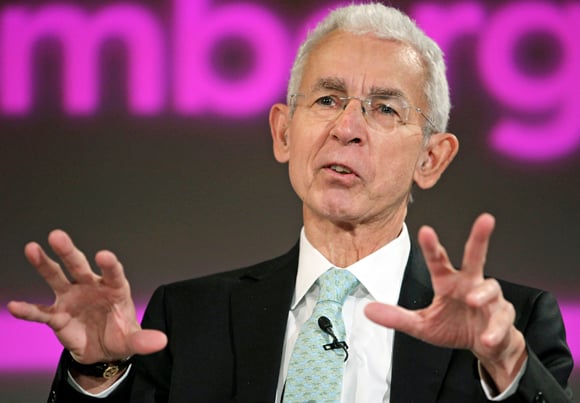

Given the stampede on Wall Street over the past few days, it's no surprise that clients are a little freaked out. But legendary stock picker Lazlo Birinyi isn't fazed. Despite the drama, he says 'the bull market is intact.'

Laszlo Birinyi, one of the first investors to recommend buying when the bull market began in 2009, said the Standard & Poor's 500 Index will continue its ascent, though possibly not to the level he had predicted.

“The bull market is intact, and while our ‘target' of 1,450 in mid-2012 is admittedly a bit shaky, our more important conclusion that a rational, disciplined portfolio can attain a 10 percent plus return in 2011 is not,” Birinyi, of Westport, Connecticut-based research firm Birinyi Associates Inc., wrote in a note today.

The S&P 500 has plunged in 10 of the past 11 days, wiping out almost $3 trillion in market value, as a political battle over the U.S. debt ceiling prompted Standard & Poor's to cut the country's debt rating. Birinyi said there's no fundamental reason for the slide, and equities will continue the rally that took the S&P 500 69 percent higher since March 2009.

“The decline is, we submit, in large part political, not financial, which makes us somewhat more optimistic,” Birinyi wrote. “It is impossible to segregate the political from the financial but we would hope that at some point, financial trumps political, which has historically been the case.”

The benchmark gauge for U.S. equities climbed 2.1 percent to 1,142.37 at 1:33 p.m. today in New York. That curbed losses since July 22 to 15 percent, data compiled by Bloomberg show. Equity strategists estimate the S&P 500 will climb to 1,389 by the end of the year, according to the average forecast in a Bloomberg survey.

Unlikely to Gain

Birinyi said financial companies and banks, commodity stocks and health-care companies are unlikely to outperform as the rally continues. Financial companies historically are underperformers after the first part of a bull market and dividend-paying stocks, such as pharmaceutical companies, aren't necessarily a good investment, Birinyi said.

Dividend investing is “an excellent strategy for the current environment,” Oppenheimer & Co.'s New York-based chief investment strategist, Brian Belski, wrote in an Aug. 8 note. JPMorgan Chase & Co. recommend today that investors buy General Electric Co. and Johnson & Johnson for their dividend yields.

Energy and financial shares and are two of the three worst performing groups in the S&P 500 since July 22, losing more than 18 percent.

“Despite our stance, we are not necessarily excited about the prospects for the indices,” Birinyi said. “Our preference continues to be for individual discrete names which may have few common characteristics.”

--Bloomberg News--