A survey of advisers' expectations for the next 12 months shows the only consensus is that there's a rocky road ahead.

InvestmentNews surveyed the industry on its outlook as it heads into the second half of a year that has already sent markets, the economy and the day-to-day operations of financial advisory firms into uncharted territory. Advisers shared sentiments on their business environment as well as their broad investing plans for the next quarter.

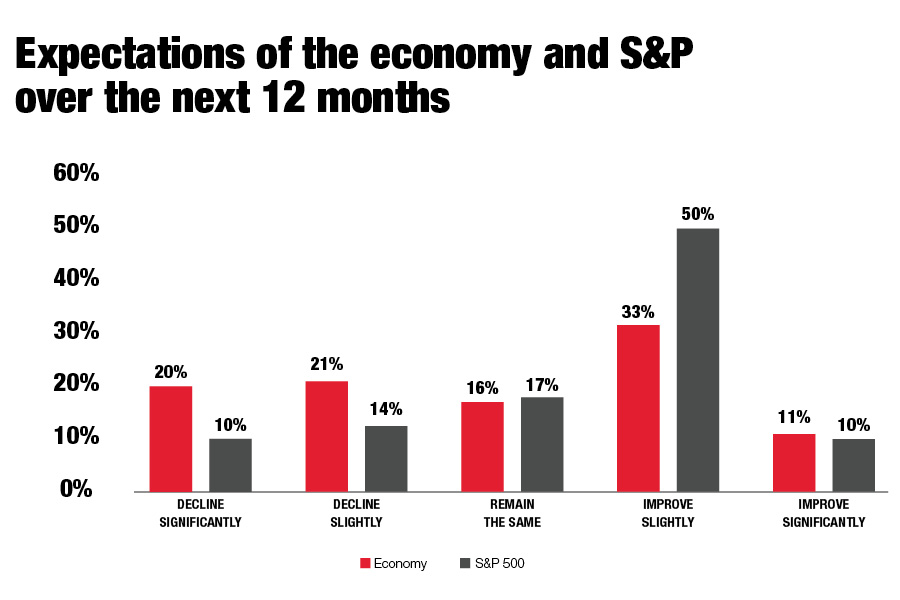

A majority (60%) of advisers expect the overall stock market to improve over the next year, though they were less confident about the underlying economy.

On median, bulls projected a 7% rise in the S&P 500 over the next 12 months, while bears projected a 12% decline.

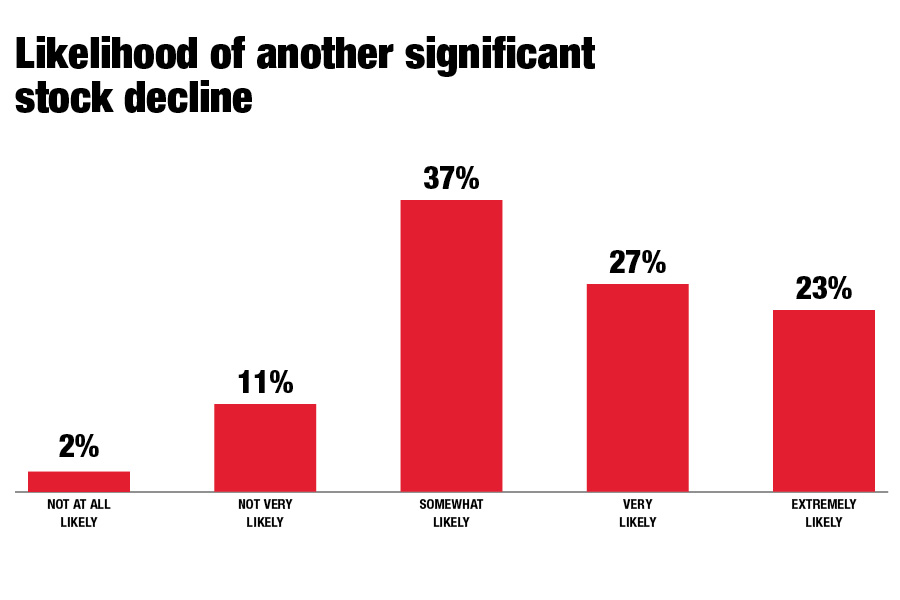

Although advisers were generally optimistic that markets and economic activity will be higher a year from today, few predicted an entirely smooth interim. About half believe the S&P is highly likely to experience another pandemic-driven decline of 10% or more in the next year.

