Reports of the demise of excess U.S. household savings were greatly exaggerated. Revised government data indicate that Americans have hundreds of billions of dollars more in extra cash stashed away than previously believed.

“It definitely raises the prospects of a soft landing pretty significantly,” Citigroup Inc. senior global economist Robert Sockin said. He puts the odds of a soft landing at around 50-50, after previously viewing a recession as more likely than not.

Sockin reckons that households have about $1 trillion in excess savings remaining — a tally in line with a growing number of estimates. That still-large stockpile, some 3½ years after the first fiscal rescue package, may offer a cushion for the economy in the face of headwinds including a surge in bond yields that’s raising borrowing costs for households and companies.

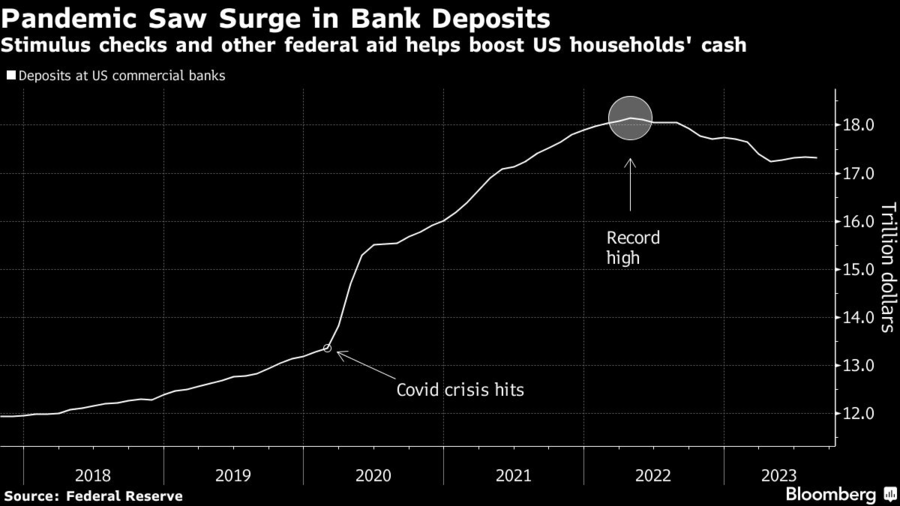

Americans were able to build up a savings cushion during the pandemic, in part as a result of large government support, but have since seen that eroded by elevated inflation and a return to more normal spending patterns as fears of Covid faded.

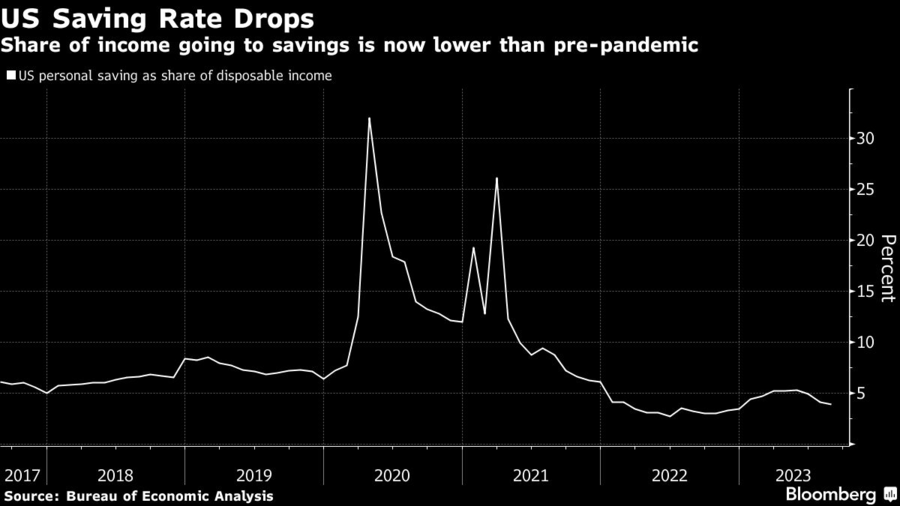

Economists’ estimates of excess savings hinge on their assessment of the underlying trend in the savings rate. The lower the perceived trend prior to the pandemic, the bigger the bundle of extra savings built up during the virus crisis.

In its comprehensive update of national economic data at the end of last month, the Bureau of Economic Analysis revised down calculations for household savings to reflect a change in how it accounts for income from mutual funds and real estate investment trusts. The bulk of those revisions occurred prior to the pandemic.

As a result, the household savings rate was lowered to an annual average of 6.5% from 2017 through 2019, from 7.9% previously, tilting economists’ estimates of the trend downward.

Savings then surged to 15.4% of disposable income in 2020 and 11.4% in 2021 after the onset of the pandemic. It slumped to an average of 3.3% last year and stood at 3.9% in August.

The BEA’s revisions prompted JPMorgan Chase & Co. economists Michael Hanson and Murat Tasci to ramp up their estimate of the savings buffer to $1.2 trillion, from $400 billion. “Excess saving may not be exhausted until sometime next year,” they wrote in an Oct. 6 report.

“Households are in a lot better financial shape than we thought,” said Jonathan Pingle, chief U.S. economist for UBS Group, who increased his estimate of excess savings by $600 billion to more than $1 trillion after the recent data revisions.

He still sees the U.S. falling into a recession, though it comes later and is milder than he previously expected: It begins in the second quarter of next year, rather than this year, with the economy contracting by a half percent peak to trough compared to closer to 1%.

In a widely noted paper released on Aug. 16, Federal Reserve Bank of San Francisco researchers Hamza Abdelrahman and Luiz Oliveira argued that excess savings was all but exhausted.

While they haven’t updated their numbers, other economists such as Sockin have replicated their methodology using the new government data. Those calculations indicate that households still have more than $500 billion in extra cash squirreled away.

Much of the excess cash is held by upper-income households. Moody’s Analytics chief economist Mark Zandi reckons that more than half of the $1.8 trillion in excess savings he calculates remains is held by households in the top 10% of the income bracket.

Americans have also benefited from increased household wealth, courtesy of higher property and equity prices since the pandemic.

“They can sustainably save less of their paychecks and spend more of their income because they have more wealth,” Sockin said.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.