European nations are also under review, El-Erian said. Standard & Poor's said on Dec. 5 that Germany and France may be stripped of their AAA credit ratings as the region's crisis prompted the New York firm to put 15 euro nations on review for possible downgrade.

El-Erian singled out nine countries that might remain in the currency union if policy makers decide to downsize it -- Austria, Belgium, Finland, France, Germany, Italy, Luxembourg, the Netherlands and Spain.

“The critical issue is whether Italy and Spain will be included,” he said.

Pimco expects Europe's economy to shrink by 1 percent to 2 percent in the coming year, with the risks to that forecast skewed to the downside, El-Erian added.

He voiced skepticism that the recent acceleration in U.S. growth will prove sustainable and forecast that the world's largest economy will expand little, if at all, over the next year. He said the recent growth spurt had been fueled by a drop in savings that he doesn't expect to last.

“Currently projections are for 3 to 3.5 percent” economic growth in the fourth quarter, El-Erian said. “It wouldn't surprise me if we end up below that.”

The economy expanded at an annualized rate of 2 percent in the third quarter, according to the Commerce Department in Washington.

--Bloomberg News--