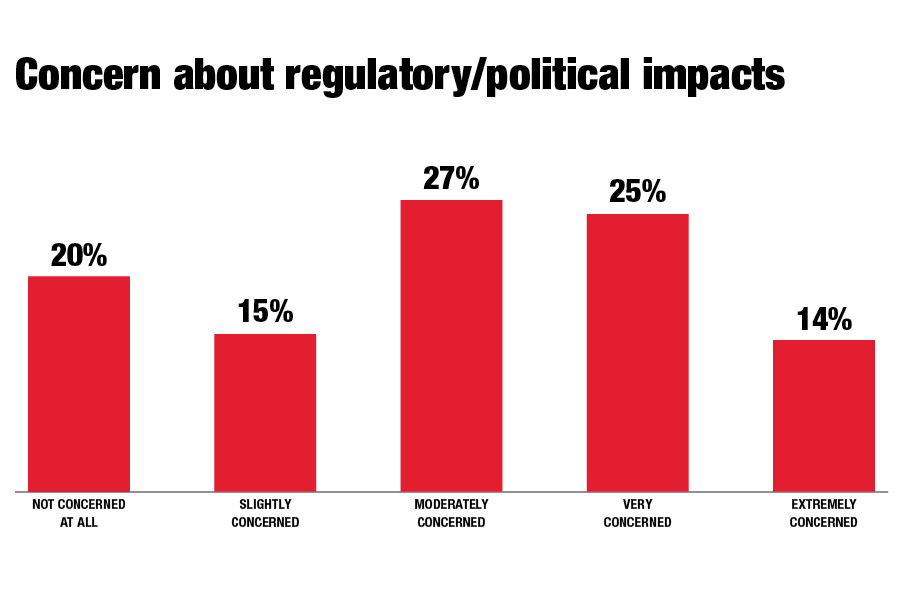

Most advisers were also at least moderately concerned that political and regulatory developments over the next 12 months could negatively impact their book of business.

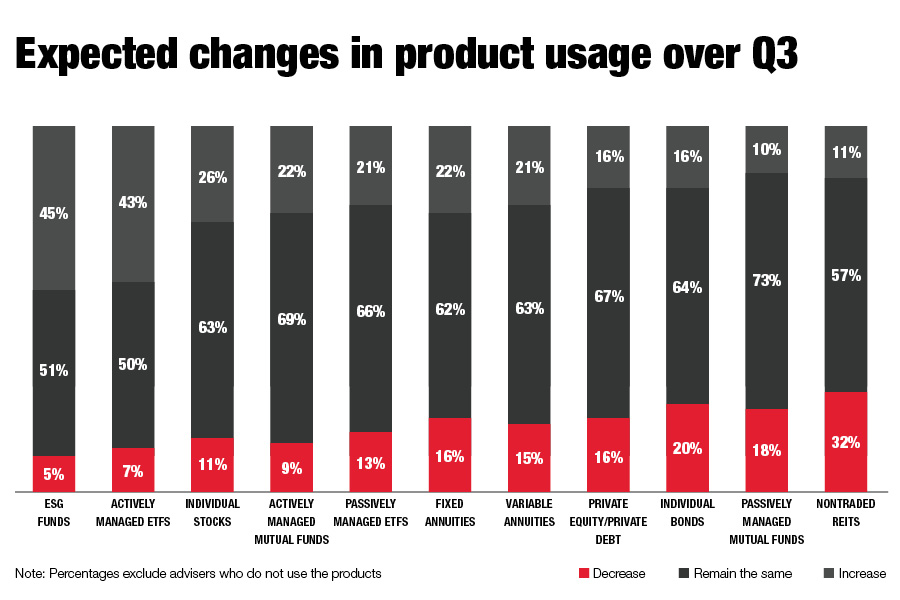

ESG funds are poised to make gains over the quarter, with 45% of advisers who deploy the products in their portfolios planning to increase their usage. Other products that are expected to gain in popularity reflected an environment of uncertainty and an increased emphasis on finding alpha, with 28% of all advisers planning to increase their usage of actively managed ETFs and 21% expecting to purchase more individual stocks over the next three months.

