In a world where everything appears to be undergoing a digital transformation and AI continues to provide innovative ways to disrupt the norm, it’s kind of reassuring that some of the old ways are still winning.

Asset managers are navigating an increasingly competitive market and their institutional clients have been sharing their preferred strategies for client engagement – and the top one could not be more far removed from digital.

Cogent Syndicated by Escalent surveyed investment managers who oversee institutional assets of DB pensions, endowments, foundations, tax-exempt organizations, large DC retirement plans, and insurance company general accounts.

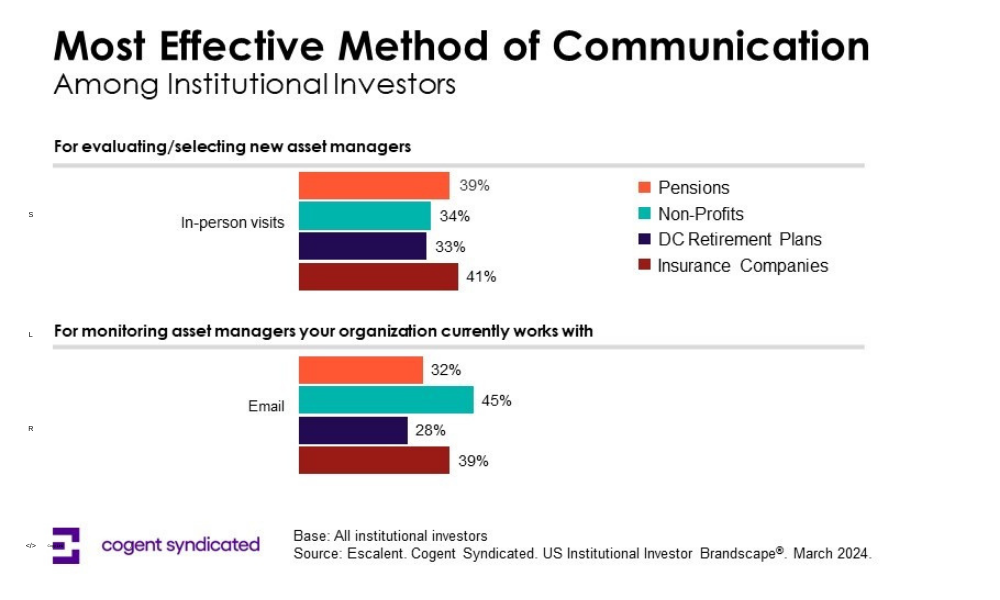

The research found that when evaluating prospective asset management partners, respondents ranked one-to-one interactions above digital options such as emails, webinars, websites and social media. These methods are also important within asset managers’ overall engagement mix, but the survey revealed the growing value placed on personal relationships between asset managers and clients.

"Institutional asset managers are putting a significant emphasis on digital outreach in a bid to capture the attention of new clients," said Linda York, a senior vice president in Escalent's Cogent Syndicated division. "However, our research indicates that in-person interactions are the most important tool managers can leverage during the consideration phase. Brands should balance the use of digital platforms with the benefits of face-to-face connection to ensure they are cultivating meaningful relationships and building trust and rapport."

The study shows that once a personal connection has been established, email is the preferred form of ongoing communication, but augmenting this with conference interactions and webinars produced the best return on investment for asset managers.

"Institutional investors are increasingly demanding more from their asset managers. Along with seeking higher yield, lower fee solutions, they are looking to managers for practical, insightful market perspectives," added York. "To remain competitive, asset managers must align their communication strategies with their audience's attitudes and behaviors. That may mean pulling back on low-lift, low-yield activities like social media in favor of meetings, webinars and events that allow them to engage directly with prospects and clients and demonstrate their expertise and experience."

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.