Tesla Inc.’s historic entry into the S&P 500 could be bad news for shareholders of some other stocks in the index -- at least temporarily.

Funds that mimic the benchmark are set to buy more than $70 billion of the carmaker’s shares and dump an equal amount of stock in existing members, producing intense selling pressure that could lead to dislocations, warned Greg Sutton, head of portfolio trading at Citadel Securities, one of the most active traders of U.S. stocks.

The potential funding stress is one factor that had prompted the index’s overseers to consider implementing the addition in two tranches. After consulting with the financial community, S&P Dow Jones Indices decided that Tesla will join the traditional way: in one shot, before markets open on Monday. The danger is that trading in many stocks may not be active enough to absorb the sudden deluge of supply.

“Adding it all at once creates more stock that needs to be sold for the funding trade, which potentially creates more impact -- especially in less-liquid components of the S&P 500,” Sutton said by phone. “The market can digest it, but there is the potential for liquidity impact.”

While S&P 500 members get shuffled frequently, Tesla’s enormous size adds an unusual layer of uncertainty this time. Boasting a market capitalization of more than $600 billion, Elon Musk’s company is joining as the sixth-largest company in the index. Since the stock it’s replacing -- Apartment Investment and Management Co. -- is only a tiny fraction of Tesla’s size, all other constituents are at risk of feeling the pinch.

To Howard Silverblatt, senior index analyst at S&P Dow Jones, the Tesla trade is the easier one to execute for professionals because it’s just a matter of how much they are willing to pay. A bigger challenge, as he sees it, involves hundreds of stocks that are up for sale virtually at the same time.

“It’s things that they’ve all done before, just not on this magnitude,” Silverblatt said. “There should be a lot of commotion, but hopefully it goes smooth.”

Berkshire Hathaway Inc., Procter & Gamble Co. and Johnson & Johnson are among stocks facing the risks from elevated selling pressure, according to data compiled by Kevin Muir of the MacroTourist blog. The trio is estimated to each have a number of shares to be disposed that is equal to the average daily trading volume in the past three months. While that may not sound like a lot, imagine if the selling flares up in the final minutes of Friday’s session, the last window of trading before Tesla’s entry. That’s the time when passive investors tend to step up transactions so as to track the benchmark as close as possible.

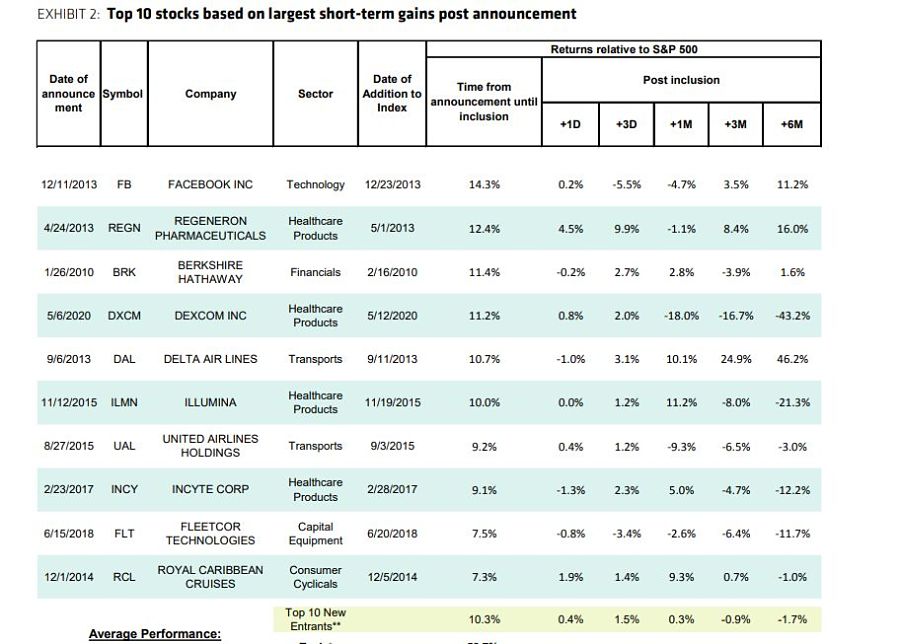

To be sure, mammoth additions like this have happened before. Tesla is the biggest entrant by market value in history. However, when measured as a percentage of the S&P 500, its weighting is similar to Berkshire Hathaway’s in 2010, when Warren Buffett’s firm was picked to join, data compiled by Sanford C. Bernstein showed. Yet with passive investing now accounting for roughly half of equity funds, up from 30% a decade ago, the funding requirement this time will be much higher, warned analysts including Toni Sacconaghi and Ann Larson.

Since S&P Dow Jones announced the news of Tesla’s addition on Nov. 16, the stock has rallied more than 60%. Over the stretch, about 52 million shares changed hands each day on average, 77% more than the previous month. During the past decade, the 10 biggest new entrants climbed an average 10% from the announcement until the actual inclusion, Bernstein’s analysis showed.

Money managers may have already started adjusting portfolios in anticipation of the changes, with Tesla’s share offering earlier this month providing an opportunity to build positions. Some may opt to carry out part of the trade in the days leading up to the event, leaving some residual amount to work out around Friday’s close. To minimize tracking errors, or deviation from the benchmark, some may choose to use market-on-close orders or turn to options to help performance.

“They’re going to be pulling out all the stops,” said Ben Johnson, director of global ETF research at Morningstar Inc. “They are not going to be taking any one singular approach, not using any one tactic in isolation, but using all of the different tools that are available to them to try to again leave no footprint and minimize the cost to their investors.”

Friday is poised to be one of the busiest trading sessions on record, with other market events scheduled that typically spur a torrent of equity transactions -- index rebalances as well as expirations of options and futures on indexes and equities.

U.S. stock volume hit an all-time high of more than 19 billion shares a day in late February amid bear-market carnage. While some stocks may suffer dislocations because of Tesla-related selling, Sutton at Citadel is confident the broader market structure is well equipped to handle the turbulence.

What happened earlier this year “was actually a decent stress test for the system and overall everything seemed to work well,” Sutton said.

Eliseo Prisno, a former Merrill advisor, allegedly collected unapproved fees from Filipino clients by secretly accessing their accounts at two separate brokerages.

The Harford, Connecticut-based RIA is expanding into a new market in the mid-Atlantic region while crossing another billion-dollar milestone.

The Wall Street giant's global wealth head says affluent clients are shifting away from America amid growing fallout from President Donald Trump's hardline politics.

Chief economists, advisors, and chief investment officers share their reactions to the June US employment report.

"This shouldn’t be hard to ban, but neither party will do it. So offensive to the people they serve," RIA titan Peter Mallouk said in a post that referenced Nancy Pelosi's reported stock gains.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.