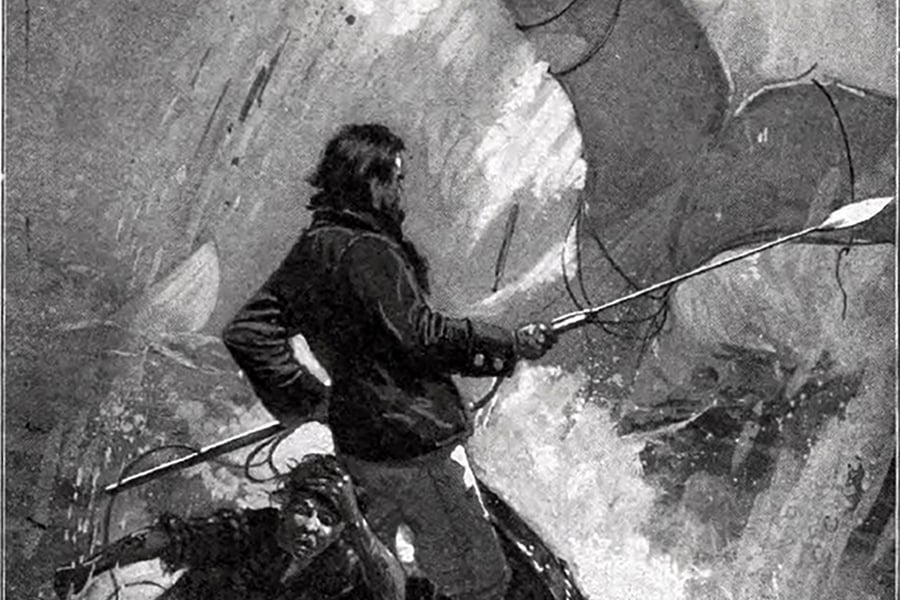

When Herman Melville wrote Moby Dick, he had never actually visited the quaint Massachusetts isle of Nantucket. His multivolume novel spanned an epic battle — and now another, maybe less epic battle is being waged on the island dubbed "the most expensive in the world." This time, the protagonists are all actual real residents, or at least part-time residents.

Nantucket is used to millionaires and even billionaires — at the end of last month the median house price was $5 million, or a whopping $1,600 per square foot.

And right next to one of those houses on the exclusive Old North Wharf sits Straight Wharf Fish Market.

The market closed in 2019 for refurbishment, with owners Gabriel Frasca and Kevin Burleson planning to add ice cream and a 62-seat restaurant. “We aim to be that local clam shack that every Cape and coastal town has on the water, serving classics like clam rolls, fish sandwiches, lobster rolls, and a few modern touches as well,” Burleson wrote in the license application.

Unfortunately for Frasca and Burleson, their business is just 18 inches away from a $6.5 million, 1,200-square-foot house that belongs to Charles Johnson, a majority stakeholder in the San Francisco Giants and ex-head of financial firm Franklin Resources,

Johnson, who's valued by Forbes at $4.9 billion, is suing to stop the development, along with others, and claims the Beverage Oversight Committee granted the business an alcohol permit in haste. He argues that the decision "disregarded the negative effect that the granting of the license would have on the abutting residences and neighbors."

Historically, Straight Wharf Fish functioned as a fish distributor and dessert parlor. Its doors closed in 2019, and refurbishments commenced late 2020, currently paused due to the ongoing lawsuit.

"We are optimistic about a possible agreement shortly. We're eager to progress," Frasca told CBS yesterday.

It’s not all the big money that is against the clam shack though, as it seems the business has managed to get industry legend (and Nantucket summer resident) Charles Schwab on its side.

Early in on the process, attorney Danielle deBendictis (who coincidentally owns a restaurant on the island) wrote to the board claiming to represent Charles Schwab and the Johnsons in their opposition to the eatery. Shortly thereafter Schwab’s representatives told the local newspaper that they knew nothing about the opposition or the attorney.

In fact, Schwab’s attorney has subsequently written to Frasca to offer Schwab’s support for the proposition. “I want to confirm for you in writing that: The Schwabs do not oppose your restaurant; and the Schwabs have full confidence that you, NIR (Nantucket Island Resorts), and the Town will work out the details to make sure that everything is good for the neighborhood and community,” he wrote. “We all hope that you have a great 2023 season and many to come.”

The retreat enclave stands as one of the most expensive in the world. A recent survey by TravelMag.com cited the island, located 30 miles off the Massachusetts coast, as "the priciest seaside hotspot globally," measuring hotel tariffs. In one recent transaction, a beachfront property in Nantucket sold for a whopping $38.1 million, marking a Massachusetts record.

And Charles Schwab isn’t the only billionaire who’d like beer with clams — the property developer is also a billionaire — Steve Karp of Nantucket Island Resorts (#374 on Forbes at $1 billion), who is keen to settle the matter amicably. “Why would you care about a little fish market on Nantucket?” Karp told Bloomberg. “It is a small, little restaurant in Nantucket — and it has become a big national story.”

Karp paid $55 million back in 2005 for a portfolio that included the fish restaurant at the heart of the dispute. As of this week, Karp hopes that relocating some of the restaurant’s equipment may do the trick, and get Johnson on side.

Elsewhere in Utah, Raymond James also welcomed another experienced advisor from D.A. Davidson.

A federal appeals court says UBS can’t force arbitration in a trustee lawsuit over alleged fiduciary breaches involving millions in charitable assets.

NorthRock Partners' second deal of 2025 expands its Bay Area presence with a planning practice for tech professionals, entrepreneurs, and business owners.

Rather than big projects and ambitious revamps, a few small but consequential tweaks could make all the difference while still leaving time for well-deserved days off.

Hadley, whose time at Goldman included working with newly appointed CEO Larry Restieri, will lead the firm's efforts at advisor engagement, growth initiatives, and practice management support.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.