Securitized debt products sure have come a long way in the past 15 or so years, from igniting a global financial crisis to being today's bond instrument of choice for financial advisors.

Securitized debt involves bundling various bonds of a certain variety into a single security and then selling it to investors. Back during the so-called great financial crisis an overly high percentage of these bundled debt bonds turned into debt bombs, blowing up investor balance sheets worldwide due to their suspect quality.

As a result, regulators in the ensuing years cracked down on such securities in order to make them once again safe for public consumption.

Well, apparently the government’s draconian response did the trick, because those bad old days seem to be a distant memory on Wall Street.

Collateralized Loan Obligations (CLOs), for example, are surging in popularity with issuance hitting record levels so far in 2024. CLO new issuance totaled $39.3 billion in Q3 2024, according to Carlyle, a 42 percent increase compared to Q3 2023. Meanwhile, CLO new issuance is on track to surpass 2021's record year of $184.8 billion.

CLOs are floating-rate instruments, which means their coupons reset with interest rates, typically every quarter. This makes CLOs less sensitive to interest rate changes than fixed-rate instruments and with less volatile price moves. Due to these traits, CLOs tend to outperform in periods of rising rates, which, despite the Fed’s best cutting efforts, is exactly what is currently happening at the long end of the yield curve.

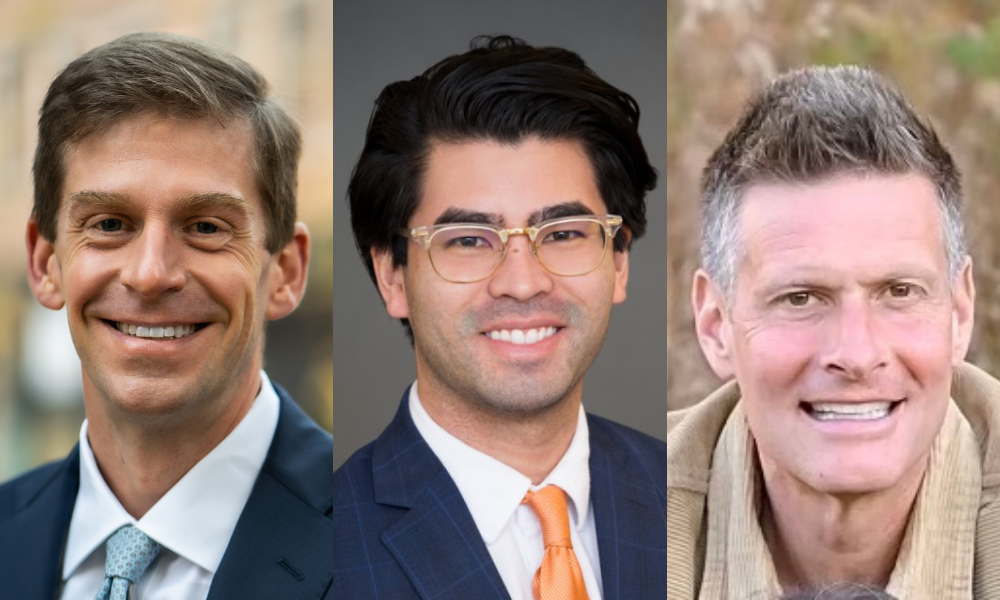

“I think the silver lining in the great financial crisis is that it introduced regulation and transparency to this asset class in a way that we haven't seen before. And it's facilitated really an explosion in underwriting,” said Sam Reid, investment partner at Canyon Partners.

Rick Wedell, president and chief investment officer at RFG Advisory is bullish on funds that have exposure to floating rate AAA CLO exposure. In his view, the floating rate AAA space gives him a beneficial combination of high spreads, short duration, and "nice ratings." He adds that a holding that is focused on short duration allows him to flex his overall portfolio duration up or down fairly easily, which is helpful from a portfolio construction standpoint.

“Historically the AAA CLO space has been fairly stable relative to other securitized markets, and we like the asset class as a small part of our overall fixed income exposure,” Wedell said. “We have a constant model weight at this time.”

Chris Brown, private wealth advisor and managing director at Kingswood US, is adding to his CLO and CMO (Collateralized Mortgage Obligations) portfolio allocations. He says he likes CLOs in the current market environment because they tend to be well-diversified, thereby offering investors more security from default risk.

“Many CLOs offer floating rate coupons which are great for interest rate moves, tend to be senior secured and, in many cases offer significant return potential,” Brown said. “It is a great place to find fixed-income exposure for clients needing fixed-income in their portfolio.”

Meanwhile, Nicholas Codola, senior portfolio manager at Brinker Capital Investments, said CLOs and CMOs are great diversifiers within fixed income in that they offer a portfolio of diversified loans that historically have very low default rates, especially compared to corporate debt. Those also have a very attractive yield over Treasuries, so they can serve as a source of alpha generation over money markets, he said.

“They have also been a source of alpha over the US Agg Bond Index this year given the very volatile rate environment. That extra yield provides a cushion in the event that we stay slightly shorter duration compared to the benchmark and rates fall precipitously, but also provide protection if rates increase as we’ve seen post-election,” Codola said.

Despite his appreciation for securitized bonds, Codola said he is not planning on materially adding more to his CLO position right now, saying they are attractively priced due to the immense retail interest and renewed appetite from institutional players like banks and insurance companies.

“We think they are still relatively attractive over corporates which are bottom decile of spreads, but they are no longer by any means cheap,” he said. “Mortgages, both Agency and CMBS do still provide pockets of opportunity as spreads are neutral if not outright on sale, so we will monitor that and may take on select opportunities.”

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.