Dimensional Fund Advisors converted two more of its equity mutual funds into exchange-traded vehicles, further boosting the quant giant’s heft in the $6.8 trillion arena.

The Austin, Texas-based firm’s Tax Managed DFA International Value Portfolio and its T.A. World ex U.S. Core Equity Portfolio are now the Dimensional International Value ETF (DFIV) and Dimensional World ex U.S. Core Equity 2 ETF (DFAX), respectively, according to a press statement Monday.

The move adds two more funds and about $8.1 billion in assets to Dimensional’s ETF lineup. The firm founded by David Booth now boasts nine ETFs worth around $40 billion, according to data compiled by Bloomberg.

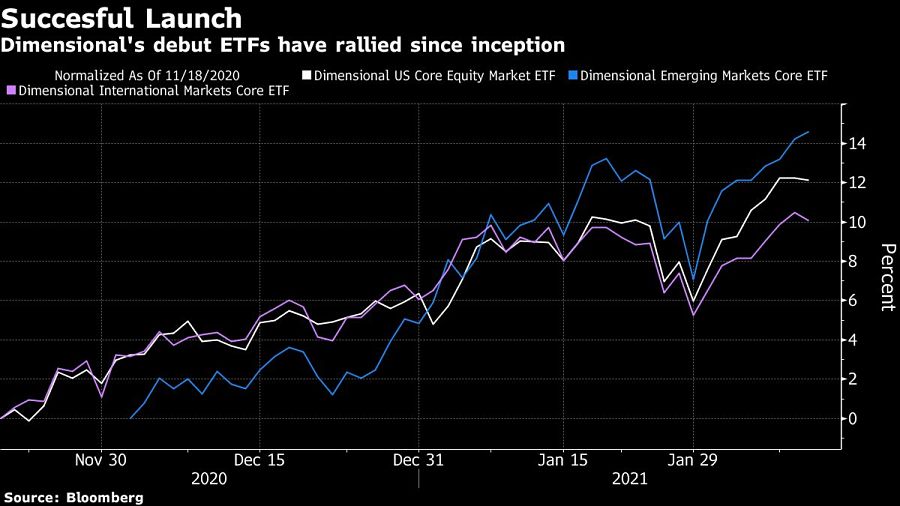

In June, Dimensional became only the second U.S. issuer to pull off a conversion, transforming $29 billion worth of mutual funds into ETFs in an industry record. The asset manager -- which controls $660 billion -- has aggressively targeted the ETF universe since launching its first products last November, touting the structure’s tax advantages and client demand.

Citigroup analysts said in a June forecast that Dimensional’s conversions would be one of several factors behind a $21 trillion shift from mutual funds to ETFs over the next decade. Bloomberg Intelligence expects $1 trillion worth of such switches to take place over the next 10 years.

JPMorgan Asset Management has announced plans to switch four funds with $10 billion in assets into ETFs next year.

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.