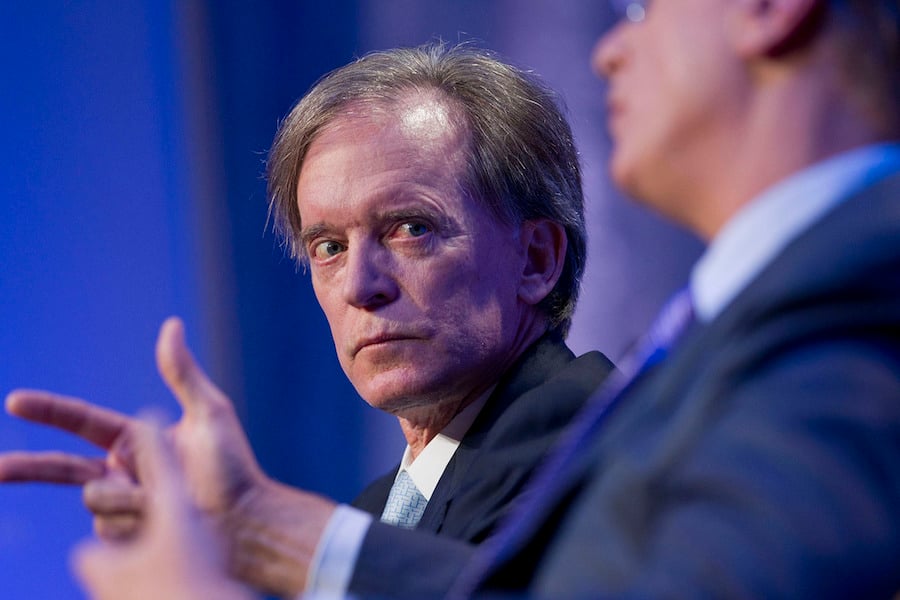

Pacific Investment Management Co. may not win a quick end to Bill Gross's lawsuit claiming he's owed hundreds of millions of dollars after allegedly being forced out of the firm he co-founded 45 years ago.

Pacific Investment Management Co. may not win a quick end to Bill Gross' lawsuit claiming he's owed hundreds of millions of dollars after allegedly being forced out of the firm he co-founded 45 years ago.

A California state judge tentatively ruled that Mr. Gross met minimum requirements to go forward with his wrongful termination lawsuit against Pimco.

“Gross alleges sufficient facts based on allegations concerning his status as the founder, a 40-year history, an alleged track record of bringing success and/or fame to the enterprise, as well as a series of alleged oral promises/assurances of continued employment,” California Superior Court Judge Martha Gooding in Santa Ana said in her tentative decision, issued before a hearing scheduled for Monday.

Pimco says the case should be thrown out because Mr. Gross failed to show he had any agreement with the firm guaranteeing his employment. The company also argued in a court filing that its profit-sharing plan clearly provides no basis for him to allege he was improperly deprived of bonuses for two quarters.

Michael Reid, a Pimco spokesman, didn't immediately respond to an e-mail Sunday seeking comment on the tentative ruling.

The judge will issue a final decision after listening to further arguments from both sides. She won't rule on the merits of Mr. Gross's allegation that his resignation wasn't truly voluntary and that Pimco breached its contract with him. The only question before her now is whether there's a legal basis for his claims.

Mr. Gross left Pimco in September 2014 amid a public falling out with other managing directors after lagging results at the Pimco Total Return Fund, then the world's largest mutual fund, led to a flood of redemptions. The money manager sued a year later, claiming he was ousted so that Pimco wouldn't have to pay him his $200-million cut of the bonus pool and his rivals could increase their compensation.

Mr. Gross, who built Pimco on fixed-income investments, opposed the company's expansion into higher-risk asset classes such as equities, commodities, real estate and hedge fund-like products, according to his complaint.

Mr. Gross, 71, now co-manages the $1.26 billion Janus Global Unconstrained Bond Fund, which has gained 0.8% this year while almost breaking even since he took over management in October 2014, according to data compiled by Bloomberg. Most of the money in the unconstrained fund is from Mr. Gross's $2 billion personal fortune. Mr. Gross has said he will donate any award or settlement from the lawsuit to charity.

The case is Mr. Gross v. Pacific Investment Management Co., 30-2015-00813636, California Superior Court, Orange County (Santa Ana).