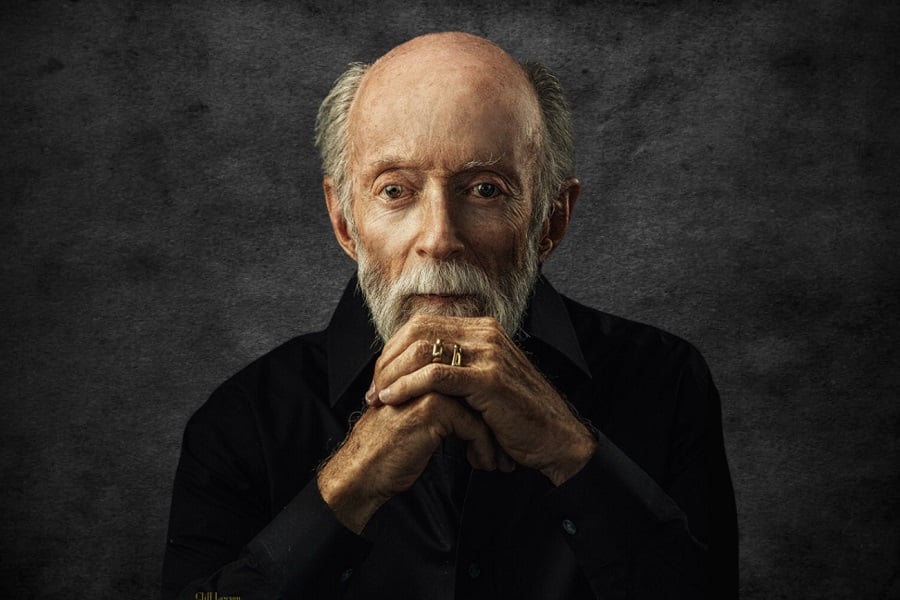

Stephen Kohn wants to help financial advisors who are looking for a new job, seeking to address a customer complaint on their record, have questions about licensing, or need help with a range of other issues.

Earlier this year, the former Finra board member established the Financial Professionals Coalition, an organization that he describes as a resource for financial advisors at a time when he says they have nowhere else to turn.

“The majority of people in this industry are disenfranchised people,” said Kohn, president of DMK Advisor Group. “They have no say in absolutely anything. It seemed to me they needed to have a voice.”

The core of the coalition is almost three dozen financial firm executives, lawyers, advocates and other professionals who are called founders. They have volunteered to help advisors who contact the coalition with professional questions and challenges they have.

“The coalition provides courtesy consultations with industry experts,” according to its website.

"The background of the founders reveals an amazing history of talent, accomplishment and compassion," said Kohn, who has nearly four decades of experience in the brokerage industry and sold his former firm, Stephen A. Kohn & Associates, to DMK in 2020.

The coalition serves “1.2 million registered representatives, associated persons, traders, bankers, back-office staff and owners of broker-dealers and registered investment advisors,” it says on its website.

Membership in the organization is free. Kohn said it has an ample budget but declined to reveal how it is funded. Last month, it rolled out its newest offering, a "Marketplace" that offers advertising for open positions at firms, professional services and other announcements.

The coalition is not a traditional trade association, Kohn said. For instance, lobbying lawmakers and regulators “is not on our radar,” he said. But the group will weigh in on regulatory proposals on occasion with comment letters.

The group essentially represents Kohn’s attempt to advance the brokerage industry on his own after what he called a disappointing stint on the board of the Financial Industry Regulatory Authority Inc.

He ran unsuccessfully for a position on the Finra board representing small firms before he finally won a seat in 2017. He served a three-year term before being defeated for reelection by Wendy Lanton. Kohn ran again last year, when he lost to Linde Murphy.

Small firms comprise the vast majority of Finra’s membership. But Kohn said he wasn’t able to make a breakthrough on issues affecting the constituency when he served on Finra’s governing body because they were blocked by large-firm representatives.

“It was a very, very difficult and very, very frustrating experience,” Kohn said. “The small-firm people were heard but not listened to.”

He said it took most of his three-year term on the broker-dealer self-regulator's board to find his footing.

“By the time you got up to speed, you were on the down side of your term,” Kohn said. “That was part of the frustration.”

Small firms are defined by Finra as those that have between one and 150 reps. There were 3,021 Finra small firms in 2022 compared to 165 large firms, which have 500 or more reps. The Finra board has 22 members, 10 of whom are industry representatives. Three of the industry members are from small firms.

“Small firms comprise an important part of the brokerage industry that Finra oversees, and small firms have a critical voice on Finra’s Board of Governors and Small Firm Advisory Committee, among other opportunities to contribute their perspective,” Finra spokesperson Rita De Ramos wrote in an email.

Paige Pierce, a current Finra governor, said she and her small-firm colleagues have been successful in shaping Finra regulations that impact small firms, such as pandemic relief, remote supervision of branch offices and rules for maintaining credentials during an absence from the industry.

“We have built a good reputation on the board,” said Pierce, owner of Bley Investment Group. “When we speak in subcommittee meetings, other board members listen. They don’t always agree. In the complicated world of the remit of the Finra Board of Governors, it has been my experience that we’re making a difference in those rooms for investors and industry-member firms.”

Kohn stressed that the coalition, which he co-founded with Bill Singer, a securities lawyer and founder of the BrokeandBroker blog, is “not here to fight with Finra.”

His goal, he said, is to “elevate the industry. We’re here to be a clearinghouse for resources. We’re here to help.”

Despite a lighter regulatory outlook and staffing disruptions at the SEC, one compliance expert says RIA firms shouldn't expect a "free pass."

FINRA has been focused on firms and their use of social media for several years.

RayJay's latest additions bolster its independent advisor channel's presence across Pennsylvania, Florida, and Washington.

The deal ending more than 30 years of ownership by the Swiss bank includes six investment strategies representing more than $11 billion in AUM.

Divorce, widowhood, and retirement are events when financial advisors may provide stability and guidance.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.