Small investors are back — in a big way.

Their fingerprints are visible on Apple Inc.’s staggering rally. They piled into Tesla Inc. as it tripled, and turned speculative fliers like Virgin Galactic Holdings Inc. into some of the most heavily traded shares in the country. Why the enthusiasm? Some see a link to decisions by brokerages to cut commissions on trades to nothing.

While it’s tough to know what’s causing what — bull markets are fueled by new converts but also lure them — trading volume at online and discount brokers has exploded. TD Ameritrade Holding Corp., which started offering free trading in October, has seen million-trade days multiplying at a record pace.

Along with ETrade Financial Corp., daily average revenue trades — a standard industry metric that may be a bit of a misnomer now since buying and selling is free — have almost doubled to an all-time high since last September, data compiled by Sundial Research showed.

“When you take a bull market and juice it with zero commission trading, we can expect it to generate interest among retail accounts. That, it did,” said Jason Goepfert, president of Sundial. “Retail traders have become manic.”

Individual investors were seen as indifferent participants for much of the 11-year bull market. No more. The latest leg of their emergence times closely with October, when ETrade, Charles Schwab and TD Ameritrade slashed commission fees to zero. Not that it’s firm proof of anything, but since the start of that month, the S&P 500 is up 13% and the Nasdaq 100 has surged 24%.

Conversations with a handful of clients found lots of praise for zero-commission trades but mostly conservative purchases — index funds and blue chips. Matt Hermansen, 23, who works for a concrete company in Oakland, Calif., said the absence of fees makes him more willing to trade.

“I’ll invest smaller amounts. Before I never really invested anything less than $1,000, $500 minimum,” he said in a phone interview. “Now if I have enough to buy an extra share, I’ll do it. I’ll do like $300.”

At TD Ameritrade, the number of days where the amount of trades topped 1 million reached 38 during the fiscal first quarter ended Dec. 31, according to Steve Boyle, interim president and chief executive. That compares to 23 such days in all of fiscal year 2019.

It’s “a new world in discount brokerage where price no longer clouds the comparison for trades,” Mr. Boyle said in an earnings statement on Jan. 21. By that date, the company’s monthly volume had already risen 40% from a year ago, averaging 1.4 million trades per day.

At Charles Schwab, similar trends has played out. Daily average revenue trades have increased 74% since the firm’s fee cut, Sundial’s data showed.

Randy Frederick, vice president of trading and derivatives at Charles Schwab, said the surge in trading also reflects a growing confidence in the bull market. Indeed, from the coronavirus outbreak to Apple’s sales warning, nothing has been able to stop shares from marching higher.

“It’s partially driven by free commissions, but I don’t think it’s just that, because not everyone is offering free commissions,” Mr. Frederick said. “The fact that we have been in a bull market for a long time, people are just optimistic. Things are going up and they continue to go up.”

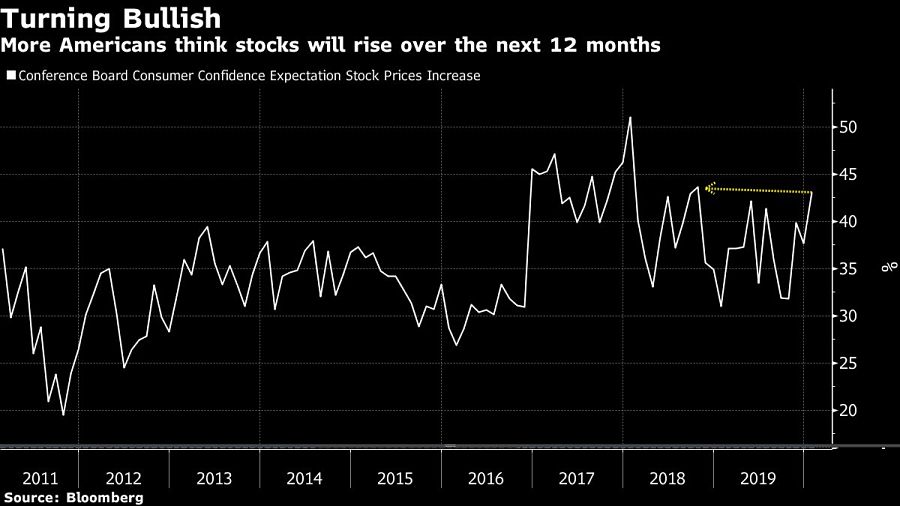

U.S. households are turning more optimistic on the stock market. According to the latest sentiment reading from the Conference Board, the share of respondents expecting stocks to rise in the next year advanced to 43.1% in January, the highest since October 2018.

Hot stocks get the most attention. At TD Ameritrade, Apple, Microsoft Inc., Tesla and Virgin Galactic have been among the highly traded this year, according to JJ Kinahan, the company’s chief market strategist. Shares of the two tech giants have climbed at least 9%, double the S&P 500’s gain.

Tesla, Elon Musk’s automaker, and Virgin Galactic, Richard Branson’s space-tourism company, have done even better, with triple-digit advances. Virgin Galactic, in particular, has seen retail investors talking up their positions on message boards like r/wallstreetbets on Reddit.

“A lot of our millennial clients over the past six months were buyers of Tesla,” Mr. Kinahan said.

“Younger people buy products they are familiar with, or more importantly, think are going to be viable products down the road,” he added. “It does make sense to say that some of these, maybe Virgin Galactic, may be a product that makes sense in 10 years.”

For Peter Cecchini, chief global market strategist at Cantor Fitzgerald, retail investors' affection for both tech stocks and loss-making companies is creating flashbacks to the internet frenzy in late 1990s.

“There’s sometimes no fundamental reason for it. It just is based on perception — a perception based on narratives that run only an inch deep,” he said in note. “Let’s see how much longer it persists. This kind of activity often unwinds much faster than the wind up.”

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

It's the mega-RIA firm's third $1B+ acquisition in just three months.

The deal marks a strategic entry into private asst markets for the ETP, ETF innovator.

Wall Street leaders propose ways to monetize the mortgage giants.

Changes in legislation or additional laws historically have created opportunities for the alternative investment marketplace to expand.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.