The Federal Reserve slowed its drive to rein in inflation and said further interest-rate hikes are in store as officials debate when to end their most aggressive tightening of credit in four decades.

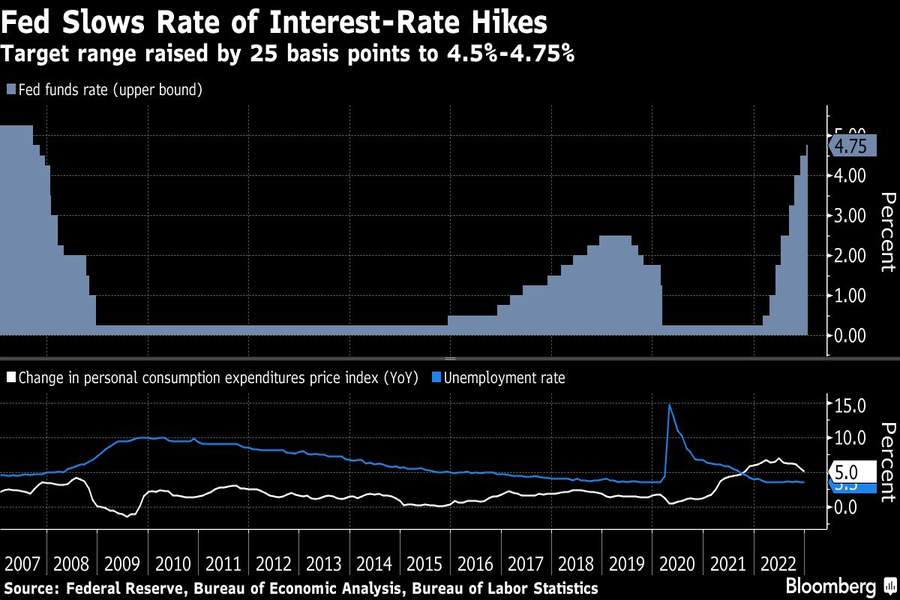

Chair Jerome Powell and fellow policymakers lifted the Fed’s target for its benchmark rate by a quarter percentage point to a range of 4.5% to 4.75%. The smaller move followed a half-point increase in December and four jumbo-sized 75 basis-point hikes prior to that.

Powell told reporters at his post-meeting press conference that policy will need to remain restrictive “for some time” and that officials would need “substantially more evidence” to be confident that inflation was on track to decline to the Fed’s 2% target.

The unanimous decision by the Federal Open Market Committee was in line with financial market expectations.

“The committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time,” the Fed said in a statement issued after the two-day policymaking meeting, repeating language it has used in previous communications.

In a sign that the end of the hiking cycle may be in sight, the committee said the “extent of future increases” in rates will depend on a number of factors including cumulative tightening of monetary policy. It had previously tied the “pace” of future increases to those factors.

In another shift from its last statement, the Fed noted that inflation “has eased somewhat but remains elevated,” suggesting policymakers are growing more confident that price pressures have peaked.

That compares with prior language where officials simply stated price growth was “elevated.”

U.S. stocks remained lower and Treasury yields rose as investors assessed the statement and awaited Powell’s comments.

Investors will be watching to see if Powell pushes back against market expectations that the Fed will it end its tightening campaign soon and cut rates later in the year as inflation eases and economic growth slows.

At their prior meeting in December, 17 of 19 policymakers forecast that they’ll increase rates to 5% or above this year, with none looking for cuts. There were no fresh forecasts published on Wednesday.

Some Fed officials sounded more hopeful last month that they can achieve a soft landing of the world’s largest economy, bringing down inflation without crashing the U.S. into a recession. White House officials and the International Monetary Fund are also voicing more optimism.

Most private economists though don’t think the Fed will get by without pushing the U.S. into a downturn. Forecasters surveyed by Bloomberg in January put the probability of a contraction over the next year at 65%.

After initially dismissing a surge in prices as temporary, Fed policymakers have been scrambling to get control of runaway inflation before it becomes embedded into the economy, lifting rates sharply from levels close to zero as recently as a year ago.

They’re also reducing the Fed’s balance sheet at a record clip, withdrawing hundreds of billions of dollars from the financial system.

While policymakers have had some success in reining in inflation — the Fed’s favorite gauge slowed to a year-on-year rate of 5% in December from 7% in June - they’ve been loath to declare victory until they’re confident price rises are on track to return to their 2% price target.

Powell has zeroed in on the labor market as a source of potential inflationary pressure, arguing that demand for workers is outstripping supply and that wages are rising too quickly to be consistent with the Fed’s 2% inflation target.

Officials got some welcome news on that front as they began their two-day meeting Tuesday, with the Labor Department reporting that a broad gauge of wages and benefits slowed in the final three months of 2022.

Another reading on the jobs market arrives Friday, when the government releases the employment report for January. Payrolls growth is forecast to have slowed to 190,000 last month from 223,000 in December while unemployment may have ticked up to 3.6% from 3.5%.

The Fed’s repeated rate increases have taken a toll on the U.S. economy. Hammered by a steep rise in mortgage rates, the housing market has slumped, with new home sales declining in 2022 to their lowest level in four years.

Manufacturing has also hit the skids, hurt by a slowdown in the global economy and a shift in consumer spending away from goods to services. Industrial production has dropped for three straight months.

However, consumer expenditures, the bulwark of the economy, have generally held up in the face of sky-high inflation, as households drew on savings built up during the pandemic and saw incomes boosted by a vibrant jobs market.

But there were signs of fraying as 2022 drew to a close. Adjusted for changes in prices, personal spending dropped 0.3% in December, with outlays for services stagnating, the first month without an increase since January 2022.

Elsewhere in Utah, Raymond James also welcomed another experienced advisor from D.A. Davidson.

A federal appeals court says UBS can’t force arbitration in a trustee lawsuit over alleged fiduciary breaches involving millions in charitable assets.

NorthRock Partners' second deal of 2025 expands its Bay Area presence with a planning practice for tech professionals, entrepreneurs, and business owners.

Rather than big projects and ambitious revamps, a few small but consequential tweaks could make all the difference while still leaving time for well-deserved days off.

Hadley, whose time at Goldman included working with newly appointed CEO Larry Restieri, will lead the firm's efforts at advisor engagement, growth initiatives, and practice management support.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.