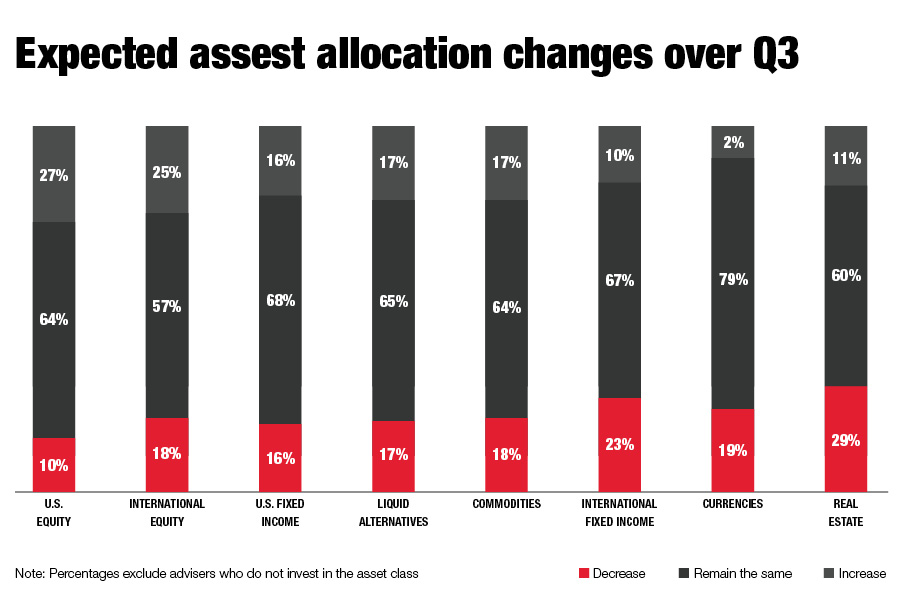

Zooming out to underlying asset classes, real estate assets were poised for net selling as pandemic lockdowns cast doubt on the future of commercial real estate.

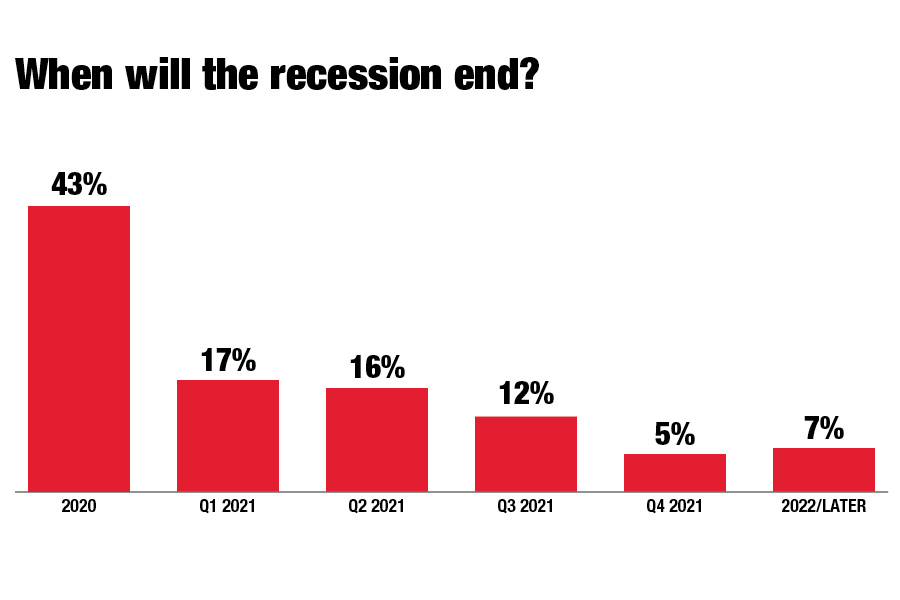

U.S. equities' leadership among asset classes may reflect advisers’ collective expectation that the recession that began in February will be relatively short-lived. A plurality believe that it has either already ended or will have by the end of the year. Among the rest, few expect the recession to drag past the first half of 2021.

Interestingly, advisers’ view of the economic recovery appeared to be shaped by their work environments, Fifty-seven percent of advisers whose firms have already resumed onsite work expected the economy to emerge from recession by the end of the year. But among advisers whose firms have permanently expanded remote work arrangements or plan to reopen later than September, only 32% expected the downturn to be so brief.

[Interested in even more ESG news? Check out InvestmentNews’ ESG Clarity US]

This survey, conducted via email between July 6 and July 16, includes responses from 159 financial advisers and closely related professionals. All respondents worked at industry firms, and more than 90% personally managed client assets. For questions about IN Research offerings, contact [email protected].

From outstanding individuals to innovative organizations, find out who made the final shortlist for top honors at the IN awards, now in its second year.

Cresset's Susie Cranston is expecting an economic recession, but says her $65 billion RIA sees "great opportunity" to keep investing in a down market.

“There’s a big pull to alternative investments right now because of volatility of the stock market,” Kevin Gannon, CEO of Robert A. Stanger & Co., said.

Sellers shift focus: It's not about succession anymore.

Platform being adopted by independent-minded advisors who see insurance as a core pillar of their business.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.