Goldman Sachs Group Inc. has effectively bowed to pressure from the continuing rally in U.S. stocks and abandoned its call for another steep sell-off.

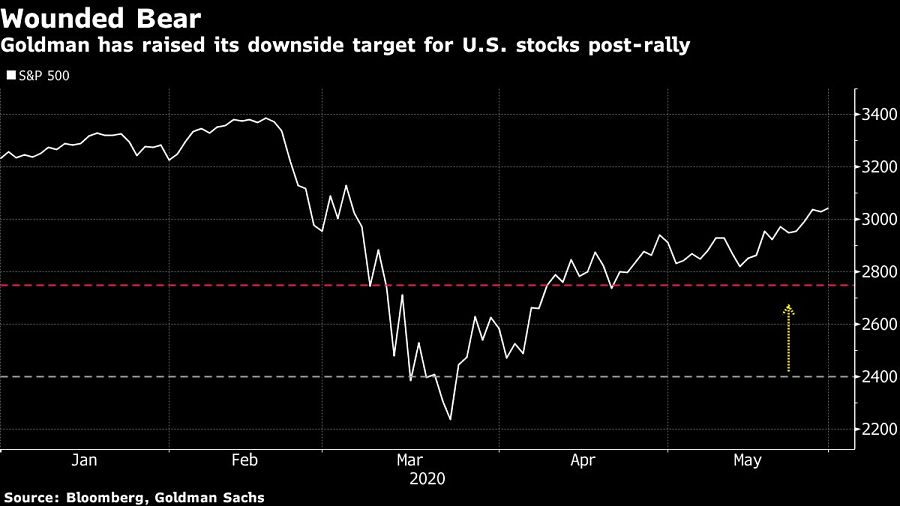

Strategists led by David Kostin have rolled back their prediction that the S&P 500 would slump to the 2,400 level -- over 20% below Friday’s 3,044 close -- and now see downside risks capped at 2,750. The U.S. equity benchmark could even rally further to 3,200, they wrote in a note Friday.

“The powerful rebound means our previous three-month target of 2,400 is unlikely to be realized,” the strategists wrote. “Monetary and fiscal policy support limit likely downside to roughly 10%. Investor positioning has oscillated between neutral and low and is a possible 5% upside catalyst.”

The shift came just after JPMorgan Chase & Co.’s strategists shifted in the other direction -- reining in their bullish outlook. JPMorgan’s Marko Kolanovic warned about rising U.S.-China tensions in a note Thursday.

Goldman’s strategists maintained their year-end target of 3,000 for the benchmark U.S. stock gauge.

Goldman continues to argue that short-term returns are skewed to the downside -- “or neutral at best” -- thanks to the risk of an economic, earnings, trade or political “hiccup” to the normalization trend. A broader participation in the rally would be needed for the S&P 500 to move meaningfully higher.

The S&P 500 has climbed 36% from its March 23 low, helped by massive fiscal and monetary support, mega-cap outperformance and optimism about the economy restarting, according to Goldman. Last month it argued that fear of missing out was a key driver of the rebound in stocks.

Mayer Brown, GWG's law firm, agreed to pay $30 million to resolve conflict of interest claims.

Orion adds new model portfolios and SMAs under expanded JPMorgan tie-up, while eMoney boosts its planning software capabilities.

National survey of workers exposes widespread retirement planning challenges for Gen Z, Millennials, Gen X, and Boomers.

While the choice for advisors to "die at their desks" might been wise once upon a time, higher acquisition multiples and innovations in deal structures have created more immediate M&A opportunities.

A father-son pair has joined the firm's independent arm in Utah, while a quartet of planning advisors strengthen its employee channel in Louisiana.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave