There’s hardly been a quiet year for bitcoin since its inception, but 2023 has been a standout: The price of the digital asset has more than doubled, the U.S. is on the cusp of having spot-price bitcoin ETFs, and the founder of a major exchange that melted down in 2022 has been convicted on numerous fraud charges.

The exchange-traded fund aspect alone could generate immense interest among advisors who have been on the fence about digital assets, particularly for those whose clients have been clamoring for bitcoin allocations. But even 15 years after bitcoin’s invention, blockchain-enabled digital assets are very young compared with well-established asset classes, which leaves many hesitant to consider crypto as a long-term investment.

But as bitcoin has diverged from its correlation to the U.S. stock market, advisors might consider it as an alternative to gold, said Tyrone Ross, co-founder of Turnqey Labs and former CEO of Onramp Invest.

The recent price increase “is meaningful – but it’s also on the back of the hype around ETFs and the progress that has been made in the courts, with the SEC,” Ross said. “The problem, though, is that there aren’t a lot of advisors allocated to bitcoin.”

Part of the reason for that is the wild volatility in its price since 2017. But there also hasn’t been much education available to advisors until somewhat recently. Ross has been working with the American College of Financial Services on three continuing education modules on crypto that are coming out in January, he said.

There are more resources available today to help advisors and clients make educated decisions about if and how to allocate assets, Ross said.

“The data gathering is better. The infrastructure is better than it was even 18 months or two years ago,” he said. “It’s a lot easier for advisors to take a look now and run some analysis, and have the right, regulated vehicles.”

“I almost got to the point where I was going to put [digital assets] into portfolios, and then bitcoin crashed,” said Chris Chen, wealth strategist at Insight Financial Strategists. That decision wasn’t really about market timing, he said. “I have thought a little further on it. Really, we don’t understand, as people who deal with investments, what the behavior of bitcoin is … We don’t have a clue.”

A longer history would help, at least for the sake of better understanding what the general place of digital assets is within portfolios. Of course, the lack of history won’t stop some clients from being interested in such assets, but short-term bets on them are speculative, Chen said.

“It has the potential of shooting up like a rocket, and it has the potential of coming down as one,” he said. “Investing is not so much about returns … it’s also about measuring risk in your portfolio. We have no idea what the risk is [for digital assets].”

Chen also takes issue with bitcoin and other digital assets being called cryptocurrency.

“I don’t think it has the characteristics of one,” he said. “The central banks of the world … will not release the authority over monetary policy to private bands of individuals.”

Further, the fixed limit on the number of bitcoins means that it is deflationary, he said.

But Chen and others agree that the advent of a spot bitcoin ETF would legitimize it as an asset.

Watchers expect the Securities and Exchange Commission to issue a decision on spot bitcoin ETF applications late this year or early next year, most likely approving them. Earlier this year, the agency lost a court battle brought by Grayscale Investments over the rejection of its request to transform its trust into an ETF. According to various reports, the SEC does not plan on appealing the decision.

