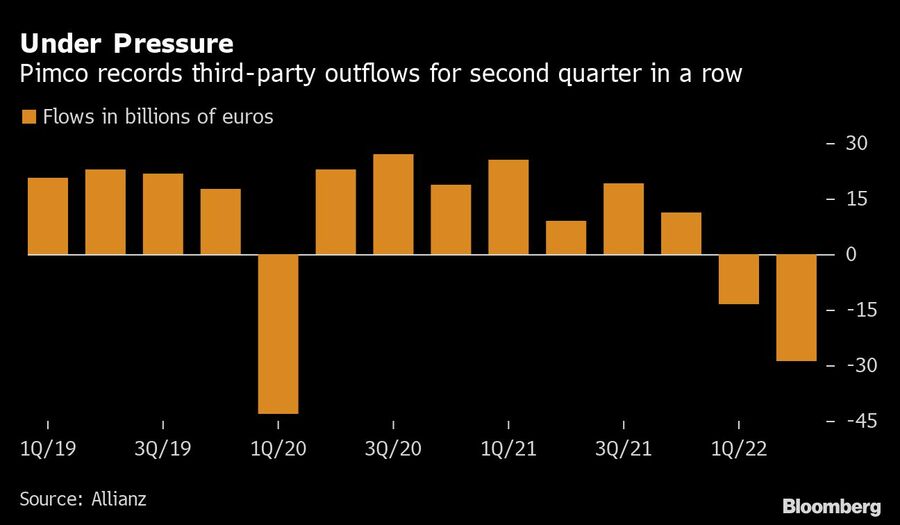

Bond giant Pacific Investment Management Co. saw outside clients pull money for a second straight quarter amid a global sell-off in bonds.

Investors withdrew 28.7 billion euros ($29.4 billion) from Pimco in the three months ended in June, parent Allianz said Friday, adding to the first outflows since the onset of the pandemic earlier this year. Allianz group operating profit rose in the second quarter, driven by the German company’s property-casualty insurance business.

Allianz counts on its asset management units to diversify its business beyond insurance, while Pimco is facing headwinds as investors flee fixed-income securities after high inflation prompted interest-rate hikes, making existing bonds less attractive.

The outflows continued into the second quarter, Allianz CFO Giulio Terzariol said in an interview on Bloomberg Television. But once the interest-rate situation stabilizes, "all those outflows are going to become inflows,” he added.

Allianz shares were down 1.9% at 1:41 p.m. in Frankfurt. Analysts at Citigroup said Pimco outflows were significantly higher than expected, while analysts at Jefferies wrote their enthusiasm was dampened by lower assets under management and other factors.

Pimco’s total third-party assets dropped to 1.39 trillion euros ($1.42 trillion) in the second quarter considering market and currency moves, compared to 1.45 trillion euros ($1.48 trillion) at the end of March.

“Pimco is in the eye of the Fed hike storm and will likely be a much smaller company when all is said and done,” said Eric Balchunas, an analyst at Bloomberg Intelligence. “Although it could be worse as some of its funds are outperforming, which could help down the road if and when investors come back.”

Allianz group operating profit rose more than expected to 3.5 billion euros ($3.6 billion) in the second quarter, compared to 3.3 billion euros ($3.4 billion) a year earlier. The property-casualty insurance business profited from improved underwriting and investment results, while earnings in the life insurance and asset management segments were weighing on overall profit.

Allianz confirmed its 2022 operating profit target at 13.4 billion euros ($13.7 billion), plus or minus 1 billion euros ($1.02 billion).

Terzariol said Allianz might consider another share buyback over the next six to 12 months. “At this moment, buybacks might even be a better idea as opposed to M&A,” he said.

The bond sell-off was not the only challenge Allianz Chief Executive Oliver Baete had to deal with in asset management this year. A unit of Allianz Global Investors agreed to pay $5.8 billion after misrepresenting the risk posed by some of its hedge funds that collapsed amid pandemic market turmoil. In a deal with regulators, the company agreed to transfer most of the AGI US business to Voya Financial Inc.

Allianz will eventually also take a hit of about 400 million euros to profit from the sale of a majority in its Russian operations, part of a retreat from the country in the wake of the war in Ukraine, it said earlier.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.