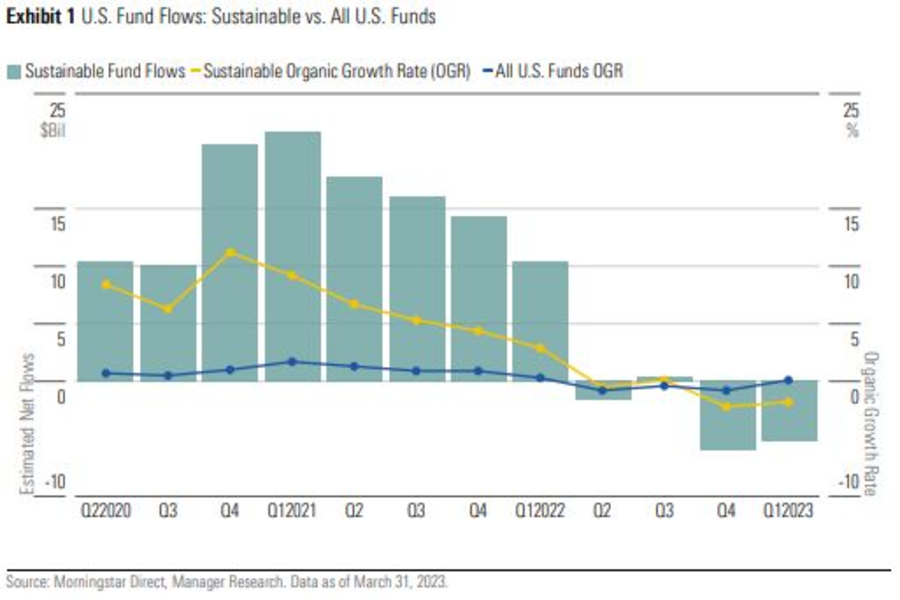

U.S. funds that choose stocks based on environmental, social and governance criteria posted outflows for the second consecutive quarter as investors fled to safer assets amid Federal Reserve rate hikes.

Investors yanked $5.2 billion from U.S.-domiciled sustainable funds in the first quarter of this year, according to a report by Morningstar Inc. The exodus was driven by the $13.6 billion iShares ESG Aware MSCI USA ETF (ESGU), which shed $6.5 billion over that period.

A steady drop in fund flows came as Russia’s invasion of Ukraine boosted oil prices and consequently shares of companies involved in the production of fossil fuels, which tend to be excluded from ESG portfolios.

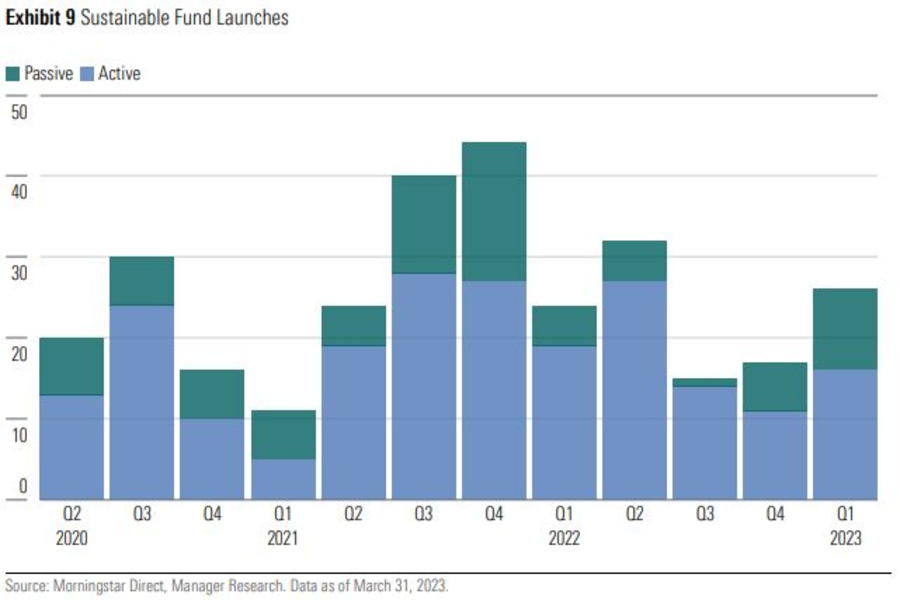

But the outflows didn’t seem to deter asset managers, as 27 sustainable funds debuted in the first quarter, up from the number of launches in the fourth quarter of 2022. And sustainable-fund assets climbed to almost $296 billion — the highest they’ve been since the first quarter of 2022 — thanks, in part, to higher equity and bond valuations, Morningstar’s report said.

It has still paid to be a stock-picker in the ESG arena during this tough market. Actively managed sustainable funds broke a three-quarter outflow streak to post inflows for the first time in a year. Passive sustainable funds, meanwhile, saw an outflow of $6.1 billion in the first quarter, with ESGU’s losses weighing on the group.

Despite a lighter regulatory outlook and staffing disruptions at the SEC, one compliance expert says RIA firms shouldn't expect a "free pass."

FINRA has been focused on firms and their use of social media for several years.

RayJay's latest additions bolster its independent advisor channel's presence across Pennsylvania, Florida, and Washington.

The deal ending more than 30 years of ownership by the Swiss bank includes six investment strategies representing more than $11 billion in AUM.

Divorce, widowhood, and retirement are events when financial advisors may provide stability and guidance.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.