Investors have poured $2 billion so far this year into the biggest gold exchange-traded fund on the market, in a sign that the investing public is seeking a safe haven amid the recent equities market dive.

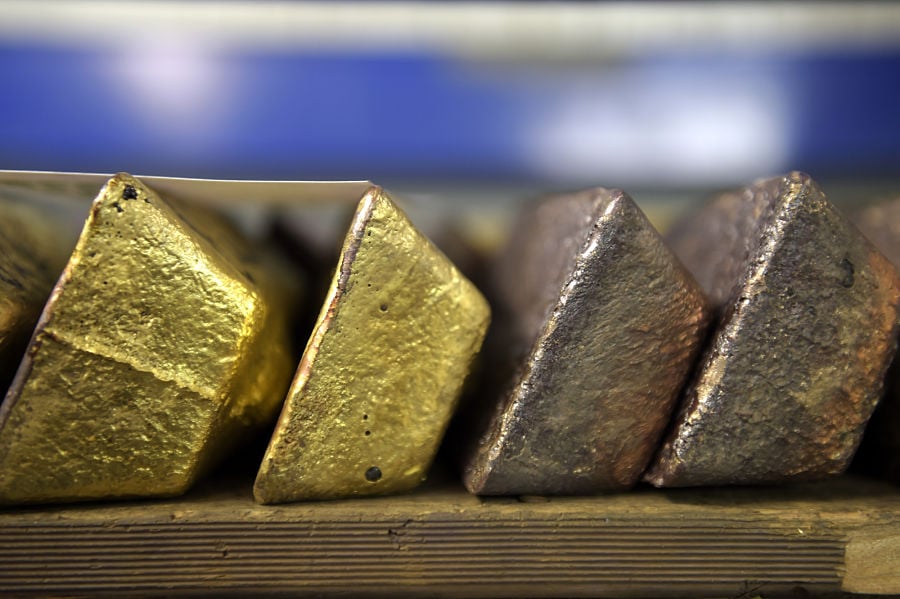

The price of gold, in fact, has hit its highest mark in six years. Gold bullion is on track to break $1,700 per ounce as investors rebalance their portfolios by shifting to an asset class that is often favored because of its lack of correlation to stocks and bonds.

That's not what many advisers are telling their clients to do. They largely have cautioned clients away from making hasty decisions based on the market dip.

“Gold was already set to do pretty well this year,” said George Milling-Stanley, State Street Global Advisors’ chief gold strategist, citing an expected trading range near $1,700 per ounce prior to the coronavirus outbreak. “I think that will prove to be pretty conservative.”

Gold prices were at $1,645 at midday Thursday, according to the online retailer JM Bullion. Prices peaked near $1,900 in 2011, then fell below $1,100 in late 2015, according to the online index Gold Price.

The asset class is tempting investors after several bad days for stocks. The Dow Jones Industrial Average dropped by more than 3% on Monday and Tuesday, and after little change on Wednesday, it closed at about 4.4% lower Thursday afternoon.

The $49 billion SPDR Gold Trust ETF (GLD) has seen about $2 billion in net inflows year to date, Mr. Milling-Stanley said. That product is the biggest gold ETF on the market.

“Gold ETFs tend to get stronger interest the longer that the volatility takes place within the equities markets,” said Todd Rosenbluth, head of ETF and mutual fund research at CFRA Research. “This [new] sell-off in equities has really been just this week. If we see a prolonged correction … then demand for gold ETFs will likely increase.”

The demand does not appear to be reflected in all gold funds, however. Many lower-cost ETFs, for example, have not seen new sales akin to those experienced by GLD, Mr. Rosenbluth said.

“It gives the impression that this is more of an institutional shift in risk sentiment, as opposed to a [shift among] more cost-conscious retail investors,” he said, adding that while the asset class is a good place to hide in the short term, it’s not clear how long the equities sell-off may last.

Mr. Millling Stanley said that an allocation of 2% to 10% of a portfolio to gold can help improve risk-adjusted returns “in good times and bad.”

A research report from gold ETF provider GraniteShares found that an allocation of as much as 35% to gold had the biggest impact on the Sharpe ratio, which helps measure risk-adjusted return, though the company did not encourage investors to make such a sizable investment in the asset class.

“If people are already in gold, I don’t know if there is anything else they need to do. But if they don’t have an allocation, this is as good a time as any,” Mr. Milling-Stanley said. “Gold looks better when everything else is extremely volatile.”

The recent volatility is not the only element in the surge of gold prices. Several factors, including global economic and geopolitical risks, have also played a role, he said. In addition, mining peaked in 2014, and the amount of new gold being added to the market has been limited, which has further pushed up prices, he said.

“The best news in financial markets is that equities in this country have gone up for 10 straight years, but that gives a lot of people pause,” Mr. Milling-Stanley said. “This is the kind of market in which liquid alternatives come into their own.”

A Texas-based bank selects Raymond James for a $605 million program, while an OSJ with Osaic lures a storied institution in Ohio from LPL.

The Treasury Secretary's suggestion that Trump Savings Accounts could be used as a "backdoor" drew sharp criticisms from AARP and Democratic lawmakers.

Changes in legislation or additional laws historically have created opportunities for the alternative investment marketplace to expand.

Wealth managers highlight strategies for clients trying to retire before 65 without running out of money.

Shares of the online brokerage jumped as it reported a surge in trading, counting crypto transactions, though analysts remained largely unmoved.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.