'The rules have been changed here,' says Pimco debt guru

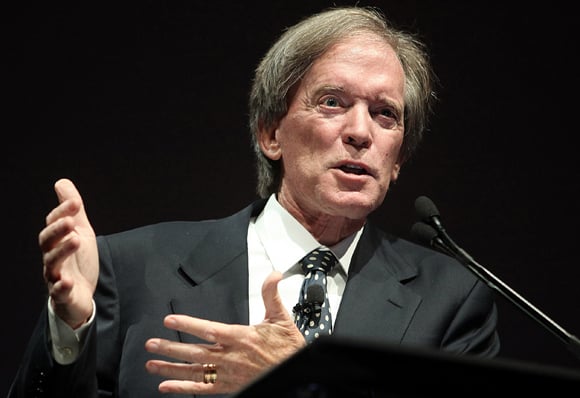

The “sanctity” of bondholders' contracts has been diminished by Greece's pushing through the biggest sovereign restructuring in history, according to Bill Gross of Pacific Investment Management Co.

“The rules have been changed here,” Gross, co-chief investment officer at Pimco, said in a radio interview on “Bloomberg Surveillance” with Tom Keene and Ken Prewitt. “The sanctity of their contracts is certainly lessened. Bondholders have that to look forward to going into the future.”

Greece drove through its debt swap after cajoling private investors to forgive more than 100 billion euros ($132 billion) of debt, opening the way for a second rescue package. The subordination of private bondholders to government organizations such as the European Central Bank may have added as much as 1 percentage point to bond yields, Gross said.

The International Swaps & Derivatives Association meets today to consider a “potential credit event” related to Greece. The association will likely consider Greece's restructuring a default, triggering credit-default swap insurance on the debt, Gross said. Pimco, based in Newport Beach, California, is a member of the committee that decides whether the default insurance will pay out.

‘Full-Nelson'

“I would suggest overwhelmingly that the CDS is going to be triggered,” said Gross, the founder of Pimco and manager of the world' biggest bond fund. “It's sort of like a half-nelson or even a full-nelson in wrestling terms being applied to bondholders under Greek law. They're all being forced to go along.”

Yields on Greece's new bonds may climb to as high as 20 percent amid “material risks” stemming from implementation of terms for the biggest sovereign restructuring in history, Morgan Stanley said yesterday in a report.

Traders are offering to buy and sell the potential new bonds at yields on 11-year securities of 22 percent, according to a person yesterday familiar with the prices who declined to be identified because he wasn't authorized to comment. Pimco has said that the firm doesn't own any Greek debt.

“I'm not forecasting a second default but the markets certainly are,” Gross said. “Markets expect another one down the road.”

With Greece now in a fifth year of recession, Prime Minister Lucas Papademos's government had said that it was ready to force holders of Greek-law bonds into the swap. The use of collective action clauses may trigger $3 billion of insurance payouts under rules governing credit-default swap contracts.

‘Escape Velocity'

In the U.S., employers boosted payrolls more than forecast in February, capping the best six-month streak of job growth since 2006. The jobless rate held at 8.3 percent. The 227,000 increase in payrolls followed a revised 284,000 gain in January that was bigger than first estimated, Labor Department figures showed today in Washington.

“It's a good number, not just the headline but also the revision,” Mohamed El-Erian, who shares the title of chief investment officer with Gross, said today in an interview on Bloomberg Television. “It's indicative of a healing process. We're not yet at escape velocity.”

--Bloomberg News--