Bitcoin breached $23,000 for the first time in history as more Wall Street names crowd into the world’s largest digital currency, which is up 220% this year.

As momentum builds, analysts predict more gains ahead.

The digital coin jumped more than 9% on Thursday, touching a high of $23,256.92, according to a composite of prices compiled by Bloomberg. Bitcoin and the wider Bloomberg Galaxy Crypto Index have both more than tripled this year. Cryptocurrency-linked stocks in South Korea, Japan and China climbed.

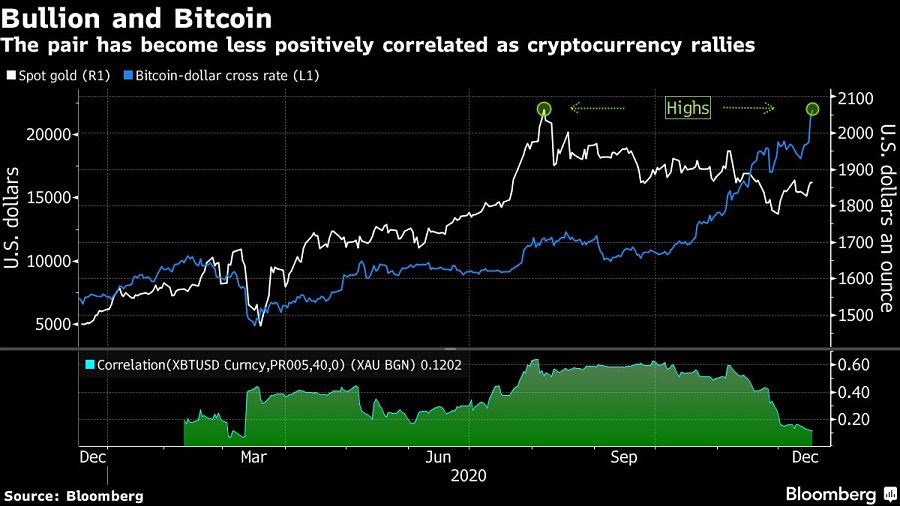

The rally in digital assets is polarizing opinion, given Bitcoin’s history of boom and bust. Proponents argue the cryptocurrency is muscling in on gold as a portfolio diversifier amid dollar weakness and potential inflationary pressure. Others see speculative fervor that will inevitably lead to a bust akin to the meltdown three years ago after a furious Bitcoin rally.

Yet there are signs that longer-term investors like asset managers and family offices are playing more of a role this time around, alongside trend-following quant funds.

Bitcoin’s scarcity combined with “rampant money printing” by the Federal Reserve mean the digital token should eventually climb to about $400,000, Scott Minerd, chief investment officer at Guggenheim Investments, said Wednesday.

Here’s what people in markets are saying about Bitcoin’s move:

The “price will now go from linear to parabolic” in part because retail investors so far have largely been “out of this rally,” said Kay Van-Petersen, global macro strategist at Saxo Capital Markets in Singapore.

“The move above $20,000 has been coming and I’m probably a little surprised it didn’t come sooner,” said Craig Erlam, senior market analyst at Oanda Europe. “Fed stimulus may have given it an extra kick, but let’s face it, Bitcoin doesn’t need it. A break above $20,000 may bring the buzz and a strong end to the year.”

“The lowest-ever Bitcoin annual volatility measure versus gold and the stock market near the end of 2020 may sustain the crypto’s performance advantage in 2021,” Bloomberg Intelligence strategist Mike McGlone said in a report. He sees the price ratio of Bitcoin to gold headed for 100, if history is repeated, from its current level of around 12.

If Bitcoin sustains its momentum, then “testing $36,000 will be the next real objective,” said Dan Gunsberg, CEO of Hxro, a crypto trading platform. But he indicated that a significant break below $13,800 would herald a much weaker period.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.