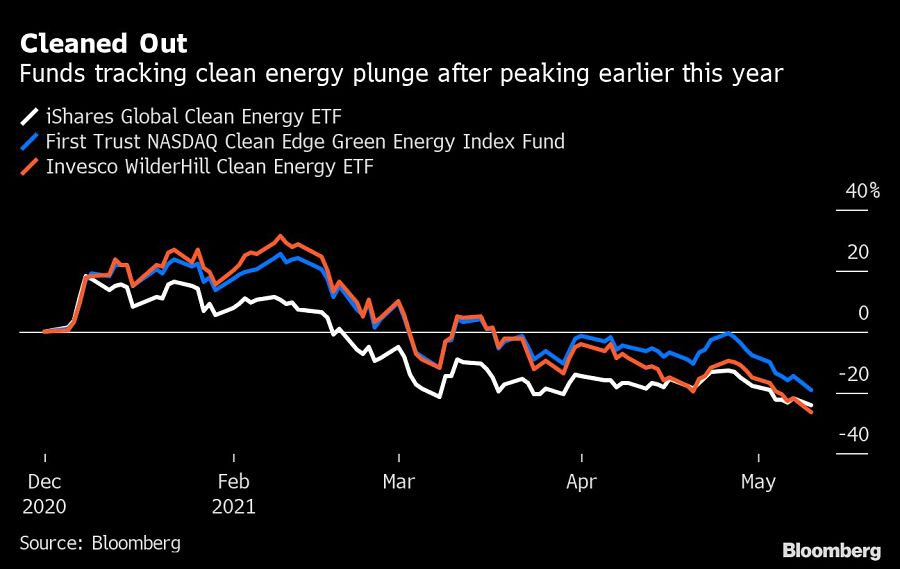

After a stellar 2020, the record-breaking boom in clean energy funds is rapidly giving way to a bust.

Investors are yanking cash from the sector at the fastest pace in a year, while two of the biggest exchange-traded funds tracking the industry -- the iShares Global Clean Energy ETF (ICLN) and Invesco Solar ETF (TAN) -- have each tumbled at least 24% in 2021. Since the beginning of May, about $154 million has been pulled from clean energy ETFs.

Thank the pressure on big-tech stocks. Funds that have higher environmental, social and governance standards have long benefited from substantial stakes in giant growth companies. Now a post-pandemic economic recovery is triggering a rotation to cheaper shares, and the benefits are swiftly becoming drawbacks.

“They had such a huge run in 2020, but like many of these momentum and growth funds, they have given back much of their gains in 2021,” said Mohit Bajaj, director of ETFs for WallachBeth Capital. “Now we are seeing a rotation out of those into more value-oriented names.”

Further details on President Joe Biden’s $2.25 trillion infrastructure plan haven’t been greeted with the enthusiasm that many analysts had hoped. In addition, several clean energy funds took a hit late last month after Enphase Energy Inc. -- a popular holding -- reported semiconductor shortages and supply chain issues.

“A return to clean-energy ETF inflows exceeding January’s $5 billion may require a performance rebound,” Adeline Diab, an ESG analyst for Bloomberg Intelligence, wrote in a note Tuesday. “Rising interest rates, widening competition and strained supply chains have tapped the brakes on flow momentum.”

Assets in the category have dropped for the past three months in a row and are now at $18.1 billion. That’s down from their peak of $22.3 billion at the end of January.

Other large clean energy ETFs such as the First Trust NASDAQ Clean Edge Green Energy Fund Index (QCLN) and the Invesco Wilderhill Clean Energy ETF (PBW) are also facing outflows amid a slide of more than 18% this year.

With their heavy tech exposures, the pain that clean energy funds are facing could just be getting started. JPMorgan Chase & Co. strategist Marko Kolanovic warned last week that big allocations into growth and ESG strategies may leave money managers vulnerable to inflation. As data continue to point to higher prices of goods and services, he bets investors will be forced to shift from low-volatility plays to value stocks.

“As money rotates away from those emerging growth themes and into the more economically sensitive areas of the market, clean tech becomes a source of funds,” said Dan Russo, portfolio manager at Potomac Fund Management.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Raymond James also lured another ex-Edward Jones advisor in South Carolina, while LPL welcomed a mother-and-son team from Edward Jones and Thrivent.

MyVest and Vestmark have also unveiled strategic partnerships aimed at helping advisors and RIAs bring personalization to more clients.

Wealth management unit sees inflows of $23 billion.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.