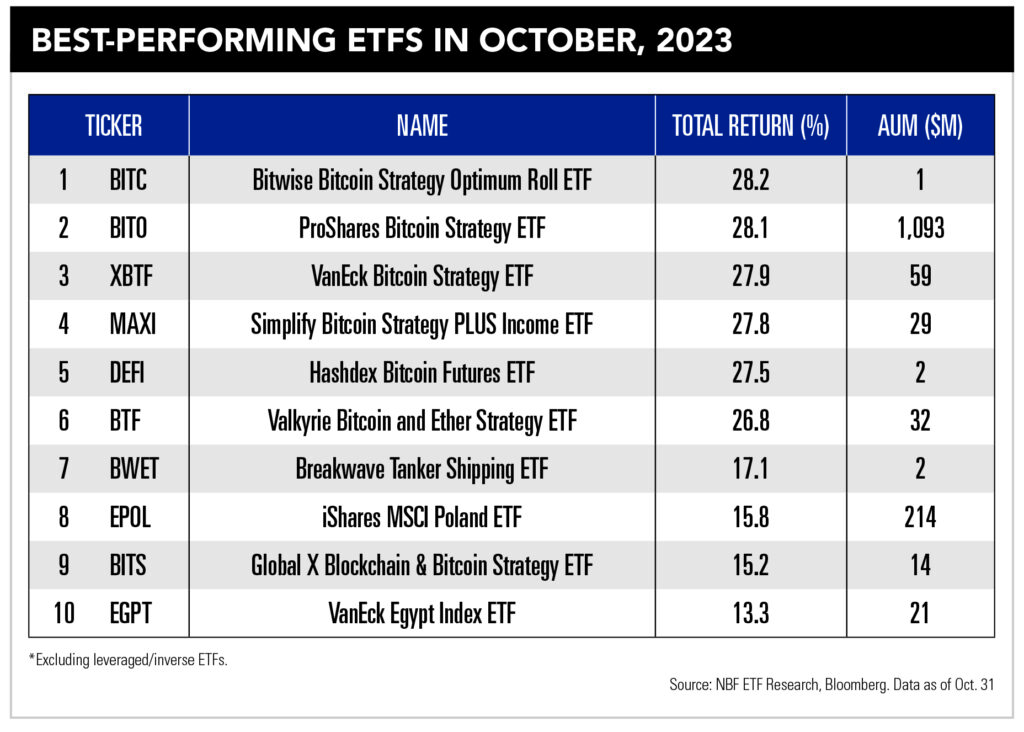

While there are a handful of bitcoin futures ETFs on the market, interest in those funds has been meager compared to the forthcoming spot-price products. The first bitcoin futures ETF, ProShares’ Bitcoin Strategy ETF (BITO), debuted just over two years ago and represents about $1 billion, making it the biggest such fund on the market.

Relatedly, the first ether futures ETFs were recently approved by the SEC, and the products are only a little over a month old.

Financial advisor Douglas Boneparth, president of Bone Fide Wealth, was an early adopter of bitcoin, acquiring a bitcoin miner with a partner in 2014. He has yet to sell any of the bitcoin he owns, he said.

“Wow – what a ride it’s been. I’m still very long-term bullish on bitcoin. I view it as a digital store of value – digital gold, if you will,” he said. “I get that you can make jewelry out of [gold], but all money is a construct, at the end of the day.”

With that firsthand experience, Boneparth’s been in a good position to educate clients, he said. But he recommends that everyone take a few dollars to play around with bitcoin to gain an understanding of how digital assets and blockchain technology work.

“People are going to have to deal with blockchain technology at some point in time,” he said. “The sooner you can figure out how it works and be knowledgeable, the better off you’re going to be.”

While Boneparth self-custodies his bitcoin in cold storage, most people are far from being ready for that. And that’s one of the aspects of a spot bitcoin ETF that’s exciting, he said.

“Now people can get exposure to this asset class in a very traditional way, through an ETF wrapper,” he said. “That is very bullish for bitcoin.”

A number of legal actions this year drew more attention to the digital asset and crypto space, most notably the recent conviction of FTX founder Sam Bankman-Fried. While it could be reassuring for some that potential bad actors are facing consequences, it is likely just as disconcerting for those who are unsure about digital assets.

“It doesn’t instill confidence in the space at large. And if you’re not super knowledgeable about bitcoin or cryptocurrency, and you see large institutions go under … how can you not say, ‘This is not a space I want to mess around with or expose my clients to,’” Boneparth said.

But exchanges are centralized companies that have nothing to do with the underlying assets or blockchain technology, he noted. “These are institutions run by fraudsters. If you can’t separate those two things, you are not going to have a confident view of the space.”

Upon Bankman-Fried’s conviction earlier this month on numerous fraud charges, Better Markets CEO Dennis Kelleher said the wider issue of malfeasance in the crypto world is far from being addressed.

“The lying, cheating, and stealing has to stop,” Kelleher said in a statement. “FTX and Sam Bankman-Fried are not one-offs in the crypto industry. In fact, today’s conviction is a condemnation of the entire crypto industry and its business model, which is based on breaking the law for a financial product that has no socially useful purpose.”

Ross acknowledged that the industry is to blame for Bankman-Fried’s rise.

“We anointed that clown,” Ross said. “That was a very bad decision. The entire industry was hung up on him … and it was bad for all involved.”

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.